Understanding the TREC Earnest Money Release Form

When it comes to real estate transactions in Texas, the Texas Real Estate Commission (TREC) plays a crucial role in regulating the process. One essential document in this process is the TREC Earnest Money Release Form. This form is used to release the earnest money held in escrow when a real estate transaction falls through. In this article, we will explore five ways to complete the TREC Earnest Money Release Form and provide a comprehensive guide to understanding its importance.

What is the TREC Earnest Money Release Form?

The TREC Earnest Money Release Form is a document used to release the earnest money deposit held in escrow when a real estate transaction is cancelled or terminated. The earnest money deposit is a payment made by the buyer to demonstrate their commitment to purchasing the property. When the transaction falls through, the buyer may be entitled to a refund of their earnest money deposit.

Why is the TREC Earnest Money Release Form Important?

The TREC Earnest Money Release Form is essential because it provides a standardized process for releasing the earnest money deposit. Without this form, the release of the earnest money deposit can be a contentious issue between the buyer and seller. The form helps to prevent disputes and ensures that the earnest money deposit is released in a fair and timely manner.

5 Ways to Complete the TREC Earnest Money Release Form

Completing the TREC Earnest Money Release Form requires careful attention to detail. Here are five ways to complete the form:

-

Mutual Agreement: The buyer and seller can mutually agree to release the earnest money deposit. This can be done by signing the TREC Earnest Money Release Form and returning it to the escrow agent.

-

Termination of the Contract: If the real estate contract is terminated, the earnest money deposit can be released using the TREC Earnest Money Release Form. The form must be signed by both parties and returned to the escrow agent.

-

Default by the Seller: If the seller defaults on the contract, the buyer can use the TREC Earnest Money Release Form to release the earnest money deposit. The form must be signed by the buyer and returned to the escrow agent.

-

Default by the Buyer: If the buyer defaults on the contract, the seller can use the TREC Earnest Money Release Form to release the earnest money deposit. The form must be signed by the seller and returned to the escrow agent.

-

Court Order: In some cases, a court order may be required to release the earnest money deposit. The TREC Earnest Money Release Form can be used in conjunction with a court order to release the earnest money deposit.

Steps to Complete the TREC Earnest Money Release Form

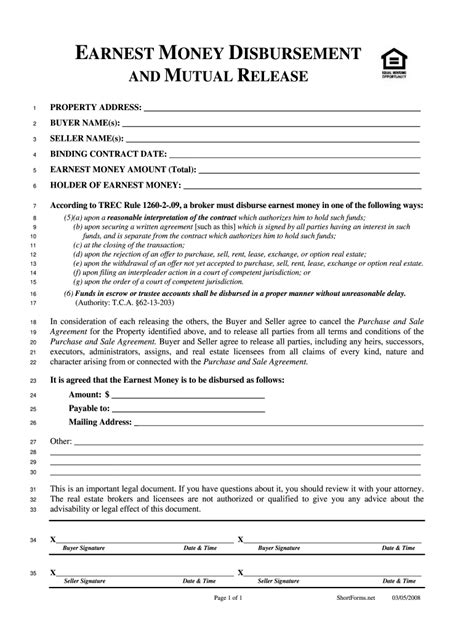

Completing the TREC Earnest Money Release Form requires the following steps:

-

Obtain the Form: Obtain a copy of the TREC Earnest Money Release Form from the Texas Real Estate Commission website or from a real estate agent.

-

Fill Out the Form: Fill out the form completely and accurately. Make sure to include the following information:

- The name and address of the buyer and seller

- The property address

- The amount of the earnest money deposit

- The reason for releasing the earnest money deposit

-

Sign the Form: Sign the form in the presence of a notary public. The buyer and seller must both sign the form.

-

Return the Form: Return the completed form to the escrow agent. The escrow agent will then release the earnest money deposit according to the instructions on the form.

Practical Examples

Here are some practical examples of how to complete the TREC Earnest Money Release Form:

- Example 1: John and Mary are buying a house in Texas. They make an earnest money deposit of $10,000. However, the transaction falls through due to financing issues. John and Mary can use the TREC Earnest Money Release Form to release the earnest money deposit.

- Example 2: David and Emily are selling their house in Texas. They receive an earnest money deposit of $5,000 from the buyer. However, the buyer defaults on the contract. David and Emily can use the TREC Earnest Money Release Form to release the earnest money deposit.

Statistical Data

According to the Texas Real Estate Commission, the TREC Earnest Money Release Form is used in over 50% of real estate transactions in Texas. This highlights the importance of understanding how to complete the form correctly.

Conclusion

Completing the TREC Earnest Money Release Form requires careful attention to detail. By following the steps outlined in this article, buyers and sellers can ensure that the earnest money deposit is released in a fair and timely manner. Whether you are a buyer or seller, understanding how to complete the TREC Earnest Money Release Form is essential for a successful real estate transaction.

What is the purpose of the TREC Earnest Money Release Form?

+The TREC Earnest Money Release Form is used to release the earnest money deposit held in escrow when a real estate transaction falls through.

Who can use the TREC Earnest Money Release Form?

+The buyer and seller can use the TREC Earnest Money Release Form to release the earnest money deposit.

What information is required on the TREC Earnest Money Release Form?

+The form requires the name and address of the buyer and seller, the property address, the amount of the earnest money deposit, and the reason for releasing the earnest money deposit.