Completing Illinois Form 1040 correctly is crucial for accurate tax filing and avoiding potential penalties. As the primary form for personal income tax in Illinois, it requires attention to detail and understanding of the tax laws and regulations. In this article, we will guide you through the 5 essential steps to complete Illinois Form 1040 correctly.

Why Accurate Tax Filing Matters

Before diving into the steps, it's essential to understand the importance of accurate tax filing. The Illinois Department of Revenue relies on the information provided in Form 1040 to determine your tax liability. Inaccurate or incomplete information can lead to delays in processing your return, penalties, and even audits. By following the correct steps, you can ensure a smooth tax filing process and avoid any potential issues.

Step 1: Gather Required Documents and Information

To start, gather all the necessary documents and information required to complete Form 1040. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Dependents' Social Security numbers or ITINs

- W-2 forms from all employers

- 1099 forms for freelance work, interest, dividends, and capital gains

- Receipts for deductions, such as charitable donations and medical expenses

- Last year's tax return (for reference)

Having all the required documents and information readily available will help you complete the form accurately and efficiently.

Step 2: Determine Your Filing Status

Determining Your Filing Status

Your filing status determines the tax rates and deductions you're eligible for. Illinois Form 1040 provides five filing status options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status based on your marital status, dependents, and other factors. If you're unsure, consult the Illinois Department of Revenue's guidelines or seek professional advice.

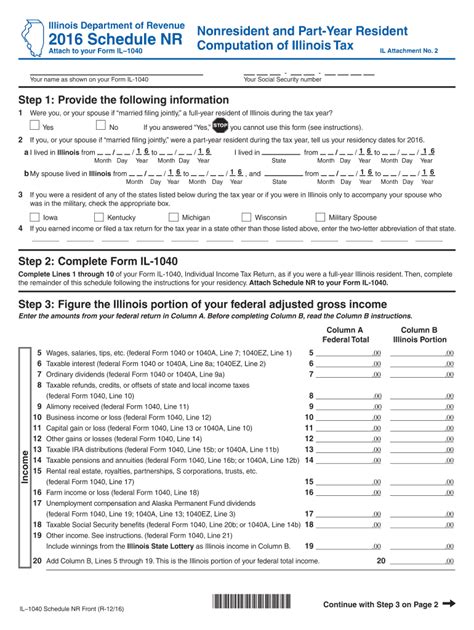

Step 3: Complete the Income Section

Reporting Your Income

The income section is the most critical part of Form 1040. Report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Freelance work and self-employment income

- Unemployment benefits

Use the correct lines and columns to report each type of income. Make sure to include all income, even if it's not reported on a W-2 or 1099.

Step 4: Claim Deductions and Credits

Deductions and Credits: Reduce Your Tax Liability

Deductions and credits can significantly reduce your tax liability. Illinois Form 1040 offers various deductions and credits, including:

- Standard deduction

- Itemized deductions (charitable donations, medical expenses, etc.)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Claim the deductions and credits you're eligible for, but be sure to follow the guidelines and limitations.

Step 5: Review and Sign the Form

Final Review and Signature

Before submitting Form 1040, review it carefully to ensure accuracy and completeness. Check for:

- Mathematical errors

- Incomplete information

- Incorrect filing status

- Missing signatures

Sign and date the form, and make sure your spouse signs as well if filing jointly.

Get Help When You Need It

If you're unsure about any part of the process or need assistance, consider consulting a tax professional or contacting the Illinois Department of Revenue.

By following these 5 steps, you'll be able to complete Illinois Form 1040 correctly and avoid potential issues. Remember to stay organized, take your time, and seek help when needed.

Share Your Thoughts

Have you completed Illinois Form 1040 before? Share your experiences and tips in the comments below.

What is the deadline for filing Illinois Form 1040?

+The deadline for filing Illinois Form 1040 is typically April 15th of each year. However, if you need an extension, you can file Form IL-505-I by the original deadline to receive an automatic six-month extension.

Can I e-file Illinois Form 1040?

+Yes, you can e-file Illinois Form 1040 through the Illinois Department of Revenue's website or through a tax software provider. E-filing is faster and more convenient than mailing a paper return.

What if I need to amend my Illinois Form 1040?

+If you need to amend your Illinois Form 1040, you can file Form IL-1040-X, Amended Individual Income Tax Return. You'll need to explain the changes and provide supporting documentation.