As a business owner in Texas, navigating the complexities of sales tax can be a daunting task. One crucial aspect of sales tax compliance is obtaining a resale certificate, which allows you to purchase goods tax-free for resale purposes. In this article, we will delve into the world of Texas sales tax resale certificates, focusing specifically on Form 01-339. We will provide you with 7 valuable tips to help you understand and effectively utilize this essential document.

What is a Resale Certificate?

Before we dive into the specifics of Form 01-339, it's essential to understand what a resale certificate is and why it's necessary. A resale certificate is a document that allows a business to purchase goods tax-free, with the intention of reselling them. This certificate is typically provided by the buyer to the seller, and it ensures that the seller does not charge sales tax on the transaction.

Why Do I Need a Resale Certificate?

As a business owner in Texas, you need a resale certificate to avoid paying sales tax on goods you intend to resell. Without a resale certificate, you would be required to pay sales tax on these goods, which would increase your costs and potentially reduce your profit margins. By obtaining a resale certificate, you can purchase goods tax-free and avoid this unnecessary expense.

Tips for Completing Form 01-339

Now that we've covered the basics of resale certificates, let's move on to the specifics of Form 01-339. Here are 7 valuable tips to help you complete this form correctly:

Tip 1: Ensure You Have a Valid Business Entity

To obtain a resale certificate, you must have a valid business entity. This can be a sole proprietorship, partnership, corporation, or limited liability company (LLC). Make sure you have registered your business with the Texas Secretary of State and obtained any necessary licenses and permits.

Tip 2: Gather Required Information

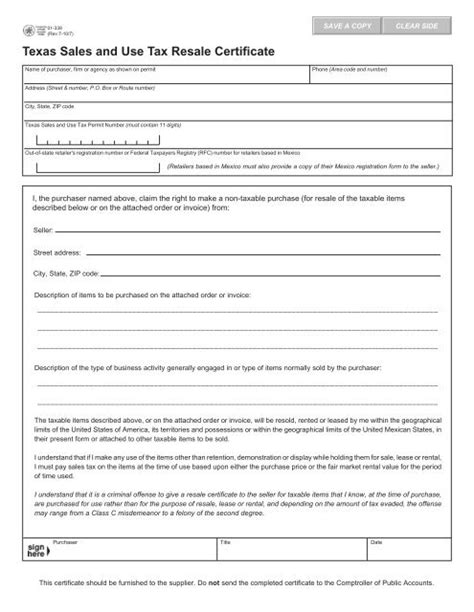

Before completing Form 01-339, gather all the required information. This includes your business name, address, and Texas sales tax permit number. You will also need to provide the name and address of the seller, as well as a description of the goods being purchased.

Tip 3: Complete the Form Accurately

When completing Form 01-339, make sure to fill out all the required fields accurately. This includes your business information, the seller's information, and a detailed description of the goods being purchased. Inaccurate or incomplete information can lead to delays or even rejection of your resale certificate.

Tip 4: Sign and Date the Form

Once you've completed Form 01-339, sign and date it. This is a crucial step, as the form must be signed and dated to be considered valid. Make sure to keep a copy of the completed form for your records.

Tip 5: Provide the Form to the Seller

Once you've completed and signed Form 01-339, provide it to the seller. The seller will use this form to verify that you are eligible to purchase goods tax-free. Make sure to provide the form before making a purchase, as the seller may not honor the resale certificate if it's not received in a timely manner.

Tip 6: Keep Records of Your Resale Certificates

It's essential to keep accurate records of your resale certificates, including Form 01-339. This will help you track your certificates and ensure that you can provide them to the seller when needed. You should also keep records of the goods you purchase using the resale certificate, including receipts and invoices.

Tip 7: Renew Your Resale Certificate as Necessary

Resale certificates are typically valid for a specific period, usually 4 years. Make sure to renew your resale certificate before it expires to avoid any interruptions in your business operations. You can renew your resale certificate by completing a new Form 01-339 and providing it to the seller.

Benefits of Using Form 01-339

Using Form 01-339 can provide several benefits for your business, including:

- Avoiding sales tax on goods purchased for resale

- Reducing costs and increasing profit margins

- Simplifying the purchasing process for goods intended for resale

- Ensuring compliance with Texas sales tax laws and regulations

Common Mistakes to Avoid

When using Form 01-339, there are several common mistakes to avoid. These include:

- Inaccurate or incomplete information on the form

- Failure to sign and date the form

- Not providing the form to the seller in a timely manner

- Not keeping accurate records of resale certificates and purchases

By avoiding these common mistakes, you can ensure that you're using Form 01-339 correctly and avoiding any potential issues with your resale certificates.

Conclusion

Obtaining a resale certificate is a crucial step in avoiding sales tax on goods purchased for resale in Texas. By following these 7 tips for completing Form 01-339, you can ensure that you're using this essential document correctly and avoiding any potential issues. Remember to keep accurate records of your resale certificates and purchases, and renew your resale certificate as necessary to maintain compliance with Texas sales tax laws and regulations.

What is the purpose of a resale certificate?

+A resale certificate is a document that allows a business to purchase goods tax-free, with the intention of reselling them.

How do I obtain a resale certificate in Texas?

+You can obtain a resale certificate in Texas by completing Form 01-339 and providing it to the seller.

How long is a resale certificate valid in Texas?

+A resale certificate is typically valid for 4 years in Texas.