Filing taxes can be a daunting task, especially when dealing with specific forms like the Texas Form 05-158. This form is used to report and pay franchise taxes in the state of Texas, and it's crucial to complete it accurately to avoid any penalties or delays. In this article, we will guide you through the process of completing Texas Form 05-158 successfully.

What is Texas Form 05-158?

Texas Form 05-158, also known as the "Franchise Tax Report," is a form required by the Texas Comptroller of Public Accounts. It's used by businesses to report their franchise tax liability, which is a tax levied on companies for the privilege of doing business in Texas. The form is typically due on May 15th of each year, and it's essential to file it accurately and on time to avoid any penalties.

Step 1: Gather Required Information

Before starting to fill out Texas Form 05-158, you'll need to gather some essential information. This includes:

- Your business's name and taxpayer ID number

- Your business's address and contact information

- Your business's total revenue for the reporting period

- Your business's cost of goods sold and total deductions

- Your business's total franchise tax liability

Make sure to have all the necessary documents and information readily available to ensure accuracy and efficiency.

What Documents Do I Need?

- Federal income tax return (Form 1120 or Form 1120S)

- Balance sheet and income statement

- Depreciation schedule

- List of total revenue and total deductions

Step 2: Determine Your Franchise Tax Liability

To determine your franchise tax liability, you'll need to calculate your business's total revenue and deductions. This will help you determine your taxable margin, which is the amount subject to franchise tax.

- Total Revenue = Total revenue from all sources

- Total Deductions = Total cost of goods sold + Total deductions

- Taxable Margin = Total Revenue - Total Deductions

You can use the Texas Comptroller's website or consult with a tax professional to ensure you're calculating your franchise tax liability accurately.

How to Calculate Franchise Tax Liability

- Multiply your taxable margin by the franchise tax rate (0.75% or 0.375%)

- Add any additional taxes or fees

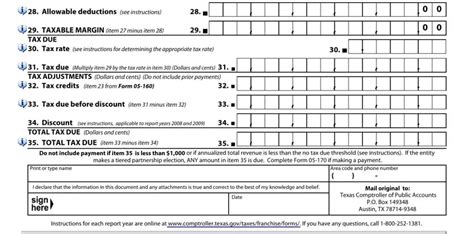

Step 3: Complete the Form

Now that you have all the necessary information and have determined your franchise tax liability, it's time to complete Texas Form 05-158. Make sure to fill out the form accurately and legibly.

- Section 1: Business Information

- Business name and taxpayer ID number

- Business address and contact information

- Section 2: Total Revenue and Deductions

- Total revenue from all sources

- Total cost of goods sold and total deductions

- Section 3: Taxable Margin and Franchise Tax Liability

- Calculate your taxable margin and franchise tax liability

- Section 4: Payment and Filing Information

- Payment information (check or electronic funds transfer)

- Filing information (mailing address and contact information)

Tips for Completing the Form

- Use black ink and print clearly

- Make sure to sign and date the form

- Keep a copy of the form for your records

Step 4: Submit the Form and Payment

Once you've completed Texas Form 05-158, you'll need to submit it to the Texas Comptroller's office along with your payment. You can file electronically or by mail.

- Electronic Filing: Use the Texas Comptroller's online portal to file and pay electronically

- Mail Filing: Send the completed form and payment to the Texas Comptroller's office at the address listed on the form

Make sure to keep a copy of the form and payment for your records.

Payment Options

- Check or money order

- Electronic funds transfer (EFT)

- Credit card (through the online portal)

Step 5: Verify and Follow Up

After submitting Texas Form 05-158, it's essential to verify that the form and payment were received and processed correctly. You can check the status of your filing on the Texas Comptroller's website.

- Verify that the form and payment were received

- Check for any errors or discrepancies

- Follow up with the Texas Comptroller's office if you have any questions or concerns

By following these steps, you can ensure that you complete Texas Form 05-158 successfully and avoid any penalties or delays.

We hope this article has provided you with the necessary information and guidance to complete Texas Form 05-158 successfully. Remember to gather all the required information, determine your franchise tax liability, complete the form accurately, submit the form and payment, and verify and follow up on the status of your filing.

If you have any questions or need further assistance, don't hesitate to comment below or reach out to a tax professional. Share this article with others who may benefit from this information, and don't forget to follow us for more helpful articles and guides on tax-related topics.

What is the due date for Texas Form 05-158?

+The due date for Texas Form 05-158 is May 15th of each year.

How do I calculate my franchise tax liability?

+To calculate your franchise tax liability, you'll need to multiply your taxable margin by the franchise tax rate (0.75% or 0.375%).

Can I file Texas Form 05-158 electronically?

+Yes, you can file Texas Form 05-158 electronically through the Texas Comptroller's online portal.