Filling out tax forms can be a daunting task, especially when it comes to state-specific forms like the Texas 130U. This form is used by the Texas Comptroller of Public Accounts to report and pay certain taxes, and it's essential to fill it out correctly to avoid any delays or penalties. In this article, we will guide you through the process of filling out the Texas 130U form correctly.

Understanding the Texas 130U Form

Before we dive into the specifics of filling out the form, let's take a look at what the Texas 130U form is used for. This form is used to report and pay taxes on certain types of business activities, such as oil and gas production, natural gas processing, and carbon dioxide production. It's essential to understand which type of business activity you are reporting on and what taxes are applicable to your situation.

Gathering Required Information

Before you start filling out the Texas 130U form, make sure you have all the required information and documents. This includes:

- Your business's name and address

- Your business's tax ID number

- The type of business activity you are reporting on

- The tax period you are reporting on

- Your tax liability for the reporting period

- Any supporting documentation, such as invoices or receipts

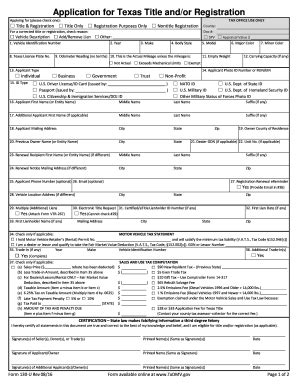

Step 1: Fill Out the Header Section

The header section of the Texas 130U form includes your business's name and address, tax ID number, and the type of business activity you are reporting on. Make sure to fill out this section accurately and completely.

- Business Name: Enter your business's name exactly as it appears on your tax ID certificate.

- Business Address: Enter your business's address, including the street address, city, state, and ZIP code.

- Tax ID Number: Enter your business's tax ID number, which can be found on your tax ID certificate.

- Business Activity: Check the box that corresponds to the type of business activity you are reporting on.

Step 2: Calculate Your Tax Liability

The next step is to calculate your tax liability for the reporting period. This will depend on the type of business activity you are reporting on and the amount of taxes you owe.

- Tax Rate: Check the tax rate for your business activity, which can be found in the instructions for the Texas 130U form.

- Taxable Amount: Enter the taxable amount for the reporting period.

- Tax Liability: Multiply the taxable amount by the tax rate to calculate your tax liability.

Step 3: Fill Out the Tax Liability Section

Once you have calculated your tax liability, fill out the tax liability section of the form.

- Tax Liability: Enter the amount of taxes you owe for the reporting period.

- Payment Amount: If you are making a payment with the form, enter the payment amount.

- Payment Method: Check the box that corresponds to your payment method, such as check or electronic funds transfer.

Step 4: Fill Out the Supporting Documentation Section

If you have any supporting documentation, such as invoices or receipts, attach them to the form.

- Supporting Documentation: Check the box that corresponds to the type of supporting documentation you are attaching.

- Description: Enter a brief description of the supporting documentation.

Step 5: Sign and Date the Form

Finally, sign and date the form to certify that the information is accurate and complete.

- Signature: Sign the form in ink.

- Date: Enter the date you signed the form.

By following these steps, you can ensure that you fill out the Texas 130U form correctly and avoid any delays or penalties. Remember to gather all the required information and documents before starting the form, and take your time to fill out each section accurately and completely.

We hope this article has been helpful in guiding you through the process of filling out the Texas 130U form correctly. If you have any questions or need further assistance, please don't hesitate to contact us.

What is the Texas 130U form used for?

+The Texas 130U form is used to report and pay taxes on certain types of business activities, such as oil and gas production, natural gas processing, and carbon dioxide production.

What information do I need to gather before filling out the Texas 130U form?

+You will need to gather your business's name and address, tax ID number, the type of business activity you are reporting on, the tax period you are reporting on, your tax liability for the reporting period, and any supporting documentation, such as invoices or receipts.

How do I calculate my tax liability for the Texas 130U form?

+To calculate your tax liability, you will need to check the tax rate for your business activity, enter the taxable amount for the reporting period, and multiply the taxable amount by the tax rate.

If you have any further questions or need assistance with filling out the Texas 130U form, please don't hesitate to contact us. We are here to help.