Get Td Bank Direct Deposit Form In 5 Easy Steps

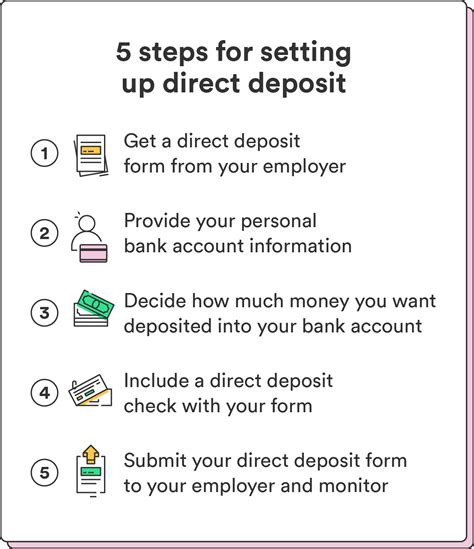

In today's fast-paced digital age, direct deposit has become an essential feature for individuals and businesses alike. TD Bank, one of the largest banks in the United States, offers a convenient direct deposit service that allows customers to receive their paychecks, government benefits, and other payments directly into their bank accounts. In this article, we will guide you through the process of getting a TD Bank direct deposit form in 5 easy steps.

Why Use TD Bank Direct Deposit?

Before we dive into the steps, let's explore the benefits of using TD Bank's direct deposit service. With direct deposit, you can:

- Receive your payments faster and more securely

- Avoid the hassle of paper checks and the risk of lost or stolen checks

- Enjoy greater control over your finances with real-time updates on your account activity

- Take advantage of TD Bank's user-friendly online banking platform to manage your accounts and track your transactions

Step 1: Determine Your Eligibility

To get started with TD Bank's direct deposit service, you need to determine if you are eligible. To qualify, you must have a valid TD Bank checking or savings account. If you don't have an account, you can apply for one online or visit a TD Bank branch near you.

Step 2: Gather Required Information

Once you have confirmed your eligibility, you will need to gather the required information to complete the direct deposit form. This includes:

- Your name and address

- Your TD Bank account number and routing number

- The type of payment you want to deposit directly (e.g., paycheck, government benefits, etc.)

- The frequency of the payments (e.g., weekly, bi-weekly, monthly, etc.)

Step 3: Access the Direct Deposit Form

You can access the TD Bank direct deposit form in several ways:

- Visit the TD Bank website and log in to your online banking account

- Download the TD Bank mobile app and access the direct deposit feature

- Visit a TD Bank branch near you and ask for a direct deposit form

- Call TD Bank's customer service hotline and request a direct deposit form be mailed to you

Step 4: Complete and Submit the Form

Once you have accessed the direct deposit form, you will need to complete it with the required information. Make sure to review the form carefully and ensure that all the information is accurate and complete. If you are submitting the form online, you can upload it to the TD Bank website. If you are submitting the form in person or by mail, make sure to sign and date it.

Step 5: Verify Your Direct Deposit

After submitting the direct deposit form, you will need to verify that the service is set up correctly. You can do this by:

- Logging in to your online banking account and checking your account activity

- Calling TD Bank's customer service hotline to confirm that the direct deposit is set up

- Visiting a TD Bank branch near you to verify that the direct deposit is active

Benefits of Using TD Bank Direct Deposit

By using TD Bank's direct deposit service, you can enjoy a range of benefits, including:

- Faster payment processing times

- Greater control over your finances

- Reduced risk of lost or stolen checks

- Real-time updates on your account activity

- User-friendly online banking platform

Conclusion

Getting a TD Bank direct deposit form is a straightforward process that can be completed in 5 easy steps. By following these steps, you can enjoy the benefits of direct deposit and take greater control over your finances. Remember to review the form carefully and ensure that all the information is accurate and complete. If you have any questions or concerns, you can contact TD Bank's customer service hotline for assistance.

What is the TD Bank direct deposit form used for?

+The TD Bank direct deposit form is used to set up direct deposit for paychecks, government benefits, and other payments.

How do I access the TD Bank direct deposit form?

+You can access the TD Bank direct deposit form online, through the TD Bank mobile app, or by visiting a TD Bank branch near you.

What information do I need to complete the TD Bank direct deposit form?

+You will need to provide your name and address, TD Bank account number and routing number, type of payment, and frequency of payments.