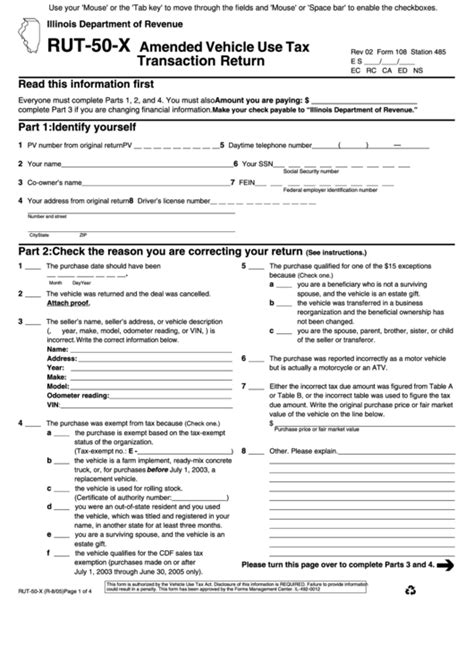

The tax season can be a daunting time for many individuals and businesses, with numerous forms to fill out and deadlines to meet. One of the most important tax forms in Poland is the RUT 50 form, which is used to report income and calculate taxes owed. In this article, we will delve into the world of tax form RUT 50, exploring its purpose, benefits, and key facts that you need to know.

What is Tax Form RUT 50?

Benefits of Filing Tax Form RUT 50

- Reduced tax liability: By accurately reporting income and claiming deductions, individuals can reduce their tax liability and avoid penalties.

- Refunds: If an individual has overpaid taxes during the year, filing tax form RUT 50 can help them claim a refund.

- Compliance with tax laws: Filing tax form RUT 50 helps individuals and businesses comply with tax laws and avoid penalties for non-compliance.

Key Facts About Tax Form RUT 50

- Who needs to file tax form RUT 50?: Tax form RUT 50 is typically filed by individuals who have income from various sources, such as employment, self-employment, and investments.

- What is the deadline for filing tax form RUT 50?: The deadline for filing tax form RUT 50 is typically April 30th of each year, although this can vary depending on the individual's circumstances.

- What information is required on tax form RUT 50?: Tax form RUT 50 requires individuals to report their income from various sources, including employment, self-employment, and investments. It also requires individuals to claim deductions and calculate their tax liability.

- How do I file tax form RUT 50?: Tax form RUT 50 can be filed electronically or in paper form. Individuals can use tax software or consult with a tax professional to ensure accurate and timely filing.

- What are the penalties for not filing tax form RUT 50?: Failure to file tax form RUT 50 can result in penalties and fines, including a late filing penalty and interest on unpaid taxes.

Tips for Filing Tax Form RUT 50

- Gather all necessary documents: Make sure you have all necessary documents, including pay stubs, receipts, and bank statements.

- Use tax software or consult with a tax professional: Tax software or a tax professional can help ensure accurate and timely filing.

- File electronically: Filing electronically can help reduce errors and speed up the refund process.

- Keep records: Keep records of your tax return and supporting documents in case of an audit.

Common Mistakes to Avoid When Filing Tax Form RUT 50

- Inaccurate income reporting: Make sure to accurately report income from all sources.

- Failure to claim deductions: Failure to claim deductions can result in a higher tax liability.

- Math errors: Math errors can delay the refund process or result in penalties.

- Late filing: Late filing can result in penalties and fines.

Conclusion: Take Control of Your Taxes with Tax Form RUT 50

What is the deadline for filing tax form RUT 50?

+The deadline for filing tax form RUT 50 is typically April 30th of each year, although this can vary depending on the individual's circumstances.

What information is required on tax form RUT 50?

+Tax form RUT 50 requires individuals to report their income from various sources, including employment, self-employment, and investments. It also requires individuals to claim deductions and calculate their tax liability.

What are the penalties for not filing tax form RUT 50?

+Failure to file tax form RUT 50 can result in penalties and fines, including a late filing penalty and interest on unpaid taxes.