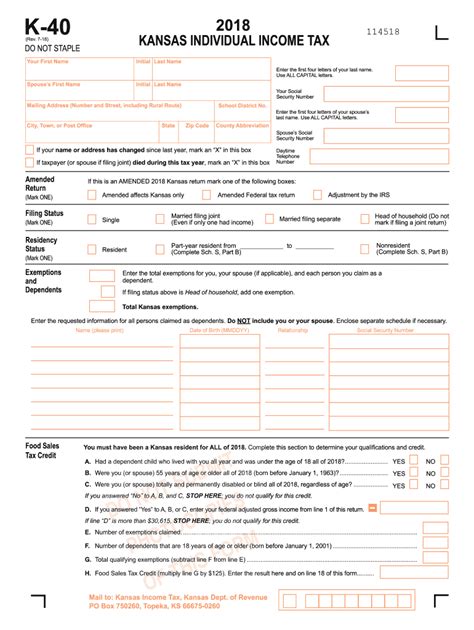

Tax season can be a daunting time for many individuals and businesses, especially when it comes to understanding the various tax forms and their purposes. One such form that Kansas residents need to familiarize themselves with is the Tax Form K-40, which is used to claim Kansas income tax. In this article, we will delve into the world of Tax Form K-40, exploring its significance, benefits, and steps to complete it accurately.

What is Tax Form K-40?

Tax Form K-40 is a Kansas state income tax return form that individuals and businesses use to report their income and claim a refund or pay any tax due. The form is designed to calculate the taxpayer's Kansas income tax liability, taking into account various income sources, deductions, and credits. It is essential to note that Tax Form K-40 is specific to Kansas residents and is used in conjunction with the federal income tax return (Form 1040).

Benefits of Filing Tax Form K-40

Filing Tax Form K-40 offers several benefits to Kansas residents, including:

- Accurate calculation of Kansas income tax liability

- Claiming refunds for overpaid taxes

- Reducing tax debt through deductions and credits

- Meeting state tax obligations

- Ensuring compliance with Kansas tax laws

Who Needs to File Tax Form K-40?

Not everyone needs to file Tax Form K-40. The following individuals and businesses are required to file:

- Kansas residents with a federal filing requirement

- Kansas residents with Kansas source income

- Non-residents with Kansas source income

- Businesses operating in Kansas

Steps to Complete Tax Form K-40

Completing Tax Form K-40 requires attention to detail and a thorough understanding of the form's sections. Here's a step-by-step guide to help you navigate the process:

- Gather necessary documents: Collect all relevant tax documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status: Choose the correct filing status, which includes single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Calculate your income: Report all Kansas source income, including wages, salaries, tips, and self-employment income.

- Claim deductions: Itemize deductions, such as mortgage interest, charitable donations, and medical expenses, or claim the standard deduction.

- Claim credits: Claim any eligible credits, such as the Kansas Earned Income Tax Credit (EITC) or the Kansas Child Tax Credit.

- Calculate your tax liability: Use the Kansas income tax tables or the tax calculator to determine your tax liability.

- Pay any tax due or claim a refund: If you owe taxes, pay the amount due by the filing deadline. If you're due a refund, claim it on the form.

Tips and Reminders

- File electronically: Filing electronically is faster, more accurate, and more secure than paper filing.

- Use tax software: Utilize tax software, such as TurboTax or H&R Block, to help with calculations and ensure accuracy.

- Meet the filing deadline: The filing deadline for Tax Form K-40 is typically April 15th, but it may vary depending on the tax year.

- Keep records: Keep all tax-related documents and records for at least three years in case of an audit.

Common Errors to Avoid

- Inaccurate income reporting: Ensure all income is reported accurately, including self-employment income and tips.

- Insufficient documentation: Keep all supporting documentation, such as W-2s and 1099s, to substantiate income and deductions.

- Incorrect filing status: Choose the correct filing status to avoid errors and potential penalties.

Kansas Income Tax Rates

Kansas has a progressive income tax system, with rates ranging from 3.1% to 5.25%. The tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| $0 - $15,000 | 3.1% |

| $15,001 - $30,000 | 4.6% |

| $30,001 - $50,000 | 5.1% |

| $50,001 and above | 5.25% |

Frequently Asked Questions

Here are some frequently asked questions about Tax Form K-40:

Can I file Tax Form K-40 electronically?

Yes, you can file Tax Form K-40 electronically through the Kansas Department of Revenue's website or using tax software.

What is the deadline for filing Tax Form K-40?

The filing deadline for Tax Form K-40 is typically April 15th, but it may vary depending on the tax year.

Can I claim a refund on Tax Form K-40?

Yes, if you've overpaid taxes, you can claim a refund on Tax Form K-40.

Can I amend my Tax Form K-40 if I made an error?

Yes, you can amend your Tax Form K-40 by filing Form K-40X, Amended Kansas Income Tax Return.

Conclusion

Filing Tax Form K-40 is an essential step in meeting your Kansas state tax obligations. By understanding the form's requirements, benefits, and steps to complete it accurately, you can ensure a smooth tax filing process. Remember to gather all necessary documents, claim eligible deductions and credits, and file electronically to avoid errors and potential penalties. If you have any questions or concerns, don't hesitate to reach out to the Kansas Department of Revenue or a tax professional for guidance.

FAQ Section

What is the purpose of Tax Form K-40?

+Tax Form K-40 is used to report Kansas income tax liability and claim a refund or pay any tax due.

Who needs to file Tax Form K-40?

+Kansas residents with a federal filing requirement, Kansas residents with Kansas source income, non-residents with Kansas source income, and businesses operating in Kansas need to file Tax Form K-40.

Can I file Tax Form K-40 electronically?

+Yes, you can file Tax Form K-40 electronically through the Kansas Department of Revenue's website or using tax software.