The world of tax filing and compliance can be overwhelming, especially for sponsors of certain investment vehicles. One crucial form that requires attention is Form 8958, which is used by the Internal Revenue Service (IRS) to collect specific information from sponsors of these entities. In this article, we will delve into the details of Form 8958, exploring its purpose, requirements, and implications for sponsors.

The Importance of Form 8958

What is Form 8958?

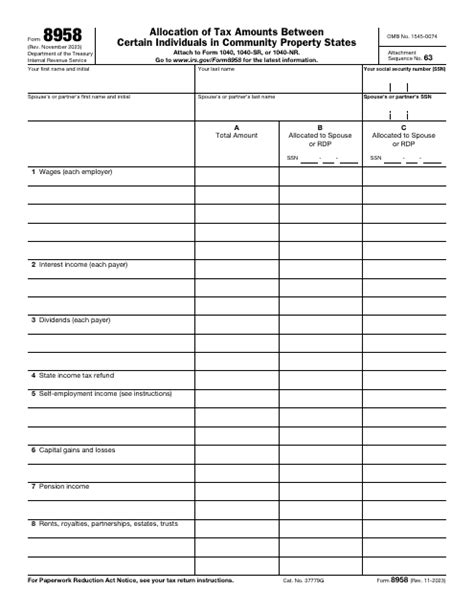

Form 8958, also known as the "Allocation of Taxable Income and (Loss) Among Partners (or Shareholders) (and Certain Other Entities)" is a tax form used by the IRS to collect information about the allocation of taxable income and loss among partners, shareholders, and certain other entities. This form is typically filed by sponsors of entities such as partnerships, S corporations, and certain trusts.

Who is Required to File Form 8958?

Not all entities are required to file Form 8958. The IRS mandates filing for certain entities, including:

- Partnerships (including limited liability companies (LLCs) that are treated as partnerships for tax purposes)

- S corporations

- Certain trusts (such as grantor trusts and qualified subchapter S trusts)

- Real estate mortgage investment conduits (REMICs)

- Real estate investment trusts (REITs)

Required Information for Sponsors

To complete Form 8958, sponsors must gather and report specific information about the entity and its partners, shareholders, or beneficiaries. The required information includes:

- Entity information: name, address, and Employer Identification Number (EIN)

- Allocation of taxable income and loss: including the percentage of ownership interest and the amount of taxable income or loss allocated to each partner, shareholder, or beneficiary

- Partner, shareholder, or beneficiary information: including name, address, and tax identification number

- Additional information: such as the entity's tax classification and the type of entity

Working Mechanism of Form 8958

The primary purpose of Form 8958 is to provide the IRS with a detailed breakdown of how taxable income and loss are allocated among partners, shareholders, or beneficiaries. This information is used to ensure that each partner, shareholder, or beneficiary reports their correct share of taxable income or loss on their individual tax return.

Steps to Complete Form 8958

To complete Form 8958, sponsors should follow these steps:

- Gather all required information about the entity and its partners, shareholders, or beneficiaries.

- Determine the tax classification of the entity and the type of entity.

- Calculate the allocation of taxable income and loss among partners, shareholders, or beneficiaries.

- Complete Form 8958, attaching any required schedules or supporting documentation.

- File Form 8958 with the IRS by the required deadline.

Practical Examples and Statistical Data

To illustrate the importance of Form 8958, let's consider a practical example. Suppose a partnership has three partners, each with a 33.33% ownership interest. The partnership generates $100,000 in taxable income, which is allocated among the partners based on their ownership interest. In this case, each partner would report $33,333 in taxable income on their individual tax return.

According to the IRS, the number of partnerships filing Form 8958 has increased significantly over the past decade, from approximately 2.5 million in 2010 to over 3.5 million in 2020. This trend highlights the growing importance of accurate and timely reporting of taxable income and loss among partners, shareholders, and beneficiaries.

Benefits of Filing Form 8958

Filing Form 8958 provides several benefits for sponsors and the IRS, including:

- Accurate reporting of taxable income and loss: ensures that each partner, shareholder, or beneficiary reports their correct share of taxable income or loss.

- Compliance with tax laws: helps sponsors meet their tax obligations and avoid penalties and fines.

- Transparency: provides the IRS with a clear understanding of the allocation of taxable income and loss among partners, shareholders, or beneficiaries.

Frequently Asked Questions

Have questions about Form 8958? Here are some answers to frequently asked questions:

- Q: Who is required to file Form 8958?

- A: Partnerships, S corporations, certain trusts, REMICs, and REITs are required to file Form 8958.

- Q: What information is required on Form 8958?

- A: Entity information, allocation of taxable income and loss, partner, shareholder, or beneficiary information, and additional information such as tax classification and type of entity.

- Q: When is Form 8958 due?

- A: The due date for Form 8958 varies depending on the type of entity and the tax year. Generally, the form is due on the 15th day of the third month following the end of the tax year.

Take Action: File Form 8958 Today

If you are a sponsor of an entity required to file Form 8958, don't wait until the last minute to gather the necessary information and complete the form. Take action today to ensure accurate and timely reporting of taxable income and loss among partners, shareholders, or beneficiaries.

We encourage you to share your thoughts and experiences with Form 8958 in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask. Let's work together to ensure compliance with tax laws and regulations.

What is the purpose of Form 8958?

+Form 8958 is used by the IRS to collect information about the allocation of taxable income and loss among partners, shareholders, and certain other entities.

Who is required to file Form 8958?

+Partnerships, S corporations, certain trusts, REMICs, and REITs are required to file Form 8958.

What information is required on Form 8958?

+Entity information, allocation of taxable income and loss, partner, shareholder, or beneficiary information, and additional information such as tax classification and type of entity.