Filing federal taxes can be a daunting task, especially when it comes to specific forms like Form 4972. This form is used to report tax on lump-sum distributions from pension and annuity plans. If you're receiving a lump-sum distribution, it's essential to understand how to file Form 4972 correctly to avoid any potential penalties or delays in processing your tax return. In this article, we'll provide you with 5 tips for filing federal Form 4972, helping you navigate the process with confidence.

Understanding Form 4972: Tax on Lump-Sum Distributions

Before we dive into the tips, it's crucial to understand what Form 4972 is and when it's required. Form 4972 is used to calculate the tax on lump-sum distributions from qualified plans, such as pension and annuity plans. These distributions are typically made when an individual retires or leaves their job. The tax on these distributions can be significant, so it's essential to report them accurately.

Tip 1: Determine If You Need to File Form 4972

Not all lump-sum distributions require filing Form 4972. To determine if you need to file this form, you'll need to check the following:

- The distribution was made from a qualified plan, such as a pension or annuity plan.

- The distribution was made in a lump sum, rather than in installments.

- You were born before January 2, 1936, and you're receiving a lump-sum distribution from a qualified plan.

- You're using the 10-year tax option to report the tax on the distribution.

If you meet these criteria, you'll need to file Form 4972.

Gathering Required Information

Before you start filling out Form 4972, you'll need to gather some required information. This includes:

- Your name, address, and Social Security number

- The name and address of the plan administrator

- The date of the distribution

- The amount of the distribution

- The amount of tax withheld

- The amount of tax due

You'll also need to determine which tax option you'll use to report the tax on the distribution. You can choose from the 10-year tax option, the 5-year tax option, or the ordinary income tax option.

Tip 2: Choose the Correct Tax Option

Choosing the correct tax option is crucial when filing Form 4972. The 10-year tax option is the most common choice, but you may be eligible for the 5-year tax option or the ordinary income tax option, depending on your situation.

The 10-year tax option allows you to spread the tax on the distribution over 10 years, reducing your tax liability in the year of the distribution. The 5-year tax option allows you to spread the tax over 5 years, while the ordinary income tax option requires you to pay the tax in the year of the distribution.

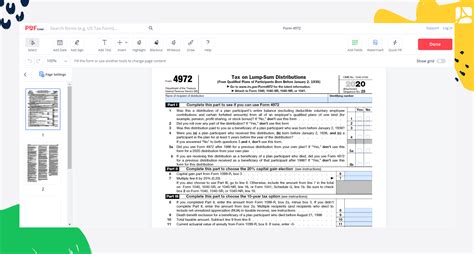

Completing Form 4972

Once you've gathered the required information and chosen your tax option, you can start completing Form 4972. The form is divided into several sections, including:

- Section 1: Lump-Sum Distribution Information

- Section 2: Tax Option

- Section 3: Tax Calculation

- Section 4: Additional Tax

You'll need to complete each section carefully, using the information you've gathered.

Tip 3: Calculate the Tax Correctly

Calculating the tax on the distribution is the most critical part of completing Form 4972. You'll need to use the tax tables or the tax rate schedules to determine the tax due. Make sure to calculate the tax correctly, as errors can result in penalties and delays.

Common Mistakes to Avoid

When filing Form 4972, there are several common mistakes to avoid. These include:

- Failing to report the distribution on Form 4972

- Choosing the wrong tax option

- Calculating the tax incorrectly

- Failing to include required documentation

Make sure to double-check your work and avoid these common mistakes.

Tip 4: Attach Required Documentation

When filing Form 4972, you'll need to attach certain documentation, including:

- Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- A copy of the plan document

- A statement from the plan administrator

Make sure to attach all required documentation to avoid delays in processing your tax return.

Electronic Filing Options

Form 4972 can be filed electronically or by mail. If you're filing electronically, you'll need to use the IRS's Electronic Filing System (EFS). This system allows you to file your tax return and Form 4972 quickly and easily.

Tip 5: Seek Professional Help If Needed

If you're unsure about how to file Form 4972 or need help with the tax calculation, consider seeking professional help. A tax professional can guide you through the process and ensure that your tax return is accurate and complete.

By following these 5 tips, you can ensure that you file Form 4972 correctly and avoid any potential penalties or delays in processing your tax return.

What is Form 4972 used for?

+Form 4972 is used to report tax on lump-sum distributions from pension and annuity plans.

Who needs to file Form 4972?

+Individuals who receive a lump-sum distribution from a qualified plan, such as a pension or annuity plan, may need to file Form 4972.

What tax options are available for reporting the tax on a lump-sum distribution?

+The 10-year tax option, the 5-year tax option, and the ordinary income tax option are available for reporting the tax on a lump-sum distribution.