Understanding the Importance of Texas Tax Exempt Form 01-339

As a resident of Texas, it's essential to understand the various tax forms and exemptions available to you. One such form is the Texas Tax Exempt Form 01-339, also known as the "Exemption Certificate for Certain Entities." This form is used to claim exemption from sales tax on certain purchases made by eligible entities. In this article, we'll delve into the details of the Texas Tax Exempt Form 01-339, its importance, and the benefits it provides.

Who is Eligible to Use the Texas Tax Exempt Form 01-339?

The Texas Tax Exempt Form 01-339 is designed for use by certain entities that are exempt from paying sales tax on their purchases. These entities include:

- Non-profit organizations

- Government agencies

- Schools and educational institutions

- Charitable organizations

- Religious organizations

These entities can use the form to claim exemption from sales tax on purchases made for their organization's use.

Benefits of Using the Texas Tax Exempt Form 01-339

Using the Texas Tax Exempt Form 01-339 can provide several benefits to eligible entities. Some of the key benefits include:

- Savings on sales tax: By claiming exemption from sales tax, entities can save a significant amount of money on their purchases.

- Simplified purchasing process: The form can be used to claim exemption on multiple purchases, making the purchasing process easier and more efficient.

- Compliance with Texas tax laws: Using the form ensures that entities are in compliance with Texas tax laws and regulations.

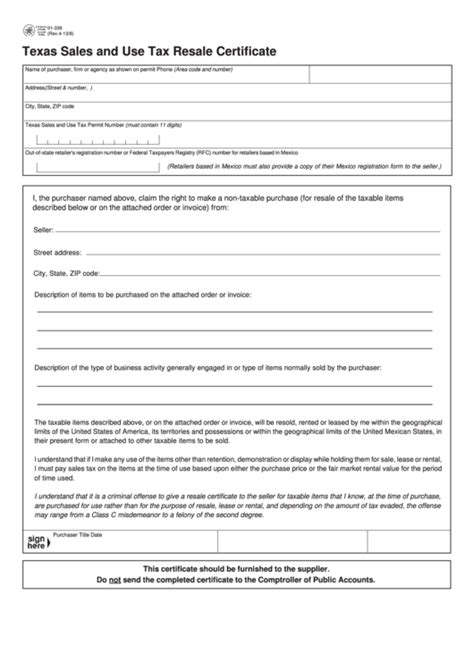

How to Complete the Texas Tax Exempt Form 01-339

To complete the Texas Tax Exempt Form 01-339, entities will need to provide certain information, including:

- Entity name and address

- Federal tax identification number (FEIN)

- Type of exemption claimed

- Description of the purchases being made

Entities will also need to sign and date the form, certifying that they are eligible for the exemption and that the information provided is accurate.

Common Mistakes to Avoid When Using the Texas Tax Exempt Form 01-339

When using the Texas Tax Exempt Form 01-339, entities should be aware of common mistakes to avoid. Some of these mistakes include:

- Failing to provide required information

- Using an outdated version of the form

- Claiming exemption on purchases that are not eligible

- Failing to sign and date the form

By avoiding these mistakes, entities can ensure that their exemption claims are processed correctly and efficiently.

Record-Keeping Requirements for the Texas Tax Exempt Form 01-339

Entities that use the Texas Tax Exempt Form 01-339 are required to maintain records of their exemption claims. These records should include:

- Copies of the completed form

- Supporting documentation for the exemption claim

- Records of the purchases made using the exemption

By maintaining accurate records, entities can ensure compliance with Texas tax laws and regulations.

Penalties for Misusing the Texas Tax Exempt Form 01-339

Entities that misuse the Texas Tax Exempt Form 01-339 may be subject to penalties and fines. These penalties can include:

- Fines and interest on unpaid taxes

- Revocation of exemption privileges

- Audit and examination of entity records

By using the form correctly and accurately, entities can avoid these penalties and ensure compliance with Texas tax laws.

Conclusion

The Texas Tax Exempt Form 01-339 is an essential tool for eligible entities to claim exemption from sales tax on certain purchases. By understanding the importance of the form, the benefits it provides, and the common mistakes to avoid, entities can ensure compliance with Texas tax laws and regulations.

Who is eligible to use the Texas Tax Exempt Form 01-339?

+The Texas Tax Exempt Form 01-339 is designed for use by certain entities that are exempt from paying sales tax on their purchases, including non-profit organizations, government agencies, schools and educational institutions, charitable organizations, and religious organizations.

What are the benefits of using the Texas Tax Exempt Form 01-339?

+The benefits of using the Texas Tax Exempt Form 01-339 include savings on sales tax, a simplified purchasing process, and compliance with Texas tax laws and regulations.

What are the common mistakes to avoid when using the Texas Tax Exempt Form 01-339?

+Common mistakes to avoid when using the Texas Tax Exempt Form 01-339 include failing to provide required information, using an outdated version of the form, claiming exemption on purchases that are not eligible, and failing to sign and date the form.

We hope this article has provided valuable insights into the Texas Tax Exempt Form 01-339. If you have any further questions or concerns, please don't hesitate to reach out.