The concept of progressive leasing has gained popularity in recent years, offering consumers a unique alternative to traditional financing options. At the heart of this innovation is the Progressive Leasing bank account form, a crucial document that initiates the leasing process. Understanding how to fill out this form correctly is essential for a smooth and successful transaction. Here, we delve into the specifics of the Progressive Leasing bank account form and provide a step-by-step guide on how to fill it out accurately.

Understanding the Progressive Leasing Bank Account Form

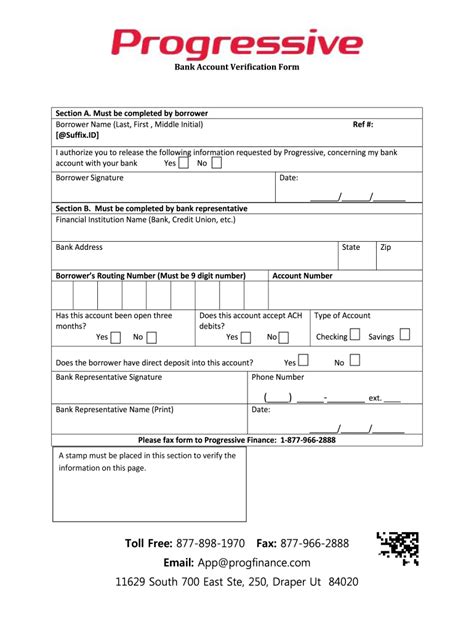

The Progressive Leasing bank account form is a comprehensive document that requires detailed personal and financial information. Its primary purpose is to assess the applicant's creditworthiness and to set up the leasing agreement. The form typically includes sections for personal details, employment information, banking details, and leasing preferences.

Section 1: Personal Details

The first section of the Progressive Leasing bank account form requires applicants to provide their personal details. This includes full name, date of birth, social security number, and contact information. It is crucial to ensure that all information provided is accurate and matches the information on your identification documents.

Method 1: Online Application

One of the most convenient ways to fill out the Progressive Leasing bank account form is through their online application portal. This method offers several benefits, including speed, convenience, and the ability to apply from anywhere with an internet connection.

- Step 1: Visit the Progressive Leasing website and navigate to the application section.

- Step 2: Fill out the online form, ensuring all required fields are completed accurately.

- Step 3: Review your application carefully before submitting it.

- Step 4: Wait for the approval decision, which is typically made within minutes.

Benefits of Online Application

- Speed: Online applications are processed much faster than traditional paper applications.

- Convenience: Applicants can apply from anywhere, at any time, as long as they have an internet connection.

- Accuracy: The online form helps minimize errors by prompting for required information and validating data in real-time.

Method 2: In-Store Application

For those who prefer a more personal touch or do not have access to the internet, applying in-store is a viable option. This method allows applicants to receive immediate assistance from store representatives.

- Step 1: Visit a retail store that offers Progressive Leasing.

- Step 2: Inform the store staff that you wish to apply for Progressive Leasing.

- Step 3: Fill out the bank account form provided by the store, ensuring accuracy.

- Step 4: Submit the form to the store staff for processing.

Benefits of In-Store Application

- Immediate Assistance: Store representatives are available to answer questions and assist with the application.

- Tangible Interaction: Some applicants may prefer the tangible experience of filling out a physical form.

Method 3: Phone Application

Progressive Leasing also offers the option to apply over the phone, catering to those who prefer verbal communication or have difficulty accessing the internet or physical stores.

- Step 1: Call the Progressive Leasing customer service number.

- Step 2: Inform the representative that you wish to apply for leasing.

- Step 3: Provide the required information over the phone.

- Step 4: Confirm the details and wait for the application to be processed.

Benefits of Phone Application

- Accessibility: Ideal for those with limited internet access or mobility issues.

- Personal Interaction: Applicants can ask questions and receive immediate feedback.

Final Considerations

Regardless of the application method chosen, it is essential to carefully review the Progressive Leasing bank account form before submission. Ensure that all information is accurate and complete, as errors or omissions can lead to delays or even rejection.

Moreover, understanding the terms and conditions of the leasing agreement is crucial. Applicants should be aware of the lease duration, payment schedule, and any associated fees.

In conclusion, filling out the Progressive Leasing bank account form is a straightforward process that can be completed through various methods. Whether you prefer the convenience of online application, the personal touch of in-store application, or the accessibility of phone application, Progressive Leasing offers flexibility to cater to different needs. By following the steps outlined and ensuring the accuracy of the information provided, applicants can successfully complete the form and embark on their leasing journey.

We hope this comprehensive guide has been informative and helpful. If you have any further questions or need more detailed explanations, please do not hesitate to ask. Your feedback and comments are invaluable to us.

What is the Progressive Leasing bank account form used for?

+The Progressive Leasing bank account form is used to initiate the leasing process. It requires detailed personal and financial information to assess the applicant's creditworthiness and set up the leasing agreement.

How long does it take to process the application?

+The processing time varies depending on the application method. Online applications are typically processed within minutes, while in-store and phone applications may take slightly longer due to the need for manual processing and verification.

Can I apply for Progressive Leasing if I have bad credit?

+Yes, Progressive Leasing considers applicants with various credit backgrounds. However, the approval decision and leasing terms may vary based on creditworthiness.