Sales tax exemptions can be a valuable asset for businesses and individuals who qualify. The Tamu Sales Tax Exempt Form is a crucial document for entities looking to claim exemptions from sales tax in Texas. Completing this form accurately and efficiently is essential to avoid delays or rejection. In this article, we will guide you through the process of completing the Tamu Sales Tax Exempt Form and provide valuable insights to help you navigate the process.

Understanding the Tamu Sales Tax Exempt Form

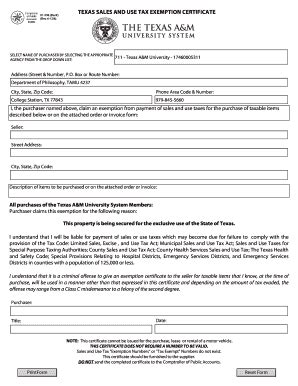

The Tamu Sales Tax Exempt Form, also known as the Texas A&M University Sales Tax Exemption Certificate, is a document used by Texas A&M University to claim exemptions from sales tax on purchases. This form is essential for entities that are exempt from paying sales tax, such as non-profit organizations, government agencies, and certain businesses.

Step 1: Determine Your Eligibility

Before completing the Tamu Sales Tax Exempt Form, you must determine if your entity is eligible for sales tax exemptions. In Texas, exemptions are available for certain organizations, including:

- Non-profit organizations

- Government agencies

- Certain businesses

- Educational institutions

Check with the Texas Comptroller's office or a tax professional to confirm your eligibility.

Step 2: Gather Required Information

To complete the Tamu Sales Tax Exempt Form, you will need to gather the following information:

- Your entity's name and address

- Your entity's tax-exempt status (e.g., 501(c)(3))

- The type of exemption you are claiming (e.g., resale, non-profit)

- The name and title of the person authorized to sign the form

Completing the Tamu Sales Tax Exempt Form

Section 1: Entity Information

In this section, provide your entity's name, address, and tax-exempt status.

- Entity Name: Enter the name of your entity exactly as it appears on your tax-exempt certificate.

- Address: Enter the address of your entity.

- Tax-Exempt Status: Select the type of tax-exempt status your entity holds (e.g., 501(c)(3)).

Section 2: Exemption Type

In this section, select the type of exemption you are claiming.

- Resale: Select this option if you are purchasing items for resale.

- Non-Profit: Select this option if you are a non-profit organization.

- Government Agency: Select this option if you are a government agency.

Section 3: Authorized Signer

In this section, provide the name and title of the person authorized to sign the form.

- Name: Enter the name of the person authorized to sign the form.

- Title: Enter the title of the person authorized to sign the form.

Section 4: Certifications

In this section, certify that the information provided is accurate and that your entity is eligible for the exemption.

- Certification: Check the box to certify that the information provided is accurate.

- Signature: Sign the form with the name of the authorized signer.

Step 3: Submit the Form

Once you have completed the Tamu Sales Tax Exempt Form, submit it to the Texas A&M University purchasing department or the vendor from whom you are making a purchase.

Tips and Reminders

- Ensure that you have the most up-to-date version of the Tamu Sales Tax Exempt Form.

- Complete the form accurately and thoroughly to avoid delays or rejection.

- Keep a copy of the completed form for your records.

Common Mistakes to Avoid

- Incomplete or inaccurate information

- Failure to provide required documentation

- Submitting an outdated version of the form

Conclusion

Completing the Tamu Sales Tax Exempt Form accurately and efficiently is crucial for entities looking to claim exemptions from sales tax in Texas. By following the steps outlined in this article, you can ensure that your form is completed correctly and submitted in a timely manner. If you have any questions or concerns, do not hesitate to contact the Texas Comptroller's office or a tax professional.

We hope this article has been informative and helpful in guiding you through the process of completing the Tamu Sales Tax Exempt Form. If you have any further questions or would like to share your experiences, please leave a comment below.

What is the Tamu Sales Tax Exempt Form?

+The Tamu Sales Tax Exempt Form is a document used by Texas A&M University to claim exemptions from sales tax on purchases.

Who is eligible for sales tax exemptions in Texas?

+Eligible entities include non-profit organizations, government agencies, and certain businesses.

What information is required to complete the Tamu Sales Tax Exempt Form?

+Required information includes your entity's name and address, tax-exempt status, and the name and title of the authorized signer.