Filing taxes can be a daunting task, especially when dealing with complex forms and regulations. For individuals and businesses operating in Puerto Rico, understanding the Puerto Rico Tax Return Form 482 is crucial for compliance with tax laws. In this article, we will delve into the world of Puerto Rico taxes and provide six valuable tips for filing the Form 482 accurately and efficiently.

Understanding the Puerto Rico Tax Return Form 482

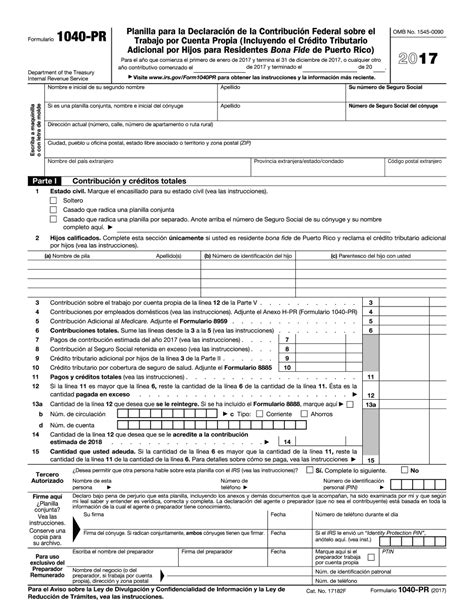

The Puerto Rico Tax Return Form 482, also known as the "Individual Income Tax Return," is a critical document for residents and non-residents alike. It's used to report income earned from various sources, including employment, self-employment, and investments. The form is divided into several sections, each requiring specific information and documentation.

Tip 1: Determine Your Residency Status

Before filing the Form 482, it's essential to determine your residency status in Puerto Rico. Residents and non-residents are subject to different tax laws and regulations. To qualify as a resident, you must have been present in Puerto Rico for at least 183 days during the tax year. Non-residents, on the other hand, are only taxed on income earned from Puerto Rican sources.

Gathering Required Documents

To file the Form 482 accurately, you'll need to gather various documents and information. This includes:

- Identification documents (passport, driver's license, etc.)

- W-2 forms from employers

- 1099 forms for freelance work or self-employment

- Interest statements from banks and investments

- Dividend statements from corporations

Tip 2: Claim Eligible Deductions and Credits

Puerto Rico offers various deductions and credits that can reduce your tax liability. These include:

- Charitable donations

- Mortgage interest

- Education expenses

- Child care credits

Make sure to claim all eligible deductions and credits to minimize your tax bill.

Understanding Tax Rates and Brackets

Puerto Rico has a progressive tax system, with tax rates ranging from 0% to 33.34%. The tax brackets are as follows:

- 0% on the first $9,000 of taxable income

- 10% on taxable income between $9,001 and $25,000

- 15% on taxable income between $25,001 and $50,000

- 20% on taxable income between $50,001 and $100,000

- 25% on taxable income between $100,001 and $200,000

- 33.34% on taxable income above $200,000

Tip 3: File for an Extension if Necessary

If you're unable to file the Form 482 by the deadline, you can request an automatic six-month extension. This will give you more time to gather documents and submit your return.

Electronic Filing and Payment Options

The Puerto Rico Treasury Department offers electronic filing and payment options for the Form 482. You can file your return online through the Treasury's website or use a tax preparation software.

Tip 4: Take Advantage of Electronic Filing

Electronic filing is a convenient and efficient way to submit your return. It reduces errors and processing time, ensuring you receive your refund faster.

Avoiding Common Mistakes and Penalties

Failing to file the Form 482 or making errors on the return can result in penalties and fines. Common mistakes include:

- Failing to report income

- Claiming incorrect deductions or credits

- Missing deadlines

Tip 5: Seek Professional Help if Necessary

If you're unsure about any aspect of the Form 482, consider seeking help from a tax professional. They can guide you through the process and ensure you're in compliance with tax laws.

Staying Informed about Tax Law Changes

Tax laws and regulations are subject to change. It's essential to stay informed about any updates or revisions that may affect your tax situation.

Tip 6: Stay Up-to-Date with Tax Law Changes

Follow reputable sources, such as the Puerto Rico Treasury Department or tax professionals, to stay informed about tax law changes. This will help you navigate the complex tax landscape and ensure you're in compliance with current laws.

By following these six tips, you'll be well-equipped to file the Puerto Rico Tax Return Form 482 accurately and efficiently. Remember to stay informed about tax law changes and seek professional help if necessary. With the right guidance and resources, you'll be able to navigate the complex world of Puerto Rico taxes with confidence.

We hope this article has provided valuable insights and information to help you with your tax filing needs. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing the Puerto Rico Tax Return Form 482?

+The deadline for filing the Form 482 is typically April 15th of each year. However, if you need an extension, you can request a six-month extension by filing Form 485.

Can I file the Form 482 electronically?

+Yes, the Puerto Rico Treasury Department offers electronic filing options for the Form 482. You can file your return online through the Treasury's website or use a tax preparation software.

What are the tax rates and brackets for Puerto Rico?

+Puerto Rico has a progressive tax system, with tax rates ranging from 0% to 33.34%. The tax brackets are as follows: 0% on the first $9,000 of taxable income, 10% on taxable income between $9,001 and $25,000, 15% on taxable income between $25,001 and $50,000, 20% on taxable income between $50,001 and $100,000, 25% on taxable income between $100,001 and $200,000, and 33.34% on taxable income above $200,000.