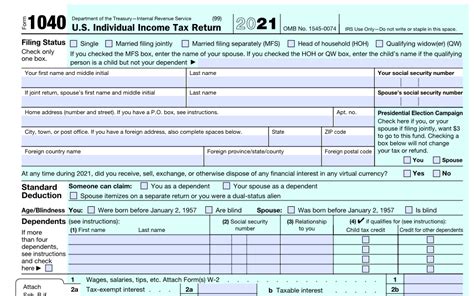

Preparing and filing tax returns can be a daunting task for many individuals. The Form 1040 is a crucial document that summarizes an individual's income, deductions, and credits, and it's essential to ensure its accuracy to avoid any issues with the IRS. As a tax professional, helping clients navigate the Form 1040 filing process can be a valuable service. Here are five tips for filing Form 1040 client statements effectively:

Understanding the Importance of Accuracy

Accuracy is paramount when filing Form 1040 client statements. A single mistake can lead to delays, audits, or even penalties. It's essential to double-check every detail, from Social Security numbers to income amounts and deductions. Encourage clients to review their statements carefully and ask questions if they're unsure about any information.

Gathering Necessary Documents

Gathering Necessary Documents

To ensure accurate filing, gather all necessary documents, including:

- W-2 forms from employers

- 1099 forms for freelance work or self-employment

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense records

Organize these documents in a logical order, and make sure clients understand what's required to support their tax return.

Choosing the Correct Filing Status

Choosing the Correct Filing Status

Filing status determines the tax rate and deductions available to clients. Ensure they choose the correct status, whether it's single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This may require discussing their personal situation, such as marital status, dependents, and residency.

Claiming Deductions and Credits

Claiming Deductions and Credits

Deductions and credits can significantly reduce clients' tax liability. Ensure they claim all eligible deductions, such as:

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable donations

- Medical expenses

Also, help clients identify potential credits, like:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

E-Filing and Record-Keeping

E-Filing and Record-Keeping

E-filing is a convenient and efficient way to submit tax returns. Ensure clients understand the benefits of e-filing, such as faster refunds and reduced errors. Additionally, advise them to keep accurate records of their tax returns, including supporting documents, for at least three years in case of audits or future reference.

By following these tips, you can help your clients navigate the Form 1040 filing process with confidence and accuracy. Encourage them to ask questions and seek professional guidance when needed.

Take Action

Now that you've learned these valuable tips for filing Form 1040 client statements, it's time to put them into practice. Share this article with your clients or colleagues, and encourage them to seek professional help if needed. Remember, accurate and efficient tax filing is essential for a stress-free tax season.

What is the deadline for filing Form 1040?

+The deadline for filing Form 1040 is typically April 15th of each year. However, this date may vary if April 15th falls on a weekend or holiday.

Can I file Form 1040 electronically?

+Yes, you can file Form 1040 electronically through the IRS website or through a tax professional. E-filing is a convenient and efficient way to submit your tax return.

What documents do I need to support my Form 1040?

+You'll need to gather documents such as W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, and medical expense records to support your tax return.