As a Subway employee, you're likely familiar with the hustle and bustle of working in a fast-paced restaurant environment. However, when it comes to taxes and benefits, things can get a bit more complicated. That's where the Subway W2 form comes in – a crucial document that helps you navigate the world of employee taxes and benefits. In this article, we'll delve into the details of the Subway W2 form, exploring its purpose, how to read it, and what you can expect in terms of taxes and benefits.

What is a W2 Form?

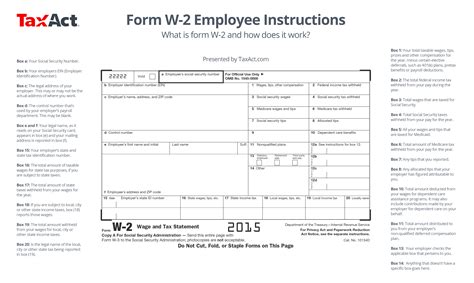

A W2 form, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees and the Social Security Administration (SSA) at the end of each year. The form outlines an employee's income, taxes withheld, and other relevant tax information. As a Subway employee, you'll receive a W2 form from your employer, which will help you file your taxes and claim any benefits you're eligible for.

What's Included on a W2 Form?

A standard W2 form includes the following information:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Employee's wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- Other relevant tax information, such as retirement plan contributions or dependent care benefits

How to Read Your Subway W2 Form

When you receive your Subway W2 form, it's essential to review it carefully to ensure everything is accurate. Here's a breakdown of what you should look for:

- Box 1: Wages, tips, and other compensation – This is your total income from Subway for the year.

- Box 2: Federal income tax withheld – This is the amount of federal income tax that was withheld from your paychecks.

- Box 3: Social Security wages – This is the amount of your income that's subject to Social Security tax.

- Box 4: Social Security tax withheld – This is the amount of Social Security tax that was withheld from your paychecks.

- Box 5: Medicare wages and tips – This is the amount of your income that's subject to Medicare tax.

- Box 6: Medicare tax withheld – This is the amount of Medicare tax that was withheld from your paychecks.

What to Do If You Find an Error on Your W2 Form

If you notice any errors on your Subway W2 form, such as an incorrect Social Security number or incorrect wages, you should contact your employer immediately. They'll need to correct the error and provide you with an updated W2 form.

Taxes and Benefits for Subway Employees

As a Subway employee, you're eligible for various taxes and benefits, including:

- Federal income tax withholding – Subway will withhold federal income tax from your paychecks, which will be reported on your W2 form.

- Social Security tax withholding – Subway will also withhold Social Security tax from your paychecks, which will be reported on your W2 form.

- Medicare tax withholding – Subway will withhold Medicare tax from your paychecks, which will be reported on your W2 form.

- Health insurance benefits – Subway offers health insurance benefits to its employees, which may be reported on your W2 form.

- Retirement plan benefits – Subway offers a 401(k) retirement plan to its employees, which may be reported on your W2 form.

Tips for Filing Your Taxes as a Subway Employee

When filing your taxes as a Subway employee, keep the following tips in mind:

- Use your W2 form to report your income and taxes withheld.

- Claim any deductions and credits you're eligible for, such as the Earned Income Tax Credit (EITC).

- Report any tips you received, as these are considered taxable income.

- Keep accurate records of your expenses, as these may be deductible.

Conclusion

As a Subway employee, understanding your W2 form and taxes is crucial for navigating the world of employee benefits and taxes. By reviewing your W2 form carefully and taking advantage of the tips and benefits outlined in this article, you'll be well on your way to filing your taxes with confidence.

FAQ Section

What is the deadline for receiving my W2 form from Subway?

+Subway is required to provide you with your W2 form by January 31st of each year.

How do I report tips on my tax return?

+You should report any tips you received on your tax return, using Form 4137. You'll need to keep accurate records of your tips, as these are considered taxable income.

What benefits does Subway offer to its employees?

+Subway offers various benefits to its employees, including health insurance, retirement plan benefits, and paid time off.