Investing in the stock market can be a lucrative way to grow your wealth, but it also comes with its own set of complexities, especially when it comes to taxes. One crucial aspect of tax compliance for investors is accurately calculating the basis of their stocks. The basis is essentially the original cost of purchasing a stock, and it plays a significant role in determining the gain or loss when the stock is sold. The IRS requires investors to report the basis of their stocks on Form 8949 and Schedule D of their tax return. To make this process easier, the IRS introduced Form 7203, also known as the S Corporation Shareholder Stock Basis Worksheet and Instructions. In this article, we'll delve into the world of stock basis calculation, exploring what it is, why it's important, and how Form 7203 can simplify the process.

Understanding Stock Basis

Stock basis is the amount an investor paid for a stock, including commissions and fees. It serves as the starting point for calculating gains and losses when the stock is sold. The basis is crucial for tax purposes because it affects the amount of capital gains tax owed. A higher basis reduces the gain, resulting in lower taxes, while a lower basis increases the gain, leading to higher taxes. Investors must keep accurate records of their stock purchases to ensure they report the correct basis on their tax return.

The Importance of Accurate Basis Calculation

Accurate basis calculation is vital for several reasons:

- Tax Compliance: The IRS requires investors to report the correct basis on their tax return. Failure to do so can result in penalties and fines.

- Capital Gains Tax: A higher basis reduces the gain, resulting in lower taxes. Inaccurate basis calculation can lead to overpayment of taxes.

- Audit Risk: Inaccurate basis calculation can increase the risk of an audit. The IRS may question the basis reported on the tax return, leading to additional scrutiny.

Using Form 7203 to Simplify Basis Calculation

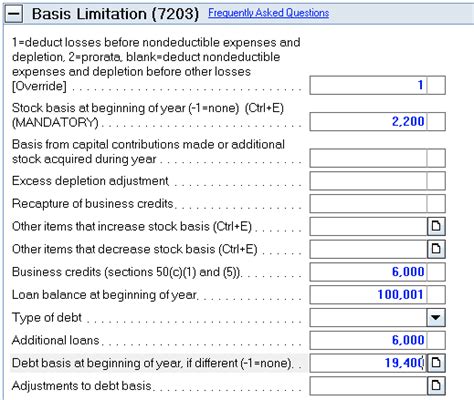

Form 7203 is a worksheet designed to help S corporation shareholders calculate their stock basis. While it's primarily intended for S corporations, the form can be useful for any investor looking to simplify their basis calculation. Here's how to use Form 7203:

- Gather Information: Collect all relevant information, including the stock purchase price, commissions, fees, and any dividends or distributions received.

- Complete the Worksheet: Fill out the worksheet, following the instructions provided. The form will guide you through the calculation process.

- Calculate the Basis: The worksheet will help you calculate the basis, taking into account all the necessary factors.

Additional Tips for Accurate Basis Calculation

In addition to using Form 7203, here are some tips to ensure accurate basis calculation:

- Keep Accurate Records: Maintain detailed records of all stock purchases, including the date, price, and any commissions or fees paid.

- Consider Dividends and Distributions: Don't forget to account for any dividends or distributions received, as these can affect the basis.

- Consult a Tax Professional: If you're unsure about any aspect of basis calculation, consider consulting a tax professional.

Conclusion

Calculating stock basis can be a complex task, but with the right tools and knowledge, it can be simplified. Form 7203 is a valuable resource for investors looking to accurately calculate their stock basis. By following the tips outlined in this article and using Form 7203, investors can ensure they report the correct basis on their tax return, reducing the risk of errors and penalties.

We encourage you to share your thoughts and experiences with calculating stock basis in the comments below. If you have any questions or need further clarification on any of the topics discussed, please don't hesitate to ask.

What is stock basis, and why is it important?

+Stock basis is the original cost of purchasing a stock, including commissions and fees. It's essential for tax purposes, as it affects the amount of capital gains tax owed. A higher basis reduces the gain, resulting in lower taxes, while a lower basis increases the gain, leading to higher taxes.

What is Form 7203, and how can it help with basis calculation?

+Form 7203 is a worksheet designed to help S corporation shareholders calculate their stock basis. While it's primarily intended for S corporations, the form can be useful for any investor looking to simplify their basis calculation. It guides you through the calculation process, taking into account all the necessary factors.

What are some common mistakes to avoid when calculating stock basis?

+Common mistakes to avoid include failing to account for dividends and distributions, not keeping accurate records, and not considering commissions and fees paid. It's essential to consult a tax professional if you're unsure about any aspect of basis calculation.