Utah taxpayers who are unable to meet the April 15th deadline for filing their individual income tax returns can breathe a sigh of relief. The Utah State Tax Commission allows taxpayers to file for a tax extension, giving them an additional six months to complete and submit their tax returns. In this article, we will delve into the Utah tax extension form, exploring five key things you need to know to ensure a smooth and stress-free extension process.

Understanding the Utah Tax Extension Form

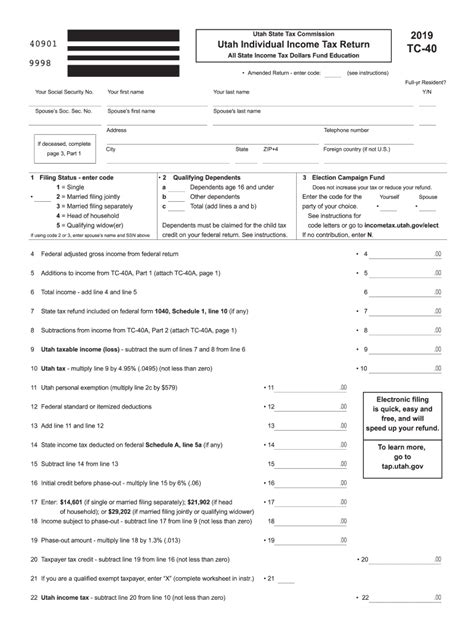

The Utah tax extension form is a simple and straightforward document that requires minimal information from taxpayers. To file for an extension, taxpayers will need to complete Form TC-559, which is available on the Utah State Tax Commission's website or through tax preparation software. The form requires taxpayers to provide their name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

Who is Eligible for a Utah Tax Extension?

To be eligible for a Utah tax extension, taxpayers must meet certain criteria. These include:

- Being a resident or non-resident individual taxpayer

- Being unable to file a complete and accurate tax return by the original deadline

- Not having filed for an extension in the past six months

It is essential to note that the Utah tax extension is not an extension to pay taxes owed. Taxpayers are still required to pay any taxes due by the original deadline to avoid penalties and interest.

Benefits of Filing a Utah Tax Extension

Filing a Utah tax extension can provide several benefits to taxpayers, including:

- Avoiding late-filing penalties and interest

- Giving taxpayers more time to gather necessary documentation and information

- Reducing stress and anxiety associated with meeting the original deadline

- Providing an opportunity to review and revise tax returns to ensure accuracy and completeness

How to File a Utah Tax Extension

Filing a Utah tax extension is a straightforward process that can be completed online or by mail. Taxpayers can file Form TC-559 electronically through the Utah State Tax Commission's website or through tax preparation software. Alternatively, taxpayers can mail a paper copy of the form to the address listed on the form.

To file online, taxpayers will need to:

- Log in to their Utah Taxpayer Access Point (TAP) account

- Select the "File an Extension" option

- Complete Form TC-559 and submit it electronically

To file by mail, taxpayers will need to:

- Download and complete Form TC-559

- Sign and date the form

- Mail the form to the address listed on the form

Important Deadlines and Dates

When filing a Utah tax extension, it is essential to keep track of important deadlines and dates. These include:

- April 15th: Original deadline for filing individual income tax returns

- June 15th: Deadline for filing Form TC-559 for a six-month extension

- October 15th: Deadline for filing the extended tax return

Common Mistakes to Avoid

When filing a Utah tax extension, taxpayers should avoid common mistakes that can result in delays or penalties. These include:

- Failing to sign and date Form TC-559

- Providing incomplete or inaccurate information

- Missing the deadline for filing the extension

- Failing to pay taxes owed by the original deadline

Conclusion: Simplifying the Utah Tax Extension Process

Filing a Utah tax extension can be a straightforward process when you understand the requirements and benefits. By following the steps outlined in this article, taxpayers can avoid common mistakes and ensure a smooth extension process. Remember to file Form TC-559 on time, provide accurate information, and pay any taxes owed to avoid penalties and interest.

We hope this article has provided you with the information you need to navigate the Utah tax extension process with confidence. If you have any further questions or concerns, please don't hesitate to reach out.

What's Next?

- Share this article with friends and family who may be facing tax-related stress

- Comment below with any questions or concerns you may have

- Visit the Utah State Tax Commission's website for more information on tax extensions and other tax-related topics.

What is the deadline for filing a Utah tax extension?

+The deadline for filing a Utah tax extension is June 15th.

Do I need to pay taxes owed when filing a Utah tax extension?

+Yes, taxpayers are still required to pay any taxes owed by the original deadline to avoid penalties and interest.

Can I file a Utah tax extension electronically?

+Yes, taxpayers can file Form TC-559 electronically through the Utah State Tax Commission's website or through tax preparation software.