The state of Georgia offers various options for filing state tax forms, making it convenient for taxpayers to choose the method that best suits their needs. Whether you prefer to file electronically or by mail, the Georgia Department of Revenue provides several ways to submit your state tax return. In this article, we will explore the five ways to file a state of GA tax form, helping you to navigate the process with ease.

Understanding the Importance of Filing State Tax Forms

Before we dive into the various filing methods, it's essential to understand the significance of filing state tax forms. In Georgia, taxpayers are required to file a state tax return if their income exceeds a certain threshold or if they have taxes withheld from their income. Filing a state tax return ensures that you are in compliance with state tax laws and helps you to claim any refunds or credits you may be eligible for.

Option 1: Electronic Filing through the Georgia Tax Center

The Georgia Tax Center is a secure online platform that allows taxpayers to file their state tax returns electronically. This method is fast, convenient, and reduces the risk of errors. To file electronically, you will need to create an account on the Georgia Tax Center website and follow the prompts to complete your tax return.

Option 2: Filing through a Tax Professional or Tax Preparation Software

Many tax professionals and tax preparation software providers, such as TurboTax or H&R Block, offer e-filing services for Georgia state tax returns. These services often provide guidance and support to help you navigate the tax filing process. If you choose to file through a tax professional or tax preparation software, make sure to select a reputable provider that is authorized by the Georgia Department of Revenue.

Benefits of E-Filing

E-filing your state tax return offers several benefits, including:

- Faster processing times

- Reduced risk of errors

- Instant confirmation of receipt

- Ability to track the status of your refund

What You Need to E-File

To e-file your state tax return, you will need:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if filing jointly)

- Your dependents' social security numbers or ITINs (if claiming dependents)

- Your W-2 forms and 1099 forms (if applicable)

- Your tax preparation software or tax professional's credentials (if filing through a tax professional)

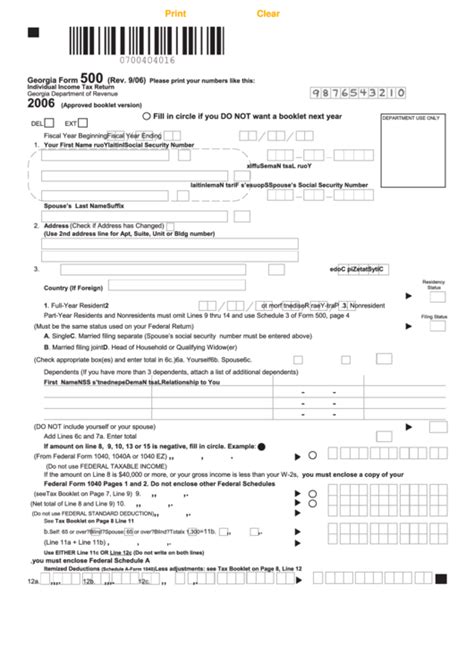

Option 3: Mailing Your Tax Return

If you prefer to file your state tax return by mail, you can download and print the necessary forms from the Georgia Department of Revenue website or pick them up from a local tax office. Make sure to complete the forms accurately and sign them before mailing them to the address listed on the form.

Option 4: Filing through a Local Tax Office

The Georgia Department of Revenue has several local tax offices throughout the state where you can file your tax return in person. These offices often provide assistance and guidance to help you complete your tax return. To find a local tax office near you, visit the Georgia Department of Revenue website.

What to Expect at a Local Tax Office

When filing at a local tax office, you can expect:

- Assistance with completing your tax return

- Review of your tax return for accuracy

- Help with any tax-related questions or concerns

- Opportunity to ask questions and seek clarification on tax laws and regulations

Option 5: Filing through a Taxpayer Assistance Center

The Georgia Department of Revenue also offers Taxpayer Assistance Centers (TACs) where you can file your tax return and receive assistance from trained tax professionals. TACs are located throughout the state and provide a range of services, including tax return preparation and review.

Additional Tips and Reminders

- Make sure to file your state tax return by the deadline to avoid penalties and interest.

- Keep a copy of your tax return and supporting documents for at least three years.

- If you need help with your tax return, consider seeking assistance from a tax professional or the Georgia Department of Revenue.

By understanding the various options for filing a state of GA tax form, you can choose the method that best suits your needs and ensure that you are in compliance with state tax laws. Remember to file your tax return accurately and on time to avoid any penalties or interest.

What is the deadline for filing a state tax return in Georgia?

+The deadline for filing a state tax return in Georgia is April 15th of each year.

Can I file my state tax return electronically if I owe taxes?

+What is the penalty for late filing of a state tax return in Georgia?

+The penalty for late filing of a state tax return in Georgia is 1% of the tax due for each month or part of a month, up to a maximum of 25%.