Accurate and efficient completion of state forms is crucial for individuals and businesses alike, as it ensures compliance with regulations and avoids potential penalties. State Form 39530 is a document that requires careful attention to detail to fill out correctly. In this article, we will explore five ways to fill out State Form 39530 accurately and efficiently.

Understanding State Form 39530

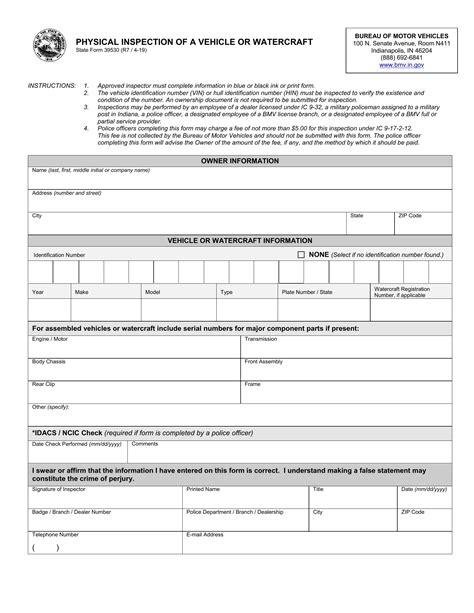

Before diving into the ways to fill out State Form 39530, it's essential to understand the purpose and requirements of the form. State Form 39530 is typically used for reporting and documentation purposes, and its specific requirements may vary depending on the state and the context in which it is used.

Breaking Down the Form's Components

To fill out State Form 39530 accurately, it's crucial to understand its various components, including:

- Personal or business information

- Reporting periods

- Financial data

- Supporting documentation

By breaking down the form into its components, individuals can better comprehend what information is required and how to provide it accurately.

1. Gather Required Information and Documents

The first step in filling out State Form 39530 is to gather all required information and documents. This includes:

- Personal or business identification

- Financial records

- Supporting documentation, such as receipts or invoices

Having all the necessary information and documents readily available will ensure that the form is filled out accurately and efficiently.

Tips for Gathering Information

- Make sure to review the form's instructions carefully to understand what information is required.

- Use a checklist to ensure that all necessary documents and information are gathered.

- Keep all documents and information organized, either physically or digitally, to make it easier to access and reference.

2. Use the Correct Filing Status

When filling out State Form 39530, it's essential to use the correct filing status. The filing status will determine which sections of the form need to be completed and which supporting documentation is required.

Common Filing Statuses

- Individual

- Business

- Non-profit organization

Using the correct filing status will ensure that the form is filled out accurately and that all necessary information is provided.

3. Complete the Form Section by Section

To avoid mistakes and ensure accuracy, it's best to complete State Form 39530 section by section. This will help individuals stay organized and focused, ensuring that all required information is provided.

Tips for Completing the Form

- Read each section carefully before filling it out.

- Use a pen or pencil to fill out the form, and make sure to write legibly.

- Double-check each section for accuracy before moving on to the next one.

4. Review and Edit the Form

Once the form is complete, it's essential to review and edit it carefully. This will help individuals catch any mistakes or errors, ensuring that the form is accurate and complete.

Tips for Reviewing and Editing the Form

- Take a break before reviewing the form to ensure a fresh perspective.

- Use a red pen or highlighter to mark any errors or corrections.

- Make sure to review the form multiple times to ensure accuracy.

5. Seek Professional Help if Needed

If individuals are unsure about how to fill out State Form 39530 or need help with a specific section, it's best to seek professional help. This can include consulting with a tax professional, accountant, or attorney.

Tips for Seeking Professional Help

- Make sure to research and find a qualified professional with experience in filling out State Form 39530.

- Be prepared to provide all necessary information and documentation to the professional.

- Ask questions and clarify any doubts or concerns before the professional begins working on the form.

We hope this article has provided valuable insights and tips on how to fill out State Form 39530 accurately and efficiently. By following these five ways, individuals can ensure that their form is complete, accurate, and compliant with regulations.

Now it's your turn! Share your experiences or tips on filling out State Form 39530 in the comments below. Don't forget to share this article with others who may find it helpful.

What is State Form 39530 used for?

+State Form 39530 is typically used for reporting and documentation purposes, and its specific requirements may vary depending on the state and the context in which it is used.

How do I know which filing status to use?

+The filing status will depend on the individual's or business's specific situation. Common filing statuses include individual, business, and non-profit organization.

What happens if I make a mistake on the form?

+If you make a mistake on the form, you can correct it by reviewing and editing the form carefully. If you're unsure about how to correct the mistake, it's best to seek professional help.