Sales tax compliance can be a daunting task for businesses, especially when it comes to filing the correct forms on time. In this article, we will discuss the importance of filing the ST-100 sales tax form and provide guidance on how to do it correctly.

Sales tax is a crucial source of revenue for many states, and it's essential for businesses to comply with the regulations to avoid penalties and fines. The ST-100 sales tax form is a critical document that businesses must file to report their sales tax liability to the state government. The form requires businesses to provide detailed information about their sales, exemptions, and tax liabilities.

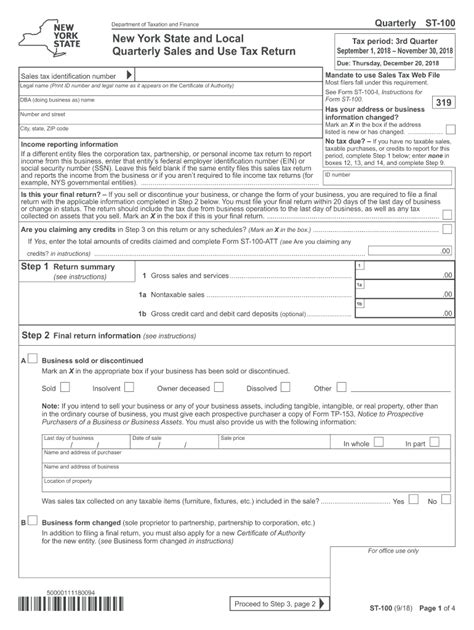

What is the ST-100 Sales Tax Form?

The ST-100 sales tax form is a document used by businesses to report their sales tax liability to the state government. The form requires businesses to provide detailed information about their sales, exemptions, and tax liabilities. The form is typically filed on a monthly or quarterly basis, depending on the state's regulations.

Why is it Important to File the ST-100 Sales Tax Form?

Filing the ST-100 sales tax form is crucial for businesses to comply with state regulations and avoid penalties and fines. The form provides the state government with the necessary information to calculate the business's sales tax liability. Failure to file the form or filing it incorrectly can result in penalties, fines, and even audits.

5 Ways to File the ST-100 Sales Tax Form

There are several ways to file the ST-100 sales tax form, and the method you choose will depend on your business's specific needs and preferences. Here are five ways to file the ST-100 sales tax form:

1. Online Filing

Online filing is a convenient and efficient way to file the ST-100 sales tax form. Most states offer online filing options through their websites or through third-party providers. To file online, you will need to create an account, enter your business information, and upload your sales tax data. Online filing is quick and easy, and you will receive an immediate confirmation of your filing.

2. Electronic Filing (EDI)

Electronic Data Interchange (EDI) is a method of filing the ST-100 sales tax form electronically through a third-party provider. EDI allows you to transmit your sales tax data directly to the state government's computer system. To file using EDI, you will need to work with a third-party provider who is authorized by the state government.

3. Paper Filing

Paper filing is a traditional method of filing the ST-100 sales tax form. To file by paper, you will need to complete the form manually and mail it to the state government's address. Paper filing can be time-consuming and prone to errors, but it is still an option for businesses that prefer this method.

4. Outsourcing to a Third-Party Provider

Outsourcing to a third-party provider is a convenient option for businesses that do not have the time or resources to file the ST-100 sales tax form themselves. Third-party providers can handle the entire filing process for you, from preparing the form to submitting it to the state government.

5. Using Sales Tax Software

Sales tax software is a specialized software that can help you prepare and file the ST-100 sales tax form. Sales tax software can automate the filing process and reduce errors. To use sales tax software, you will need to purchase the software and install it on your computer.

Benefits of Filing the ST-100 Sales Tax Form Correctly

Filing the ST-100 sales tax form correctly can have several benefits for your business. Here are some of the benefits of filing the form correctly:

- Avoid penalties and fines

- Reduce the risk of audits

- Improve compliance with state regulations

- Reduce errors and mistakes

- Improve cash flow and reduce the risk of overpayment

Common Mistakes to Avoid When Filing the ST-100 Sales Tax Form

When filing the ST-100 sales tax form, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Failing to file the form on time

- Filing the form incorrectly

- Underreporting or overreporting sales tax liability

- Failing to report exemptions and deductions

- Failing to keep accurate records

Conclusion

Filing the ST-100 sales tax form is a critical task for businesses to comply with state regulations and avoid penalties and fines. By understanding the importance of filing the form correctly and using the right filing method, businesses can reduce errors and mistakes and improve compliance. By following the tips and guidelines outlined in this article, businesses can ensure that they file the ST-100 sales tax form correctly and avoid common mistakes.

What is the ST-100 sales tax form?

+The ST-100 sales tax form is a document used by businesses to report their sales tax liability to the state government.

How often do I need to file the ST-100 sales tax form?

+The frequency of filing the ST-100 sales tax form depends on the state's regulations. It can be filed monthly or quarterly.

What are the benefits of filing the ST-100 sales tax form correctly?

+Filing the ST-100 sales tax form correctly can help businesses avoid penalties and fines, reduce errors and mistakes, and improve compliance with state regulations.