As an employer, it's essential to maintain accurate and up-to-date records of your employees' data. The SSS E4 form is a crucial document that helps you collect and update the necessary information about your employees. In this article, we'll delve into the world of SSS E4 forms, exploring their importance, benefits, and a step-by-step guide on how to fill them out.

What is the SSS E4 Form?

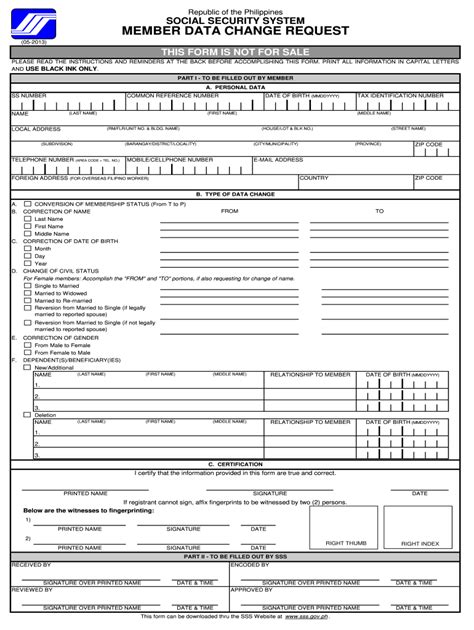

The SSS E4 form, also known as the "Member's Data Amendment" form, is a document used by the Social Security System (SSS) to collect and update information about its members. The form is used to report changes or updates in an employee's personal data, such as name, address, or dependents.

Why is the SSS E4 Form Important?

The SSS E4 form is essential for several reasons:

- It helps the SSS maintain accurate and up-to-date records of its members.

- It ensures that employees receive the correct benefits and contributions.

- It enables employers to report changes in their employees' data, such as promotions or transfers.

- It helps the SSS in planning and budgeting for future benefits and services.

Benefits of the SSS E4 Form

The SSS E4 form offers several benefits to both employers and employees. Some of these benefits include:

- Accurate record-keeping: The form ensures that the SSS has accurate and up-to-date records of its members.

- Efficient reporting: The form makes it easier for employers to report changes in their employees' data.

- Improved benefits: The form helps the SSS provide accurate and timely benefits to its members.

- Enhanced security: The form helps protect the personal data of SSS members.

How to Fill Out the SSS E4 Form

Filling out the SSS E4 form is a straightforward process. Here's a step-by-step guide to help you get started:

- Download the SSS E4 form from the SSS website or obtain a copy from your employer.

- Fill out the form using a pen or pencil. Make sure to write legibly and accurately.

- Provide the required information, such as your name, SSS number, and date of birth.

- Report any changes or updates in your personal data, such as a change in address or dependents.

- Sign and date the form.

- Submit the form to your employer or the SSS office.

Common Mistakes to Avoid

When filling out the SSS E4 form, there are several common mistakes to avoid:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Incorrect or missing SSS number

- Failure to report changes or updates in personal data

Conclusion

In conclusion, the SSS E4 form is an essential document that helps the SSS collect and update information about its members. By following the steps outlined in this article, you can ensure that your SSS E4 form is filled out accurately and efficiently. Remember to avoid common mistakes and take the time to review your form before submitting it.

We hope this article has provided you with a comprehensive guide to the SSS E4 form. If you have any questions or concerns, feel free to comment below.

What is the purpose of the SSS E4 form?

+The SSS E4 form is used to collect and update information about SSS members, including changes in personal data, such as name, address, or dependents.

How do I fill out the SSS E4 form?

+Fill out the form using a pen or pencil, providing accurate and up-to-date information. Report any changes or updates in your personal data, sign and date the form, and submit it to your employer or the SSS office.

What are common mistakes to avoid when filling out the SSS E4 form?

+Avoid inaccurate or incomplete information, failure to sign and date the form, incorrect or missing SSS number, and failure to report changes or updates in personal data.