Filing taxes can be a daunting task, especially for those who are new to the process. One crucial document that plays a significant role in the tax filing process is the W-4 form. In this article, we will delve into the world of the VA W-4 form, exploring its essential facts, benefits, and everything you need to know to make the most out of it.

The VA W-4 form is a vital document for employees in the state of Virginia, and it's essential to understand its purpose, how it works, and its benefits. Whether you're an employer or an employee, having a clear understanding of the VA W-4 form will help you navigate the tax filing process with ease.

What is a VA W-4 Form?

Understanding the Basics of VA W-4 Form

A VA W-4 form, also known as the Virginia Employee's Withholding Exemption Certificate, is a document that employees in Virginia use to claim exemptions from state income tax withholding. The form is used to determine the amount of state income tax that should be withheld from an employee's paycheck.

Why is the VA W-4 Form Important?

The Importance of VA W-4 Form in Tax Filing

The VA W-4 form is essential for several reasons:

- It helps employees claim exemptions from state income tax withholding, which can reduce the amount of taxes withheld from their paychecks.

- It ensures that employers withhold the correct amount of state income tax from their employees' paychecks.

- It helps the state of Virginia collect the correct amount of income tax revenue.

Who Needs to Fill Out a VA W-4 Form?

Eligibility Criteria for VA W-4 Form

The following individuals need to fill out a VA W-4 form:

- New employees in Virginia who want to claim exemptions from state income tax withholding.

- Existing employees in Virginia who want to change their withholding exemptions.

- Employees in Virginia who want to claim a new exemption or change their existing exemption.

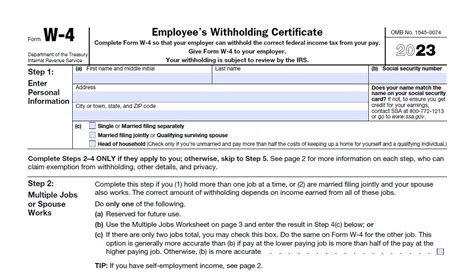

How to Fill Out a VA W-4 Form?

Step-by-Step Guide to Filling Out VA W-4 Form

Filling out a VA W-4 form is a straightforward process. Here's a step-by-step guide:

- Download the VA W-4 form from the Virginia Department of Taxation website or obtain a copy from your employer.

- Fill out the form with your personal and employment information.

- Claim your exemptions by checking the relevant boxes.

- Sign and date the form.

- Submit the form to your employer.

What are the Benefits of Filling Out a VA W-4 Form?

Benefits of Filling Out VA W-4 Form

Filling out a VA W-4 form can have several benefits, including:

- Reducing the amount of state income tax withheld from your paycheck.

- Increasing your take-home pay.

- Ensuring that you're not overpaying or underpaying state income tax.

Common Mistakes to Avoid When Filling Out a VA W-4 Form

Common Mistakes to Avoid When Filling Out VA W-4 Form

Here are some common mistakes to avoid when filling out a VA W-4 form:

- Failing to sign and date the form.

- Claiming incorrect exemptions.

- Not submitting the form to your employer.

In conclusion, the VA W-4 form is an essential document for employees in Virginia, and understanding its purpose, benefits, and how to fill it out can make a significant difference in your tax filing process. By avoiding common mistakes and taking advantage of the benefits, you can ensure that you're not overpaying or underpaying state income tax.

We hope this article has provided you with valuable insights into the world of the VA W-4 form. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your friends and family who may benefit from this information.

FAQ Section

What is the purpose of the VA W-4 form?

+The VA W-4 form is used to determine the amount of state income tax that should be withheld from an employee's paycheck.

Who needs to fill out a VA W-4 form?

+New employees in Virginia, existing employees who want to change their withholding exemptions, and employees who want to claim a new exemption or change their existing exemption need to fill out a VA W-4 form.

What are the benefits of filling out a VA W-4 form?

+Filling out a VA W-4 form can reduce the amount of state income tax withheld from your paycheck, increase your take-home pay, and ensure that you're not overpaying or underpaying state income tax.