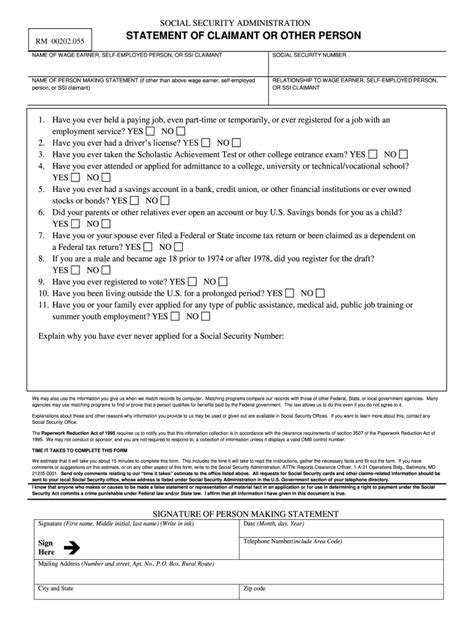

Completing the SSA Form 795, also known as the Statement of Claimant or Other Person, is a crucial step in the process of applying for Social Security benefits. This form is used to gather information about your work history, income, and other relevant details that will help determine your eligibility for benefits. While it may seem daunting, filling out the SSA Form 795 can be a straightforward process if you follow these 5 easy steps.

Step 1: Gather Required Information

Before you start filling out the SSA Form 795, make sure you have all the necessary information and documents. You will need to provide:

- Your personal details, including your name, date of birth, and Social Security number

- Information about your work history, including your employers, job titles, and dates of employment

- Details about your income, including your gross income and any deductions

- Information about your spouse and children, if applicable

Having all the required information and documents ready will make the process of filling out the form much easier and less time-consuming.

Understanding the SSA Form 795 Sections

The SSA Form 795 is divided into several sections, each requiring different types of information. Let's take a closer look at what each section entails.

Section 1: Claimant's Information

In this section, you will need to provide your personal details, including your name, date of birth, and Social Security number. You will also need to provide information about your address, phone number, and email address.

Section 1A: Claimant's Work History

In this subsection, you will need to provide information about your work history, including your employers, job titles, and dates of employment. You will need to provide details about your last job, as well as any other jobs you have held in the past.

Step 2: Fill Out Section 2: Employment History

In Section 2, you will need to provide more detailed information about your employment history. This includes:

- Your employer's name and address

- Your job title and dates of employment

- Your gross income and any deductions

- Any other relevant details about your employment

Step 3: Complete Section 3: Income and Benefits

In Section 3, you will need to provide information about your income and benefits. This includes:

- Your gross income from all sources

- Any deductions, such as taxes or health insurance premiums

- Any benefits you receive, such as retirement or disability benefits

Section 3A: Other Income and Benefits

In this subsection, you will need to provide information about any other income or benefits you receive. This includes:

- Interest or dividends from investments

- Rent or royalties from property

- Any other income or benefits not already reported

Step 4: Fill Out Section 4: Spouse and Children

In Section 4, you will need to provide information about your spouse and children, if applicable. This includes:

- Your spouse's name, date of birth, and Social Security number

- Your children's names, dates of birth, and Social Security numbers

- Any other relevant details about your family

Step 5: Review and Sign the Form

Once you have completed all the sections of the SSA Form 795, review the form carefully to ensure that all the information is accurate and complete. Sign the form in the designated area, and make sure to date it.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind when filling out the SSA Form 795:

- Make sure to answer all questions completely and accurately

- Use black ink to sign the form

- Keep a copy of the form for your records

- Submit the form to the Social Security Administration (SSA) as soon as possible

By following these 5 easy steps, you can complete the SSA Form 795 with ease and accuracy. Remember to review the form carefully before submitting it to the SSA, and don't hesitate to ask for help if you need it.

We hope this article has been helpful in guiding you through the process of filling out the SSA Form 795. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with your friends and family who may be applying for Social Security benefits.

What is the SSA Form 795 used for?

+The SSA Form 795 is used to gather information about your work history, income, and other relevant details to determine your eligibility for Social Security benefits.

How long does it take to fill out the SSA Form 795?

+The time it takes to fill out the SSA Form 795 will depend on the complexity of your work history and income. On average, it can take around 30 minutes to an hour to complete the form.

Can I submit the SSA Form 795 online?

+No, the SSA Form 795 cannot be submitted online. You will need to print and sign the form, then mail or fax it to the Social Security Administration (SSA).