Tackling debt can be a daunting task, but with a solid plan and the right strategy, you can pay off your debts faster and achieve financial freedom. One popular method is the debt snowball form, which helps you prioritize your debts and create a manageable plan to become debt-free. In this article, we'll explore the debt snowball form, its benefits, and provide a template to help you get started.

Understanding the Debt Snowball Method

The debt snowball method was popularized by financial expert Dave Ramsey. It involves listing all your debts, starting with the smallest balance first, and paying them off one by one. This approach provides a psychological boost as you quickly eliminate smaller debts and see progress.

Benefits of the Debt Snowball Method

- Provides a clear plan and focus

- Builds momentum and motivation

- Allows for quick wins and progress tracking

- Reduces stress and anxiety

How to Use the Debt Snowball Form

To use the debt snowball form, follow these steps:

- List all your debts, including credit cards, loans, and mortgages.

- Sort the debts by balance, from smallest to largest.

- Determine the minimum payment for each debt.

- Allocate as much money as possible towards the smallest debt.

- Once the smallest debt is paid off, use the money to attack the next debt.

Example of a Debt Snowball Plan

Suppose you have the following debts:

- Credit card A: $500 balance, $25 minimum payment

- Credit card B: $2,000 balance, $50 minimum payment

- Car loan: $10,000 balance, $200 minimum payment

Your debt snowball plan would prioritize the debts as follows:

- Credit card A: $500 balance

- Credit card B: $2,000 balance

- Car loan: $10,000 balance

You would pay the minimum payment on all debts except Credit card A, which you would pay off as aggressively as possible.

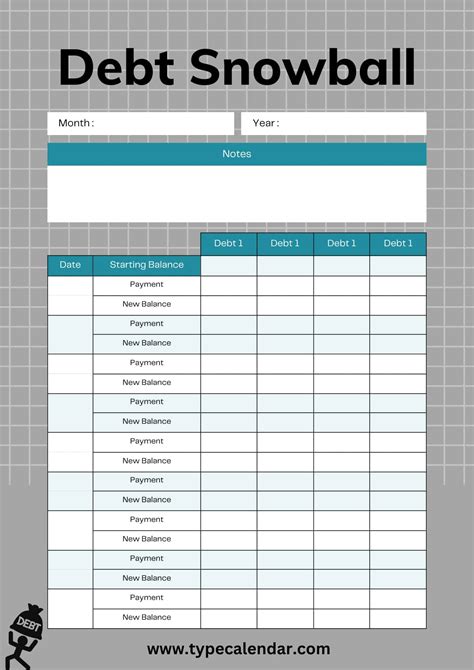

Debt Snowball Template

Here's a template to help you create your own debt snowball plan:

| Debt | Balance | Minimum Payment | Payment Priority |

|---|---|---|---|

| Credit card A | $500 | $25 | 1 |

| Credit card B | $2,000 | $50 | 2 |

| Car loan | $10,000 | $200 | 3 |

Step 1: List all your debts

- Debt: _____________________________________

- Balance: __________________________________

- Minimum Payment: _______________________

Step 2: Sort debts by balance

- Debt 1: _____________________________________

- Balance: __________________________________

- Minimum Payment: _______________________

- Debt 2: _____________________________________

- Balance: __________________________________

- Minimum Payment: _______________________

- Debt 3: _____________________________________

- Balance: __________________________________

- Minimum Payment: _______________________

Step 3: Determine payment priority

- Debt 1: _____________________________________ ( highest priority)

- Debt 2: _____________________________________

- Debt 3: _____________________________________

Tips for Success

- Create a budget and track your expenses

- Cut expenses and allocate more money towards debt repayment

- Consider consolidating debts or negotiating lower interest rates

- Stay motivated and celebrate small victories along the way

Conclusion

By using the debt snowball form, you can create a personalized plan to tackle your debts and achieve financial freedom. Remember to stay focused, motivated, and patient, and you'll be on your way to becoming debt-free.

What is the debt snowball method?

+The debt snowball method involves listing all your debts, starting with the smallest balance first, and paying them off one by one.

How do I prioritize my debts using the debt snowball form?

+Sort your debts by balance, from smallest to largest, and allocate as much money as possible towards the smallest debt.

What are some tips for success with the debt snowball method?

+Create a budget, track your expenses, cut expenses, and allocate more money towards debt repayment. Consider consolidating debts or negotiating lower interest rates.