The SR13 form, also known as the Report of Crash, is a crucial document for insurance companies in Georgia. It provides essential information about vehicle accidents, helping insurers to process claims efficiently. In this article, we will delve into the importance of the SR13 form, its key components, and the process of filling it out.

What is the SR13 Form?

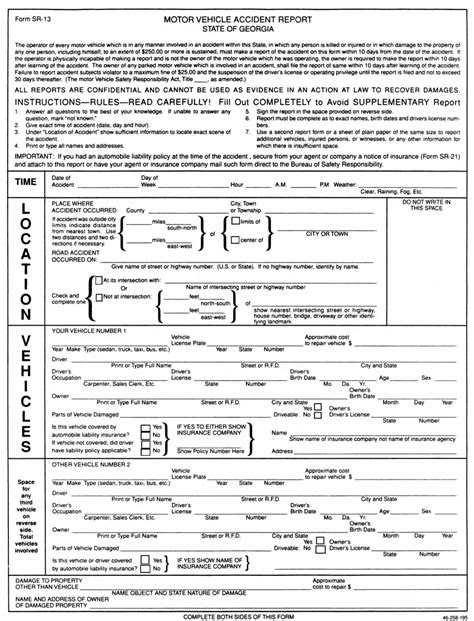

The SR13 form is a standardized document used in Georgia to report vehicle accidents to insurance companies. It is also known as the Report of Crash or the Georgia Crash Report. The form is designed to collect detailed information about the accident, including the parties involved, vehicles, and circumstances surrounding the incident.

Why is the SR13 Form Important?

The SR13 form plays a vital role in the insurance claims process. It provides insurance companies with critical information to assess the severity of the accident, determine liability, and calculate damages. The form helps insurers to:

- Identify the parties involved and their respective insurance coverage

- Understand the circumstances surrounding the accident

- Assess the extent of damages to vehicles and property

- Determine the severity of injuries sustained by parties involved

Key Components of the SR13 Form

The SR13 form consists of several sections that capture essential information about the accident. The key components include:

- Parties involved: Names, addresses, phone numbers, and insurance information of drivers, passengers, and pedestrians

- Vehicle information: Make, model, year, and Vehicle Identification Number (VIN) of vehicles involved

- Accident details: Date, time, location, and circumstances surrounding the accident

- Damages and injuries: Description of damages to vehicles and property, as well as injuries sustained by parties involved

Filling Out the SR13 Form

The SR13 form must be completed accurately and thoroughly to ensure that insurance companies receive the necessary information to process claims. Here's a step-by-step guide to filling out the form:

- Parties Involved: Fill out the names, addresses, phone numbers, and insurance information of drivers, passengers, and pedestrians.

- Vehicle Information: Provide the make, model, year, and VIN of vehicles involved.

- Accident Details: Describe the date, time, location, and circumstances surrounding the accident.

- Damages and Injuries: Describe the damages to vehicles and property, as well as injuries sustained by parties involved.

Benefits of Using the SR13 Form

The SR13 form offers several benefits to insurance companies, including:

- Efficient claims processing: The form provides essential information to assess claims quickly and accurately.

- Reduced errors: The standardized format minimizes errors and inconsistencies in reporting.

- Improved accuracy: The form helps insurers to accurately determine liability and calculate damages.

Common Mistakes to Avoid When Filling Out the SR13 Form

When filling out the SR13 form, it's essential to avoid common mistakes that can lead to delays or inaccuracies in claims processing. Some common mistakes to avoid include:

- Incomplete information: Ensure that all sections of the form are completed accurately and thoroughly.

- Inaccurate information: Double-check the accuracy of information provided, including names, addresses, and vehicle details.

- Failure to report injuries: Ensure that all injuries sustained by parties involved are reported on the form.

Best Practices for Insurance Companies

Insurance companies can optimize their claims processing by following best practices when handling the SR13 form:

- Verify information: Ensure that the information provided on the form is accurate and complete.

- Use standardized procedures: Establish standardized procedures for processing SR13 forms to minimize errors and delays.

- Communicate effectively: Communicate clearly with policyholders and claimants to ensure that they understand the claims process.

Conclusion

The SR13 form is a critical document for insurance companies in Georgia, providing essential information to process claims efficiently. By understanding the key components of the form and following best practices, insurers can optimize their claims processing and provide better service to policyholders. If you have any questions or concerns about the SR13 form, feel free to comment below or share this article with others.

What is the purpose of the SR13 form?

+The SR13 form is used to report vehicle accidents to insurance companies in Georgia, providing essential information to process claims efficiently.

Who is required to complete the SR13 form?

+Drivers, passengers, and pedestrians involved in a vehicle accident in Georgia are required to complete the SR13 form.

What information is required on the SR13 form?

+The SR13 form requires information about the parties involved, vehicles, and circumstances surrounding the accident, including names, addresses, phone numbers, and insurance information.