The SOS Form LLC-3 is a crucial document for limited liability companies (LLCs) operating in various states. This form serves as a statement of information, providing vital details about the LLC to the Secretary of State (SOS). In this article, we will delve into three essential facts about the SOS Form LLC-3, highlighting its significance, requirements, and filing process.

What is the SOS Form LLC-3?

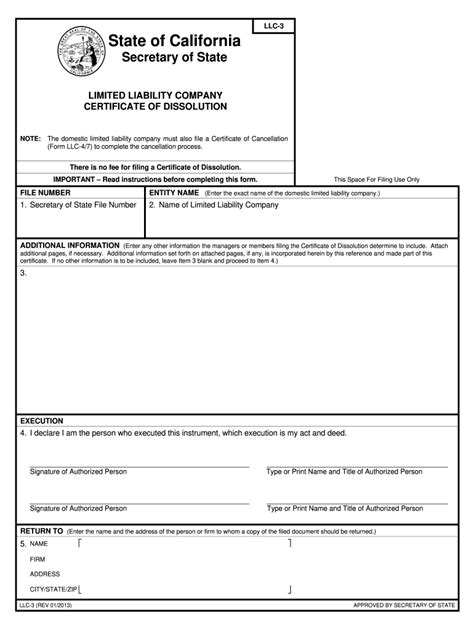

The SOS Form LLC-3 is a state-mandated document that must be filed by LLCs in certain jurisdictions. This form requires LLCs to provide updated information about their business, including the company name, address, management structure, and ownership details. The purpose of this form is to ensure that the SOS has accurate and current information about the LLC, which helps maintain transparency and accountability.

Why is the SOS Form LLC-3 Important?

The SOS Form LLC-3 is essential for several reasons:

- Compliance: Filing the SOS Form LLC-3 is a mandatory requirement for LLCs in certain states. Failure to comply with this requirement can result in penalties, fines, and even the suspension of the LLC's business activities.

- Public Record: The information provided on the SOS Form LLC-3 becomes part of the public record, making it accessible to anyone who wants to know more about the LLC. This transparency helps maintain trust and credibility in the business community.

- Internal Management: The SOS Form LLC-3 helps LLCs maintain accurate and up-to-date internal records. This is particularly important for companies with multiple owners or managers, as it ensures that everyone is on the same page regarding the company's structure and operations.

Requirements for Filing the SOS Form LLC-3

To file the SOS Form LLC-3, LLCs must provide the following information:

- Company Name and Address: The LLC's name and address, including any changes or updates.

- Management Structure: The LLC's management structure, including the names and addresses of managers or members.

- Ownership Details: Information about the LLC's ownership, including the names and addresses of owners (also known as members).

- Business Purpose: A brief description of the LLC's business purpose and activities.

How to File the SOS Form LLC-3

The filing process for the SOS Form LLC-3 varies depending on the state. However, most states allow LLCs to file the form online or by mail. Here are the general steps to follow:

- Determine Filing Requirements: Check with the SOS to determine the specific filing requirements for your state.

- Gather Required Information: Collect all the necessary information, including company name and address, management structure, ownership details, and business purpose.

- Complete the Form: Fill out the SOS Form LLC-3 accurately and completely, making sure to sign and date the document.

- Submit the Form: File the completed form with the SOS, either online or by mail, along with the required filing fee.

Consequences of Not Filing the SOS Form LLC-3

Failure to file the SOS Form LLC-3 can result in serious consequences, including:

- Penalties and Fines: LLCs may be subject to penalties and fines for non-compliance.

- Suspension of Business Activities: In extreme cases, the SOS may suspend the LLC's business activities until the form is filed.

- Loss of Good Standing: Failure to file the SOS Form LLC-3 can result in the loss of good standing, making it difficult for the LLC to obtain loans, enter into contracts, or conduct business.

Best Practices for Filing the SOS Form LLC-3

To avoid any potential issues, LLCs should follow these best practices:

- File on Time: File the SOS Form LLC-3 on time to avoid penalties and fines.

- Double-Check Information: Verify the accuracy of the information provided on the form to avoid any errors or discrepancies.

- Keep Records Up-to-Date: Regularly update the LLC's internal records to ensure that the information on the SOS Form LLC-3 is accurate and current.

In conclusion, the SOS Form LLC-3 is a critical document that LLCs must file to maintain compliance with state regulations. By understanding the requirements and consequences of not filing the form, LLCs can avoid any potential issues and ensure that their business remains in good standing.

What is the purpose of the SOS Form LLC-3?

+The SOS Form LLC-3 is a statement of information that provides vital details about the LLC to the Secretary of State (SOS). It helps maintain transparency and accountability, ensuring that the SOS has accurate and current information about the LLC.

What are the consequences of not filing the SOS Form LLC-3?

+Failure to file the SOS Form LLC-3 can result in penalties, fines, and even the suspension of the LLC's business activities. It can also lead to the loss of good standing, making it difficult for the LLC to obtain loans, enter into contracts, or conduct business.

How often do I need to file the SOS Form LLC-3?

+The filing frequency for the SOS Form LLC-3 varies depending on the state. Some states require LLCs to file the form annually, while others may require it biennially or at specific intervals. Check with the SOS to determine the specific filing requirements for your state.