Filling out a SoFi direct deposit form can be a straightforward process, but it's essential to ensure that all the necessary information is accurate and complete. In this article, we'll provide a step-by-step guide on how to fill out a SoFi direct deposit form, highlighting five key ways to ensure a smooth and successful process.

Understanding the Importance of Direct Deposit with SoFi

Direct deposit is a convenient and efficient way to receive your paycheck or other regular income directly into your SoFi account. By setting up direct deposit, you can avoid the hassle of paper checks and ensure that your funds are available in your account as soon as possible. SoFi, a popular online banking platform, offers direct deposit services to its members, making it easy to manage your finances.

The Benefits of Direct Deposit with SoFi

Before we dive into the process of filling out a SoFi direct deposit form, let's take a look at some of the benefits of using this service:

- Convenience: Direct deposit eliminates the need to physically deposit checks or wait for funds to clear.

- Faster access to funds: With direct deposit, your funds are available in your account as soon as they are deposited.

- Reduced risk of lost or stolen checks: Direct deposit minimizes the risk of lost or stolen checks, ensuring that your funds are secure.

- Easy to set up: Filling out a SoFi direct deposit form is a straightforward process that can be completed in just a few minutes.

5 Ways to Fill Out a SoFi Direct Deposit Form

Now that we've covered the benefits of direct deposit with SoFi, let's move on to the five ways to fill out a SoFi direct deposit form:

1. Gather the Necessary Information

Before you start filling out the form, make sure you have the following information:

- Your SoFi account number

- Your routing number (found on the bottom left corner of your SoFi debit card or on the SoFi website)

- Your employer's name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

Required Information for SoFi Direct Deposit Form

Here's a summary of the required information:

- SoFi account number: 10-12 digits

- Routing number: 9 digits

- Employer's name and address: Full name and mailing address

- Social Security number or ITIN: 9 digits

2. Access the SoFi Direct Deposit Form

To access the SoFi direct deposit form, follow these steps:

- Log in to your SoFi account online or through the mobile app

- Click on the "Account" tab

- Select "Direct Deposit" from the dropdown menu

- Click on "Get Started" to access the direct deposit form

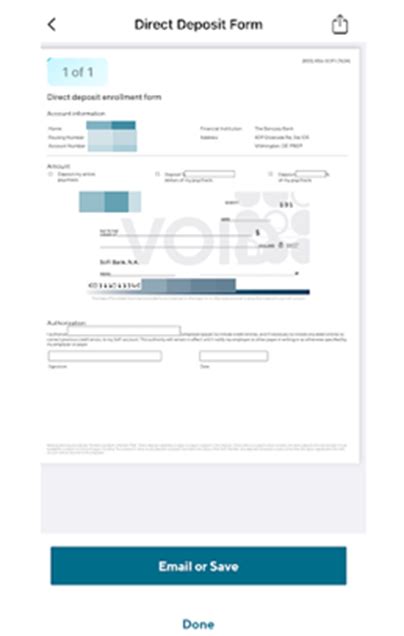

SoFi Direct Deposit Form Format

The SoFi direct deposit form is a straightforward document that requires you to fill out the necessary information. The form typically includes the following sections:

- Account information: SoFi account number, routing number, and account type

- Employer information: Employer's name, address, and phone number

- Employee information: Your name, Social Security number or ITIN, and date of birth

- Deposit information: Amount to be deposited, deposit frequency, and start date

3. Fill Out the SoFi Direct Deposit Form

Once you've accessed the form, fill out the required information carefully and accurately. Make sure to:

- Use a pen or pencil to fill out the form

- Write clearly and legibly

- Double-check your information for accuracy

Common Mistakes to Avoid

When filling out the SoFi direct deposit form, avoid the following common mistakes:

- Incorrect account number or routing number

- Missing or incomplete employer information

- Incorrect employee information

4. Submit the SoFi Direct Deposit Form

Once you've completed the form, submit it to SoFi for processing. You can:

- Upload the form to the SoFi website

- Fax the form to SoFi

- Mail the form to SoFi

SoFi Direct Deposit Form Submission Guidelines

Here are some guidelines to keep in mind when submitting the form:

- Make sure to sign and date the form

- Include all required documentation, such as a voided check or proof of income

- Allow 2-3 business days for processing

5. Verify Your Direct Deposit Setup

After submitting the form, verify that your direct deposit setup is complete. You can:

- Log in to your SoFi account online or through the mobile app

- Check your account activity for direct deposit transactions

- Contact SoFi customer support if you have any questions or concerns

Verifying Direct Deposit Setup

To verify your direct deposit setup, follow these steps:

- Log in to your SoFi account

- Click on the "Account" tab

- Select "Direct Deposit" from the dropdown menu

- Review your direct deposit setup and make any necessary adjustments

How long does it take to set up direct deposit with SoFi?

+Setting up direct deposit with SoFi typically takes 2-3 business days.

What is the required information for the SoFi direct deposit form?

+The required information includes your SoFi account number, routing number, employer's name and address, and Social Security number or ITIN.

How do I verify my direct deposit setup with SoFi?

+You can verify your direct deposit setup by logging in to your SoFi account, clicking on the "Account" tab, and selecting "Direct Deposit" from the dropdown menu.

We hope this article has provided you with a comprehensive guide on how to fill out a SoFi direct deposit form. By following these five steps, you can ensure a smooth and successful direct deposit setup with SoFi. If you have any further questions or concerns, please don't hesitate to reach out to SoFi customer support.