As a caregiver or recipient of the In-Home Supportive Services (IHSS) program, you may be familiar with the SOC 426A form. This form is used to report the number of hours worked by caregivers and to request payment for their services. However, filling out the SOC 426A form can be a daunting task, especially for those who are new to the IHSS program. In this article, we will provide you with a step-by-step guide on how to fill out the SOC 426A form, as well as some helpful tips to ensure that you get paid accurately and on time.

Understanding the SOC 426A Form

Before we dive into the details of filling out the SOC 426A form, it's essential to understand its purpose. The SOC 426A form is used by IHSS caregivers to report the number of hours worked in a given pay period. The form is usually submitted to the IHSS office on a bi-weekly basis, and it's used to calculate the caregiver's pay.

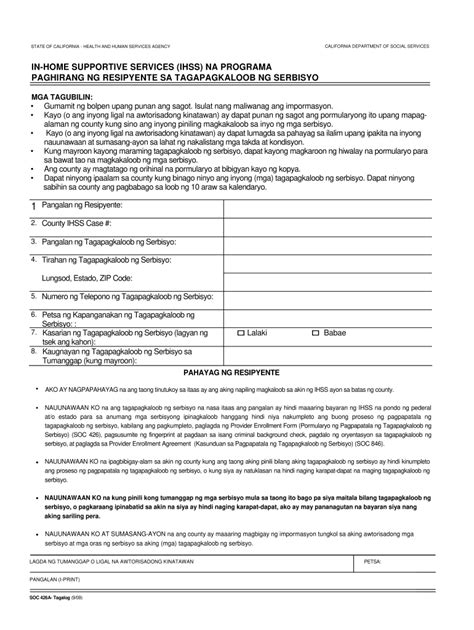

Section 1: Caregiver Information

The first section of the SOC 426A form requires you to provide your caregiver information. This includes your name, address, phone number, and IHSS provider number.

- Fill in your name, address, and phone number in the spaces provided.

- Make sure to include your IHSS provider number, which can be found on your IHSS approval letter or on the IHSS website.

Section 2: Recipient Information

The second section of the SOC 426A form requires you to provide the recipient's information. This includes the recipient's name, address, and IHSS case number.

- Fill in the recipient's name, address, and IHSS case number in the spaces provided.

- Make sure to include the recipient's IHSS case number, which can be found on the IHSS approval letter or on the IHSS website.

Section 3: Hours Worked

The third section of the SOC 426A form requires you to report the number of hours worked in a given pay period. This includes the date, start time, end time, and total hours worked.

- Fill in the date, start time, end time, and total hours worked for each day in the pay period.

- Make sure to include the total hours worked for the pay period, which should be calculated by adding up the hours worked for each day.

Section 4: Services Provided

The fourth section of the SOC 426A form requires you to report the services provided to the recipient. This includes the type of service, date, start time, end time, and total hours worked.

- Fill in the type of service, date, start time, end time, and total hours worked for each service provided.

- Make sure to include the total hours worked for each service, which should be calculated by adding up the hours worked for each day.

Section 5: Signature

The final section of the SOC 426A form requires you to sign and date the form.

- Sign and date the form in the spaces provided.

- Make sure to include your IHSS provider number and the recipient's IHSS case number on the form.

Tips for Filling Out the SOC 426A Form

Here are some helpful tips to ensure that you get paid accurately and on time:

- Make sure to fill out the form accurately and completely.

- Include all required information, such as your IHSS provider number and the recipient's IHSS case number.

- Calculate the total hours worked for each day and for the pay period.

- Include a detailed description of the services provided to the recipient.

- Sign and date the form in the spaces provided.

- Submit the form to the IHSS office on a bi-weekly basis.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out the SOC 426A form:

- Failing to include required information, such as your IHSS provider number and the recipient's IHSS case number.

- Failing to calculate the total hours worked for each day and for the pay period.

- Failing to include a detailed description of the services provided to the recipient.

- Failing to sign and date the form in the spaces provided.

- Submitting the form late or incomplete.

Conclusion

Filling out the SOC 426A form can be a daunting task, but by following these steps and tips, you can ensure that you get paid accurately and on time. Remember to include all required information, calculate the total hours worked, and include a detailed description of the services provided to the recipient. By avoiding common mistakes and submitting the form on a bi-weekly basis, you can ensure that you receive payment for your services.

Frequently Asked Questions

What is the SOC 426A form used for?

+The SOC 426A form is used by IHSS caregivers to report the number of hours worked in a given pay period.

How often should I submit the SOC 426A form?

+The SOC 426A form should be submitted to the IHSS office on a bi-weekly basis.

What information do I need to include on the SOC 426A form?

+You need to include your IHSS provider number, the recipient's IHSS case number, the date, start time, end time, and total hours worked for each day in the pay period.