As a resident of Connecticut, it's essential to understand the importance of filing your state income taxes accurately and efficiently. One crucial aspect of this process is submitting your quarterly estimated tax payments, known as CT-1040ES. In this article, we will explore five ways to file CT-1040ES with ease, ensuring you stay on top of your tax obligations and avoid any potential penalties.

Understanding CT-1040ES

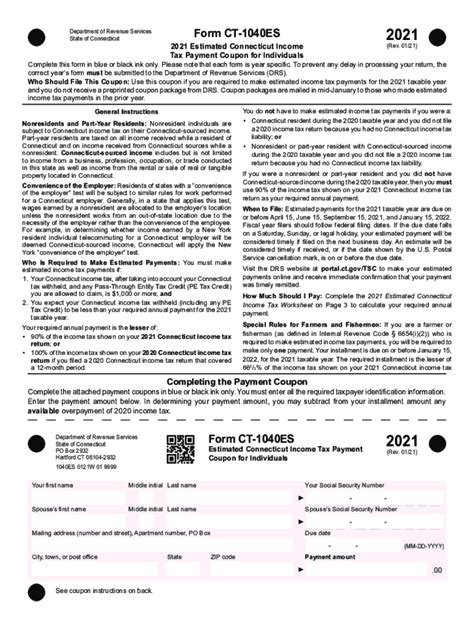

Before diving into the filing process, it's essential to understand what CT-1040ES is and why it's necessary. CT-1040ES is the form used by the Connecticut Department of Revenue Services (DRS) to report and pay quarterly estimated income taxes. If you expect to owe more than $1,000 in taxes for the year, you are required to make quarterly estimated tax payments.

Who Needs to File CT-1040ES?

Not everyone is required to file CT-1040ES. However, if you fall into any of the following categories, you will need to submit quarterly estimated tax payments:

- Self-employed individuals

- Small business owners

- Freelancers

- Independent contractors

- Anyone expecting to owe more than $1,000 in taxes for the year

5 Ways to File CT-1040ES with Ease

Now that we've covered the basics, let's explore five ways to file CT-1040ES with ease:

1. E-File Through the Connecticut DRS Website

The Connecticut DRS website offers a convenient and secure way to e-file your CT-1040ES. To get started, follow these steps:

- Visit the Connecticut DRS website at

- Click on the "File and Pay" tab

- Select "Individual" and then "Estimated Tax"

- Follow the prompts to enter your information and make a payment

2. Use Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can guide you through the CT-1040ES filing process. These programs will walk you through a series of questions, ensuring you accurately complete the form and make the necessary payments.

- Choose a reputable tax preparation software

- Follow the prompts to enter your information and complete the CT-1040ES form

- Review and submit your return

3. Hire a Tax Professional

If you're not comfortable filing your CT-1040ES on your own, consider hiring a tax professional. They will ensure your return is accurate and complete, and can even help you navigate any complex tax situations.

- Find a reputable tax professional in your area

- Provide them with your financial information and tax documents

- Review and sign your completed CT-1040ES form

4. Mail a Paper Return

If you prefer to file a paper return, you can download and print the CT-1040ES form from the Connecticut DRS website. Be sure to follow the instructions carefully and make a copy of your return for your records.

- Download and print the CT-1040ES form

- Complete the form accurately and make a copy for your records

- Mail the return to the address listed on the form

5. Use the Connecticut DRS Mobile App

The Connecticut DRS mobile app allows you to file your CT-1040ES on-the-go. This convenient option is perfect for those with busy schedules or limited access to a computer.

- Download the Connecticut DRS mobile app

- Follow the prompts to enter your information and complete the CT-1040ES form

- Review and submit your return

Penalties for Late or Inaccurate Filings

It's essential to file your CT-1040ES accurately and on time to avoid penalties. If you fail to make a quarterly payment or file an inaccurate return, you may be subject to:

- Late payment penalties

- Interest on unpaid taxes

- Accuracy-related penalties

To avoid these penalties, ensure you file your CT-1040ES by the quarterly deadlines:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Conclusion: Staying on Top of Your CT-1040ES Filings

Filing your CT-1040ES doesn't have to be a daunting task. By understanding your options and taking advantage of the resources available, you can ensure accurate and timely filings. Remember to stay organized, keep track of your deadlines, and seek help if needed. By following these tips, you'll be well on your way to stress-free CT-1040ES filings.

What is the deadline for filing CT-1040ES?

+The deadlines for filing CT-1040ES are April 15th, June 15th, September 15th, and January 15th of the following year.

Who needs to file CT-1040ES?

+Self-employed individuals, small business owners, freelancers, independent contractors, and anyone expecting to owe more than $1,000 in taxes for the year need to file CT-1040ES.

What happens if I file my CT-1040ES late or inaccurately?

+If you file your CT-1040ES late or inaccurately, you may be subject to late payment penalties, interest on unpaid taxes, and accuracy-related penalties.