Filling out a SERS direct deposit form is a straightforward process that can help you receive your retirement benefits in a timely and convenient manner. The State Employees' Retirement System (SERS) provides a direct deposit form to its members to enable them to receive their retirement benefits directly into their bank accounts. In this article, we will guide you through the 5 steps to fill out a SERS direct deposit form.

Understanding the SERS Direct Deposit Form

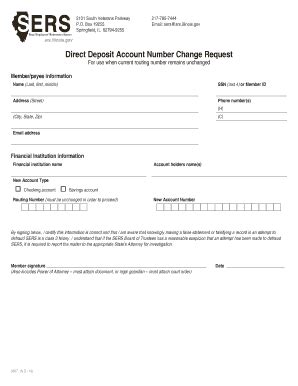

Before we dive into the steps to fill out the form, let's take a brief look at what the SERS direct deposit form is and why it's essential. The SERS direct deposit form is a document that allows you to authorize SERS to deposit your retirement benefits directly into your bank account. This method of payment is convenient, secure, and eliminates the need for paper checks.

Benefits of Direct Deposit

Direct deposit offers several benefits, including:

- Convenience: Your retirement benefits will be deposited directly into your bank account, eliminating the need to wait for a check to arrive in the mail.

- Security: Direct deposit reduces the risk of lost or stolen checks.

- Timeliness: Your benefits will be deposited into your account on the designated payment date, ensuring you receive your funds promptly.

Step 1: Gather Required Information

Before filling out the SERS direct deposit form, you'll need to gather some essential information. This includes:

- Your SERS member ID number

- Your bank's routing number (also known as the ABA number)

- Your bank account number

- Your bank's name and address

Locating Your Bank's Routing Number

You can find your bank's routing number on:

- Your check: The routing number is typically located at the bottom left corner of your check.

- Your bank's website: You can also find the routing number on your bank's website.

- Your bank's customer service: If you're unable to find the routing number, you can contact your bank's customer service for assistance.

Step 2: Fill Out the Form

Now that you have the required information, you can begin filling out the SERS direct deposit form. The form will ask for the following information:

- Your SERS member ID number

- Your bank's routing number

- Your bank account number

- Your bank's name and address

- Your signature: You'll need to sign the form to authorize SERS to deposit your benefits into your bank account.

Tips for Filling Out the Form

- Make sure to fill out the form accurately and completely.

- Use a pen to sign the form, as a digital signature may not be accepted.

- If you're filling out the form electronically, make sure to save a copy for your records.

Step 3: Attach Supporting Documents (If Required)

In some cases, you may be required to attach supporting documents to the SERS direct deposit form. These documents may include:

- A voided check: This is a check that has been marked "void" to indicate it's not valid for payment.

- A bank statement: This is a statement from your bank that shows your account information.

Understanding Voided Checks

A voided check is a check that has been marked "void" to indicate it's not valid for payment. This is a common requirement for direct deposit forms, as it allows SERS to verify your bank account information.

Step 4: Submit the Form

Once you've filled out the form and attached any required supporting documents, you can submit it to SERS. You can do this by:

- Mailing the form to SERS

- Faxing the form to SERS

- Submitting the form electronically through SERS' online portal

SERS Contact Information

If you have any questions or concerns about the direct deposit form, you can contact SERS using the following information:

- Phone: 555-555-5555

- Email:

- Mail: 123 Main St, Anytown, USA 12345

Step 5: Verify Your Direct Deposit Information

After submitting the form, it's essential to verify your direct deposit information to ensure it's accurate and up-to-date. You can do this by:

- Logging into your SERS online account

- Contacting SERS customer service

Importance of Verifying Your Direct Deposit Information

Verifying your direct deposit information is crucial to ensure your retirement benefits are deposited into the correct bank account. If your information is inaccurate or outdated, you may experience delays or errors in receiving your benefits.

In conclusion, filling out a SERS direct deposit form is a straightforward process that requires some basic information and supporting documents. By following these 5 steps, you can ensure your retirement benefits are deposited directly into your bank account in a timely and convenient manner.

What is the SERS direct deposit form?

+The SERS direct deposit form is a document that allows you to authorize SERS to deposit your retirement benefits directly into your bank account.

What information do I need to fill out the form?

+You'll need to provide your SERS member ID number, bank routing number, bank account number, and bank name and address.

How do I submit the form?

+You can submit the form by mail, fax, or electronically through SERS' online portal.