As a self-employed individual, navigating the complexities of tax season can be a daunting task. One of the most critical forms you'll need to file is the self-employment tax form, which reports your income and expenses from your business or freelance work. In this article, we'll break down the process into manageable steps, providing you with five essential tips to ensure you file your self-employment tax form accurately and on time.

Understanding Self-Employment Tax

Self-employment tax is used to fund Social Security and Medicare, and as a self-employed individual, you're responsible for paying both the employee and employer portions of these taxes. This can be a significant expense, but it's essential to understand that you're not only paying for your current benefits but also for your future retirement and healthcare coverage.

What You Need to Know Before Filing

Before diving into the tips, it's crucial to understand the basics of self-employment tax. Here are a few key points to keep in mind:

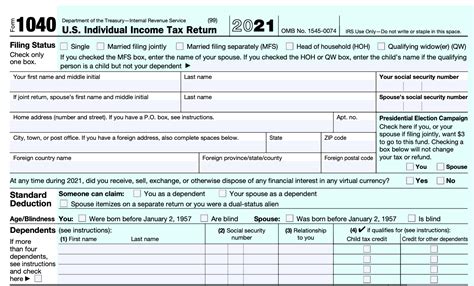

- You'll need to file Form 1040 and Schedule C (Form 1040) to report your business income and expenses.

- You'll also need to file Schedule SE (Form 1040) to report your self-employment tax.

- You're required to make estimated tax payments throughout the year if you expect to owe more than $1,000 in taxes.

Tips for Filing Self-Employment Tax Form

Now that you have a solid understanding of self-employment tax, let's dive into the five tips for filing your self-employment tax form:

Tip 1: Keep Accurate Records

Maintaining accurate and detailed records is essential for filing your self-employment tax form. This includes:

- Business income: Keep track of all income earned from your business, including invoices, receipts, and bank statements.

- Business expenses: Record all business expenses, including deductions for supplies, equipment, and travel.

- Mileage log: If you use your vehicle for business purposes, keep a mileage log to track the number of miles driven for business.

Having accurate records will ensure you're reporting the correct income and expenses on your tax return.

Tip 2: Calculate Your Net Earnings from Self-Employment

To calculate your net earnings from self-employment, you'll need to subtract your business expenses from your business income. This will give you your net profit or loss from your business.

- Business income: $100,000

- Business expenses: $50,000

- Net earnings from self-employment: $50,000

You'll report your net earnings from self-employment on Schedule SE (Form 1040).

Tip 3: Determine Your Self-Employment Tax Rate

The self-employment tax rate is 15.3% of your net earnings from self-employment. This includes:

- 12.4% for Social Security (old-age, survivors, and disability insurance)

- 2.9% for Medicare (hospital insurance)

You'll pay both the employee and employer portions of these taxes, for a total of 15.3%.

Tip 4: Calculate Your Self-Employment Tax

To calculate your self-employment tax, multiply your net earnings from self-employment by the self-employment tax rate:

- Net earnings from self-employment: $50,000

- Self-employment tax rate: 15.3%

- Self-employment tax: $7,650

You'll report your self-employment tax on Schedule SE (Form 1040).

Tip 5: Make Estimated Tax Payments

As a self-employed individual, you're required to make estimated tax payments throughout the year if you expect to owe more than $1,000 in taxes. You can use Form 1040-ES to make these payments.

- Quarterly due dates: April 15th, June 15th, September 15th, and January 15th of the following year

- Payment options: Online, phone, or mail

Making estimated tax payments will help you avoid penalties and interest on your tax bill.

Stay Organized and On Top of Your Taxes

Filing your self-employment tax form doesn't have to be a daunting task. By following these five tips, you'll be well on your way to accurately and efficiently filing your taxes. Remember to keep accurate records, calculate your net earnings from self-employment, determine your self-employment tax rate, calculate your self-employment tax, and make estimated tax payments throughout the year.

By staying organized and on top of your taxes, you'll avoid penalties and interest, and ensure you're taking advantage of all the deductions and credits available to you.

What is self-employment tax?

+Self-employment tax is used to fund Social Security and Medicare, and as a self-employed individual, you're responsible for paying both the employee and employer portions of these taxes.

How do I calculate my self-employment tax?

+To calculate your self-employment tax, multiply your net earnings from self-employment by the self-employment tax rate of 15.3%.

Do I need to make estimated tax payments?

+Yes, as a self-employed individual, you're required to make estimated tax payments throughout the year if you expect to owe more than $1,000 in taxes.