Taking control of your finances in retirement is crucial for a secure and stress-free life. One important aspect of retirement planning is managing your annuity withdrawals. If you have an Equitable annuity, understanding the withdrawal process is vital to ensure you're making the most of your hard-earned savings. In this article, we'll delve into the world of Equitable annuity withdrawal forms, providing a comprehensive, step-by-step guide to help you navigate this process with ease.

Annuities can be complex financial products, and the withdrawal process can seem daunting, especially for those who are new to retirement planning. However, with the right guidance, you can make informed decisions about your annuity withdrawals, ensuring that your financial goals are met. Whether you're looking to supplement your retirement income, cover unexpected expenses, or simply enjoy the fruits of your labor, understanding how to withdraw from your Equitable annuity is key.

Understanding Your Equitable Annuity

Before diving into the withdrawal process, it's essential to understand the basics of your Equitable annuity. An annuity is a financial product that provides a guaranteed income stream for a set period or for life in exchange for a lump sum or series of payments. Equitable offers various types of annuities, including fixed, variable, and indexed annuities, each with its own set of features and benefits.

Types of Annuities Offered by Equitable

- Fixed Annuities: Provide a fixed interest rate for a specified period.

- Variable Annuities: Allow you to invest in various assets, offering potential for growth.

- Indexed Annuities: Earn interest based on the performance of a specific stock market index.

Understanding the type of annuity you have and its features will help you make informed decisions about your withdrawals.

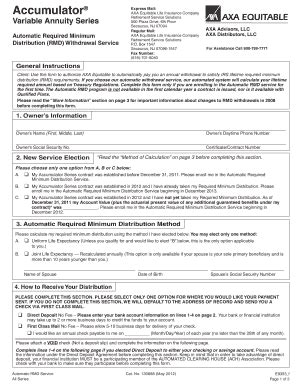

The Equitable Annuity Withdrawal Form

The Equitable annuity withdrawal form is a straightforward document that requires you to provide essential information about your withdrawal request. Here's a step-by-step guide to help you complete the form:

- Gather Required Information: Before starting the withdrawal process, ensure you have the following information readily available:

- Your annuity contract number

- Your Social Security number or tax identification number

- The amount you wish to withdraw

- Your bank account information (for direct deposit)

- Complete the Withdrawal Form: Download and print the Equitable annuity withdrawal form from the company's website or request one from your agent. Fill out the form carefully, ensuring accuracy and completeness.

- Specify Withdrawal Details: Indicate the type of withdrawal you're requesting (e.g., lump sum, systematic withdrawal, or required minimum distribution).

- Provide Payment Information: Specify how you'd like to receive your withdrawal (e.g., direct deposit, check, or wire transfer).

- Submit the Form: Mail or fax the completed form to Equitable, following the instructions provided on the form.

Additional Tips and Considerations

- Withdrawal Frequency: Consider how often you'll need to withdraw from your annuity. Systematic withdrawals can help you budget and manage your finances more effectively.

- Taxes and Penalties: Understand the tax implications of your withdrawals and potential penalties for early withdrawals (before age 59 1/2).

- Withdrawal Limits: Check your annuity contract to determine if there are any withdrawal limits or restrictions.

Common Mistakes to Avoid

When withdrawing from your Equitable annuity, it's essential to avoid common mistakes that can impact your financial security:

- Insufficient Planning: Failing to consider your overall financial situation, tax implications, and potential penalties.

- Inadequate Funding: Withdrawing too much, too soon, which can deplete your annuity funds prematurely.

- Lack of Communication: Not informing Equitable of changes to your address, bank account, or other relevant information.

Best Practices for Equitable Annuity Withdrawals

- Regular Reviews: Periodically review your annuity contract and withdrawal strategy to ensure alignment with your changing financial needs.

- Tax-Efficient Withdrawals: Consider the tax implications of your withdrawals and explore strategies to minimize tax liabilities.

- Diversification: Spread your withdrawals across different financial products and accounts to maintain a balanced financial portfolio.

Conclusion: Taking Control of Your Equitable Annuity Withdrawals

By following this step-by-step guide and understanding the intricacies of your Equitable annuity, you'll be better equipped to manage your withdrawals effectively. Remember to avoid common mistakes, adopt best practices, and regularly review your annuity strategy to ensure a secure and stress-free retirement.

We invite you to share your experiences, ask questions, or provide feedback in the comments section below. Your input will help us create more informative and relevant content for our readers.

What is the minimum withdrawal amount from an Equitable annuity?

+The minimum withdrawal amount varies depending on the type of annuity and the terms of your contract. It's best to consult your annuity contract or contact Equitable directly for specific information.

Can I withdraw from my Equitable annuity at any time?

+While you can withdraw from your annuity, there may be restrictions, penalties, or taxes associated with early withdrawals (before age 59 1/2). It's essential to review your contract and consider the implications before making a withdrawal.

How long does it take to process an Equitable annuity withdrawal?

+Processing times may vary depending on the type of withdrawal and the method of payment. Generally, Equitable processes withdrawals within 3-5 business days. However, this timeframe may be longer for certain types of withdrawals or during periods of high volume.