Schwab Simple IRA plans have become a popular choice for small businesses and self-employed individuals looking to offer a retirement savings plan to their employees. One of the key aspects of managing a Schwab Simple IRA plan is handling contributions, which is where the Schwab Simple IRA Contribution Transmittal Form comes in. In this article, we'll take a closer look at the form, its purpose, and how to complete it accurately.

What is the Schwab Simple IRA Contribution Transmittal Form?

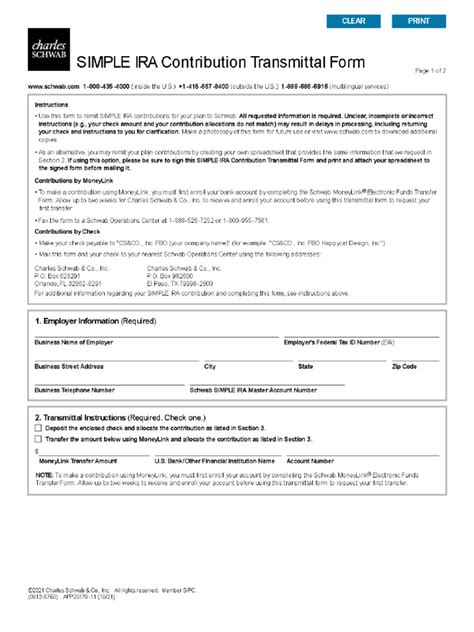

The Schwab Simple IRA Contribution Transmittal Form is a document used to transmit employee and employer contributions to a Schwab Simple IRA plan. The form is designed to help plan administrators and employers ensure that contributions are made accurately and efficiently.

Why is the Schwab Simple IRA Contribution Transmittal Form important?

The Schwab Simple IRA Contribution Transmittal Form plays a critical role in the administration of a Schwab Simple IRA plan. By using this form, plan administrators and employers can ensure that contributions are made correctly, which is essential for maintaining the plan's tax-qualified status. Failure to complete the form accurately can result in errors, delays, or even plan disqualification.

How to Complete the Schwab Simple IRA Contribution Transmittal Form

Completing the Schwab Simple IRA Contribution Transmittal Form requires attention to detail and accuracy. Here's a step-by-step guide to help you complete the form correctly:

- Plan Information: Enter the plan name, plan number, and plan administrator's name and address.

- Contribution Information: Specify the type of contribution being made (e.g., employee deferrals, employer matching, or employer non-elective contributions).

- Employee Information: List the employees participating in the plan, including their names, Social Security numbers, and contribution amounts.

- Employer Information: Enter the employer's name, address, and tax identification number.

- Contribution Amounts: Calculate and enter the total contribution amount for each employee and the employer.

- Payment Information: Specify the payment method (e.g., check or wire transfer) and provide payment instructions.

Tips for Accurate Completion

To ensure accurate completion of the Schwab Simple IRA Contribution Transmittal Form:

- Verify employee Social Security numbers and contribution amounts.

- Use a calculator to ensure accurate calculations.

- Double-check the payment information and instructions.

- Retain a copy of the completed form for plan records.

Common Mistakes to Avoid

When completing the Schwab Simple IRA Contribution Transmittal Form, avoid the following common mistakes:

- Inaccurate or missing employee information

- Incorrect contribution amounts or calculations

- Insufficient payment information

- Failure to retain a copy of the completed form

Best Practices for Managing Schwab Simple IRA Contributions

To ensure smooth management of Schwab Simple IRA contributions:

- Establish a regular contribution schedule

- Use payroll integration to streamline contributions

- Monitor plan participation and contribution rates

- Review and update plan documents as needed

Conclusion

The Schwab Simple IRA Contribution Transmittal Form is an essential tool for managing contributions to a Schwab Simple IRA plan. By understanding the form's purpose, following the completion guidelines, and avoiding common mistakes, plan administrators and employers can ensure accurate and efficient contribution processing. By implementing best practices for managing Schwab Simple IRA contributions, you can help ensure the long-term success of your retirement savings plan.

We hope this guide has been helpful in understanding the Schwab Simple IRA Contribution Transmittal Form. If you have any further questions or concerns, please don't hesitate to reach out to us. Share your thoughts and experiences with Schwab Simple IRA plans in the comments section below!

What is the purpose of the Schwab Simple IRA Contribution Transmittal Form?

+The Schwab Simple IRA Contribution Transmittal Form is used to transmit employee and employer contributions to a Schwab Simple IRA plan.

How often should I complete the Schwab Simple IRA Contribution Transmittal Form?

+The frequency of completing the form depends on the plan's contribution schedule, which may be monthly, quarterly, or annually.

What are the consequences of inaccurate completion of the Schwab Simple IRA Contribution Transmittal Form?

+Inaccurate completion of the form can result in errors, delays, or even plan disqualification.