Surrendering a Brighthouse annuity form can be a complex process, and it's essential to understand the implications and options available before making a decision. An annuity is a financial product that provides a steady income stream for a set period or lifetime in exchange for a lump sum or series of payments. Brighthouse Financial is a leading annuity provider, and their products are designed to offer flexibility and security to policyholders.

Understanding Annuity Surrender

Before surrendering a Brighthouse annuity form, it's crucial to understand the concept of annuity surrender. Annuity surrender refers to the process of terminating an annuity contract before its maturity date. This can result in penalties, fees, and potential tax implications. It's essential to carefully review the terms and conditions of the annuity contract to determine the best course of action.

Reasons to Surrender an Annuity

There are several reasons why policyholders may want to surrender their Brighthouse annuity form. Some common reasons include:

- Changes in financial circumstances or goals

- Need for liquidity or access to funds

- Dissatisfaction with the annuity's performance or fees

- Desire to switch to a different annuity or investment product

- Death of the annuitant or beneficiary

5 Ways to Surrender a Brighthouse Annuity Form

If you're considering surrendering your Brighthouse annuity form, here are five options to consider:

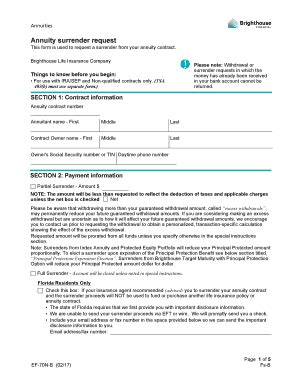

1. Full Surrender

A full surrender involves canceling the annuity contract and receiving the entire cash value minus any applicable surrender charges. This option may result in penalties and fees, and it's essential to review the contract to determine the best course of action.

2. Partial Surrender

A partial surrender allows policyholders to withdraw a portion of the annuity's cash value while leaving the remaining amount intact. This option may be subject to surrender charges and fees, and it's crucial to review the contract to determine the implications.

3. Annuitization

Annuitization involves converting the annuity's cash value into a steady income stream for a set period or lifetime. This option may provide a predictable income stream, but it may also result in a reduction in the cash value.

4. 1035 Exchange

A 1035 exchange allows policyholders to transfer the annuity's cash value to a new annuity or investment product without incurring surrender charges or fees. This option may provide an opportunity to switch to a more suitable product or take advantage of better interest rates.

5. Free Look Period

Some annuity contracts offer a free look period, which allows policyholders to review the contract and return it within a specified timeframe (usually 10-30 days) without incurring surrender charges or fees. This option may provide an opportunity to cancel the contract without penalty.

Things to Consider Before Surrendering an Annuity

Before surrendering a Brighthouse annuity form, it's essential to consider the following:

- Surrender charges and fees

- Tax implications

- Impact on retirement income or financial goals

- Alternative options or products

- Contract terms and conditions

Next Steps

If you're considering surrendering your Brighthouse annuity form, it's crucial to:

- Review the contract terms and conditions

- Consult with a financial advisor or expert

- Carefully evaluate the options and implications

- Make an informed decision based on your financial goals and circumstances

We invite you to share your thoughts and experiences on surrendering an annuity in the comments section below. Have you surrendered an annuity in the past? What were your reasons, and what were the outcomes? Your input can help others make informed decisions about their annuity contracts.

What is an annuity surrender?

+An annuity surrender refers to the process of terminating an annuity contract before its maturity date.

What are the reasons to surrender an annuity?

+Common reasons to surrender an annuity include changes in financial circumstances or goals, need for liquidity or access to funds, dissatisfaction with the annuity's performance or fees, and desire to switch to a different annuity or investment product.

What are the options for surrendering a Brighthouse annuity form?

+Options for surrendering a Brighthouse annuity form include full surrender, partial surrender, annuitization, 1035 exchange, and free look period.