The Schedule S tax form is a crucial document for individuals and businesses that earn income from self-employment, freelancing, or other sources that are not subject to withholding. As the tax season approaches, it's essential to understand the basics of this form to ensure accurate filing and avoid any potential penalties. In this article, we will delve into five essential facts about the Schedule S tax form, exploring its purpose, who needs to file it, and what information is required.

What is the Schedule S Tax Form?

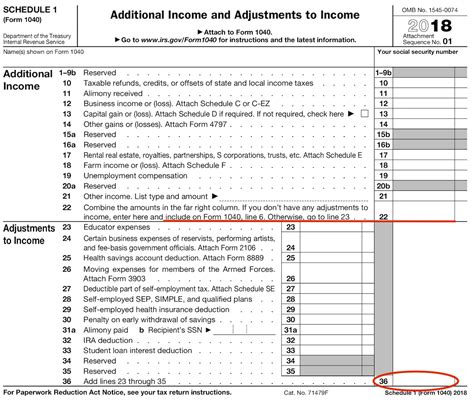

The Schedule S tax form, also known as the Form 1040 Schedule S, is a supplementary form that accompanies the standard Form 1040. Its primary purpose is to report income or loss from a business or profession, as well as deductions related to that business. This form is used to calculate the taxpayer's net earnings from self-employment, which is then reported on the Form 1040.

Who Needs to File the Schedule S Tax Form?

The Schedule S tax form is required for individuals who have income from self-employment, freelancing, or other sources that are not subject to withholding. This includes:

- Self-employed individuals, such as consultants, contractors, and freelancers

- Small business owners, including sole proprietors and single-member limited liability companies (LLCs)

- Farmers and ranchers

- Individuals who receive income from a partnership or S corporation

In general, anyone who earns income from a business or profession that is not subject to withholding is required to file the Schedule S tax form.

What Information is Required on the Schedule S Tax Form?

The Schedule S tax form requires a range of information, including:

- Business income and expenses

- Cost of goods sold

- Depreciation and amortization

- Business use of your home

- Business use of your car

- Travel expenses

- Meals and entertainment expenses

- Insurance premiums

- Retirement plan contributions

Taxpayers are also required to report any income or loss from a business or profession on the Schedule S tax form, including income from:

- Sales of goods or services

- Rent and royalties

- Interest and dividends

- Capital gains and losses

How to Calculate Net Earnings from Self-Employment

To calculate net earnings from self-employment, taxpayers need to subtract their business expenses from their business income. This is done on the Schedule S tax form, using the following steps:

- Calculate total business income

- Calculate total business expenses

- Subtract total business expenses from total business income

- Calculate net earnings from self-employment

Net earnings from self-employment are then reported on the Form 1040, and are subject to self-employment tax.

Common Mistakes to Avoid When Filing the Schedule S Tax Form

When filing the Schedule S tax form, there are several common mistakes to avoid, including:

- Failing to report all business income

- Claiming personal expenses as business expenses

- Failing to keep accurate records

- Miscalculating net earnings from self-employment

- Failing to file the Schedule S tax form altogether

To avoid these mistakes, it's essential to keep accurate records of business income and expenses, and to seek the advice of a tax professional if necessary.

Penalties for Failing to File the Schedule S Tax Form

Failing to file the Schedule S tax form can result in penalties and fines, including:

- Late filing penalty: 5% of the unpaid tax per month, up to 25%

- Late payment penalty: 0.5% of the unpaid tax per month, up to 25%

- Accuracy-related penalty: 20% of the unpaid tax

In addition, failing to file the Schedule S tax form can also result in an audit, which can be time-consuming and costly.

Conclusion: Take Control of Your Tax Obligations

In conclusion, the Schedule S tax form is an essential document for individuals and businesses that earn income from self-employment or other sources that are not subject to withholding. By understanding the purpose and requirements of this form, taxpayers can ensure accurate filing and avoid any potential penalties. Remember to keep accurate records, seek the advice of a tax professional if necessary, and file the Schedule S tax form on time to take control of your tax obligations.

Who needs to file the Schedule S tax form?

+The Schedule S tax form is required for individuals who have income from self-employment, freelancing, or other sources that are not subject to withholding. This includes self-employed individuals, small business owners, farmers and ranchers, and individuals who receive income from a partnership or S corporation.

What information is required on the Schedule S tax form?

+The Schedule S tax form requires a range of information, including business income and expenses, cost of goods sold, depreciation and amortization, business use of your home, business use of your car, travel expenses, meals and entertainment expenses, insurance premiums, and retirement plan contributions.

How to calculate net earnings from self-employment?

+To calculate net earnings from self-employment, taxpayers need to subtract their business expenses from their business income. This is done on the Schedule S tax form, using the following steps: calculate total business income, calculate total business expenses, subtract total business expenses from total business income, and calculate net earnings from self-employment.