As a business owner, navigating the complexities of corporate taxation can be a daunting task. One crucial aspect of corporate tax compliance is understanding the requirements and nuances of Schedule O, Form 1120. This form is used to report corporate ownership and stock information, and it plays a critical role in ensuring that your corporation is in compliance with tax laws and regulations. In this comprehensive guide, we will delve into the world of Schedule O, Form 1120, and explore its significance, requirements, and implications for corporate taxation.

What is Schedule O, Form 1120?

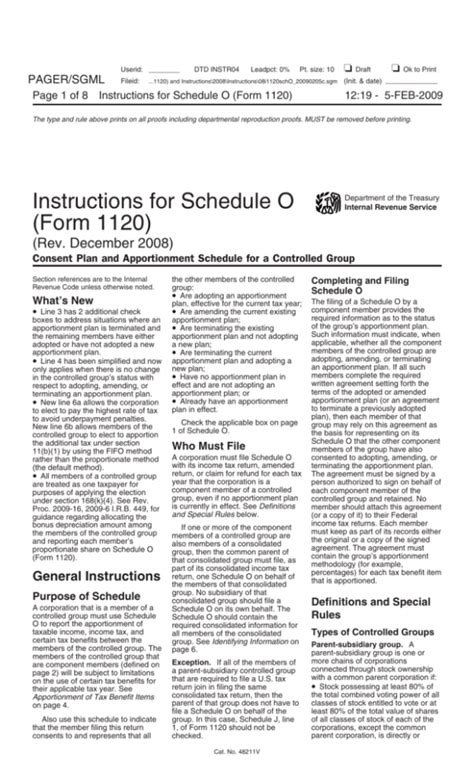

Schedule O, Form 1120 is a supplemental form that is used to report corporate ownership and stock information. This form is filed in conjunction with the Form 1120, which is the standard corporate income tax return. The purpose of Schedule O is to provide detailed information about the corporation's ownership structure, including the identity of shareholders, the number of shares outstanding, and the value of those shares.

Who Must File Schedule O?

Not all corporations are required to file Schedule O. However, if your corporation meets any of the following criteria, you will need to file this form:

- The corporation has 10 or more shareholders.

- Any shareholder owns 50% or more of the corporation's outstanding shares.

- The corporation has a change in ownership during the tax year.

- The corporation has a stock option plan or other equity-based compensation arrangement.

What Information is Reported on Schedule O?

Schedule O requires corporations to report detailed information about their ownership structure and stock transactions. The following information is typically reported on this form:

- The identity of each shareholder, including their name, address, and taxpayer identification number.

- The number of shares outstanding and the value of those shares.

- Any changes in ownership during the tax year, including sales, transfers, or other dispositions of stock.

- Information about stock option plans or other equity-based compensation arrangements.

- The fair market value of the corporation's stock.

How to Complete Schedule O

Completing Schedule O requires careful attention to detail and accuracy. Here are some steps to help you complete this form:

- Gather all necessary information about your corporation's ownership structure and stock transactions.

- Review the instructions for Schedule O and ensure you understand the reporting requirements.

- Complete the form accurately and thoroughly, using the required format and coding.

- Attach any supporting documentation, such as stock certificates or transfer agreements.

- File the completed Schedule O with your Form 1120 corporate income tax return.

Importance of Accurate Reporting on Schedule O

Accurate reporting on Schedule O is crucial for ensuring corporate tax compliance. Failure to report ownership and stock information accurately can result in penalties, fines, and even audits. Moreover, accurate reporting helps to ensure that your corporation is in compliance with tax laws and regulations, avoiding any potential disputes or litigation.

Consequences of Inaccurate Reporting

Inaccurate reporting on Schedule O can have severe consequences, including:

- Penalties and fines for non-compliance.

- Audits and examinations by the IRS.

- Disputes and litigation with shareholders or other stakeholders.

- Damage to the corporation's reputation and credibility.

Best Practices for Maintaining Accurate Records

Maintaining accurate records is essential for ensuring compliance with Schedule O reporting requirements. Here are some best practices to help you maintain accurate records:

- Keep detailed records of all stock transactions, including sales, transfers, and other dispositions.

- Maintain accurate and up-to-date shareholder information, including names, addresses, and taxpayer identification numbers.

- Use a secure and reliable record-keeping system, such as a spreadsheet or database.

- Regularly review and update your records to ensure accuracy and completeness.

Conclusion

Schedule O, Form 1120 is a critical component of corporate tax compliance, requiring corporations to report detailed information about their ownership structure and stock transactions. By understanding the requirements and nuances of this form, corporations can ensure accurate reporting and avoid potential penalties and disputes. Remember to maintain accurate records, follow best practices, and seek professional guidance when needed to ensure compliance with Schedule O reporting requirements.

FAQs

What is the purpose of Schedule O, Form 1120?

+Schedule O, Form 1120 is used to report corporate ownership and stock information, providing detailed information about the corporation's ownership structure and stock transactions.

Who must file Schedule O?

+Corporations with 10 or more shareholders, any shareholder owning 50% or more of the corporation's outstanding shares, or corporations with a change in ownership during the tax year must file Schedule O.

What information is reported on Schedule O?

+Schedule O requires corporations to report detailed information about their ownership structure and stock transactions, including shareholder information, stock outstanding, and changes in ownership.