As a corporate tax filer, navigating the complexities of the tax code can be a daunting task. One of the most critical components of the corporate tax return is the Schedule M-3, a form that provides detailed information about a corporation's financial activity. In this article, we will delve into the instructions for completing Schedule M-3, Form 1120, and explore the key concepts, requirements, and best practices for corporate tax filers.

Understanding the Purpose of Schedule M-3

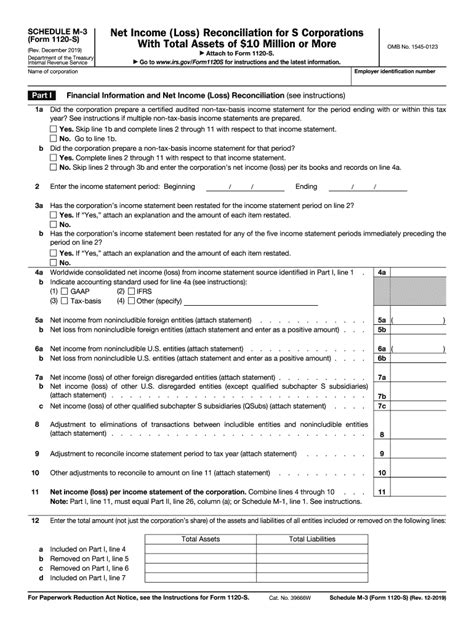

Schedule M-3 is a supplemental form that accompanies the standard Form 1120, U.S. Corporation Income Tax Return. The primary purpose of Schedule M-3 is to provide the Internal Revenue Service (IRS) with a detailed breakdown of a corporation's financial activity, including income, deductions, and other relevant financial information. This information helps the IRS to accurately assess the corporation's tax liability and ensure compliance with tax laws and regulations.

Who Must File Schedule M-3?

Who Must File Schedule M-3?

Not all corporate tax filers are required to complete Schedule M-3. The IRS requires corporations with total assets of $10 million or more to file Schedule M-3. However, certain corporations may be exempt from filing Schedule M-3, including:

- Corporations with total assets of less than $10 million

- Corporations that file Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Corporations that file Form 1120S, U.S. Income Tax Return for an S Corporation

Components of Schedule M-3

Components of Schedule M-3

Schedule M-3 consists of four main parts:

- Part I: Financial Information: This section requires corporations to report their financial activity, including income, deductions, and other relevant financial information.

- Part II: Reconciliation of Net Income (Loss) per Income Statement of the Corporation with Net Income (Loss) per Return: This section requires corporations to reconcile their net income (loss) as reported on their financial statements with their net income (loss) as reported on their tax return.

- Part III: Financial Ratios: This section requires corporations to report certain financial ratios, including their current ratio, debt-to-equity ratio, and return on assets (ROA).

- Part IV: Additional Information: This section requires corporations to provide additional information, including their cost of goods sold, gross profit, and other relevant financial information.

Completing Schedule M-3

Step-by-Step Instructions for Completing Schedule M-3

Completing Schedule M-3 requires careful attention to detail and a thorough understanding of the corporation's financial activity. Here are some step-by-step instructions for completing Schedule M-3:

- Part I: Financial Information: Report the corporation's financial activity, including income, deductions, and other relevant financial information. Use the corporation's financial statements as a reference.

- Part II: Reconciliation of Net Income (Loss) per Income Statement of the Corporation with Net Income (Loss) per Return: Reconcile the corporation's net income (loss) as reported on their financial statements with their net income (loss) as reported on their tax return. This may require adjustments for items such as depreciation, amortization, and other non-cash items.

- Part III: Financial Ratios: Calculate and report the corporation's financial ratios, including their current ratio, debt-to-equity ratio, and ROA.

- Part IV: Additional Information: Provide additional information, including the corporation's cost of goods sold, gross profit, and other relevant financial information.

Common Mistakes to Avoid

Common Mistakes to Avoid When Completing Schedule M-3

When completing Schedule M-3, it is essential to avoid common mistakes that can result in errors, penalties, and even audits. Here are some common mistakes to avoid:

- Inaccurate or incomplete financial information: Ensure that all financial information is accurate and complete.

- Failure to reconcile net income (loss): Reconcile the corporation's net income (loss) as reported on their financial statements with their net income (loss) as reported on their tax return.

- Incorrect financial ratios: Calculate and report financial ratios accurately.

- Failure to provide additional information: Provide all required additional information, including cost of goods sold, gross profit, and other relevant financial information.

Best Practices for Completing Schedule M-3

Best Practices for Completing Schedule M-3

To ensure accurate and complete completion of Schedule M-3, follow these best practices:

- Use financial statements as a reference: Use the corporation's financial statements as a reference when completing Schedule M-3.

- Reconcile financial information: Reconcile the corporation's financial information to ensure accuracy and completeness.

- Calculate financial ratios accurately: Calculate financial ratios accurately to avoid errors.

- Seek professional assistance: Seek professional assistance from a qualified tax professional or accountant if needed.

Conclusion

In conclusion, completing Schedule M-3 requires careful attention to detail and a thorough understanding of the corporation's financial activity. By following the instructions and best practices outlined in this article, corporate tax filers can ensure accurate and complete completion of Schedule M-3 and avoid common mistakes. Remember to seek professional assistance if needed, and always refer to the IRS instructions and publications for the most up-to-date information.

FAQ Section

Who must file Schedule M-3?

+Corporations with total assets of $10 million or more must file Schedule M-3.

What are the components of Schedule M-3?

+Schedule M-3 consists of four main parts: Part I: Financial Information, Part II: Reconciliation of Net Income (Loss) per Income Statement of the Corporation with Net Income (Loss) per Return, Part III: Financial Ratios, and Part IV: Additional Information.

What are common mistakes to avoid when completing Schedule M-3?

+

Additional Resources

For more information on completing Schedule M-3, refer to the IRS instructions and publications, including:

- IRS Form 1120 Instructions

- IRS Schedule M-3 Instructions

- IRS Publication 542, Corporations

Remember to always consult with a qualified tax professional or accountant if you have any questions or concerns about completing Schedule M-3.