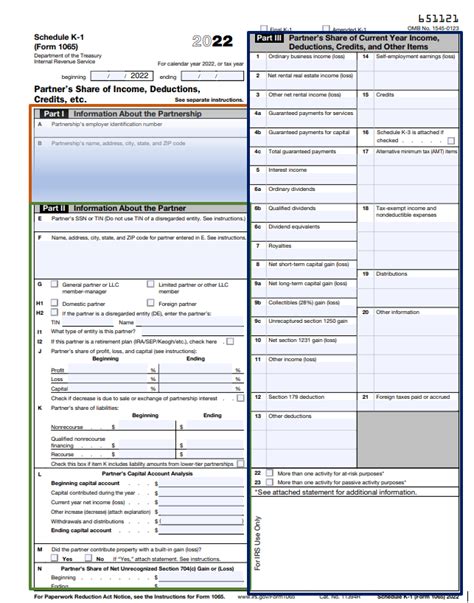

Decoding Schedule K-1 Form 1065 codes can be a daunting task for many taxpayers, especially those who are new to filing taxes for their partnership or limited liability company (LLC). The Schedule K-1 Form 1065 is a crucial document that reports a partner's share of income, deductions, and credits from a partnership or LLC. In this article, we will break down the codes used on Schedule K-1 Form 1065 and provide a comprehensive guide to help you understand and navigate this complex form.

Why is Schedule K-1 Form 1065 important?

The Schedule K-1 Form 1065 is essential for partners and shareholders of partnerships and LLCs, as it provides critical information about their share of income, deductions, and credits. This information is used to report their share of the partnership's or LLC's income on their individual tax returns. The Schedule K-1 Form 1065 also helps the IRS track the partnership's or LLC's income and ensure that all partners and shareholders are reporting their correct share of income.

Understanding the codes on Schedule K-1 Form 1065

The Schedule K-1 Form 1065 uses a series of codes to report different types of income, deductions, and credits. These codes are located in the boxes on the form and are used to categorize the information being reported. Here are some of the most common codes used on Schedule K-1 Form 1065:

- Box 1: Ordinary Business Income (Loss): This code reports the partner's share of ordinary business income or loss from the partnership or LLC.

- Box 2: Net Rental Real Estate Income (Loss): This code reports the partner's share of net rental real estate income or loss from the partnership or LLC.

- Box 3: Other Net Rental Income (Loss): This code reports the partner's share of other net rental income or loss from the partnership or LLC.

- Box 4: Guaranteed Payments: This code reports the partner's share of guaranteed payments from the partnership or LLC.

- Box 5: Interest Income: This code reports the partner's share of interest income from the partnership or LLC.

- Box 6: Dividend Income: This code reports the partner's share of dividend income from the partnership or LLC.

- Box 7: Royalty Income: This code reports the partner's share of royalty income from the partnership or LLC.

- Box 8: Net Short-Term Capital Gain (Loss): This code reports the partner's share of net short-term capital gain or loss from the partnership or LLC.

- Box 9: Net Long-Term Capital Gain (Loss): This code reports the partner's share of net long-term capital gain or loss from the partnership or LLC.

- Box 10: Other Income: This code reports the partner's share of other income from the partnership or LLC.

- Box 11: Section 179 Deduction: This code reports the partner's share of the Section 179 deduction from the partnership or LLC.

- Box 12: Other Deductions: This code reports the partner's share of other deductions from the partnership or LLC.

- Box 13: Self-Employment Tax Deduction: This code reports the partner's share of the self-employment tax deduction from the partnership or LLC.

How to decode Schedule K-1 Form 1065 codes

Decoding Schedule K-1 Form 1065 codes requires a basic understanding of tax terminology and the codes used on the form. Here are some steps to help you decode the codes on Schedule K-1 Form 1065:

- Review the instructions: Before decoding the codes on Schedule K-1 Form 1065, review the instructions provided by the IRS. These instructions will help you understand the different codes and how to report the information on your individual tax return.

- Identify the code: Identify the code being reported on the Schedule K-1 Form 1065. This code will be located in the box on the form.

- Look up the code: Look up the code in the instructions or a tax reference guide to determine what type of income, deduction, or credit it represents.

- Report the information: Report the information from the Schedule K-1 Form 1065 on your individual tax return. This may involve reporting the income, deduction, or credit on a specific line or schedule on your tax return.

Tips for decoding Schedule K-1 Form 1065 codes

Here are some tips to help you decode Schedule K-1 Form 1065 codes:

- Use tax reference guides: Use tax reference guides, such as the IRS instructions or a tax textbook, to help you understand the codes on Schedule K-1 Form 1065.

- Consult with a tax professional: If you are unsure about how to decode a code on Schedule K-1 Form 1065, consult with a tax professional. They can help you understand the code and ensure that you are reporting the information correctly on your individual tax return.

- Take your time: Decoding Schedule K-1 Form 1065 codes can be time-consuming and complex. Take your time and make sure you understand each code before reporting the information on your individual tax return.

Conclusion

Decoding Schedule K-1 Form 1065 codes can be a challenging task, but with the right guidance and resources, it can be done easily. By understanding the codes on Schedule K-1 Form 1065, you can ensure that you are reporting your share of income, deductions, and credits correctly on your individual tax return. Remember to use tax reference guides, consult with a tax professional if needed, and take your time when decoding the codes on Schedule K-1 Form 1065.

FAQ Section

What is Schedule K-1 Form 1065?

+Schedule K-1 Form 1065 is a tax form used to report a partner's share of income, deductions, and credits from a partnership or LLC.

Why is Schedule K-1 Form 1065 important?

+Schedule K-1 Form 1065 is important because it provides critical information about a partner's share of income, deductions, and credits from a partnership or LLC, which is used to report their correct share of income on their individual tax return.

How do I decode Schedule K-1 Form 1065 codes?

+To decode Schedule K-1 Form 1065 codes, review the instructions provided by the IRS, identify the code being reported, look up the code in a tax reference guide, and report the information on your individual tax return.