In recent years, Oregon has been at the forefront of implementing innovative retirement savings programs, with OregonSaves being one of the most notable initiatives. This program aims to provide a convenient and accessible way for employees to save for their future, especially those who may not have access to traditional employer-sponsored retirement plans. However, not everyone may want or need to participate in OregonSaves. If you're one of them, you're probably wondering how to opt out of OregonSaves.

Understanding the OregonSaves Program

Before we dive into the opt-out process, it's essential to understand what OregonSaves is and how it works. OregonSaves is a state-sponsored retirement savings program designed for employees who don't have access to a retirement plan through their employer. The program allows employees to contribute a portion of their paycheck to a retirement account, which is managed by a third-party administrator.

Key Features of OregonSaves

- Employees can contribute up to 5% of their salary to their OregonSaves account.

- Employers are not required to contribute to the program.

- Employees can choose from a variety of investment options, including target-date funds and exchange-traded funds (ETFs).

- The program is designed to be portable, meaning employees can take their account with them if they change jobs or move out of state.

Reasons to Opt Out of OregonSaves

While OregonSaves can be a valuable resource for many employees, there may be situations where it's not the best fit. Here are some reasons why you might want to opt out of OregonSaves:

- You already have a retirement plan through your employer or another source.

- You're not comfortable with the investment options offered by OregonSaves.

- You have other financial priorities, such as paying off high-interest debt or building an emergency fund.

Opting Out of OregonSaves in 5 Steps

If you've decided that OregonSaves isn't right for you, here's how to opt out of the program in 5 steps:

Step 1: Check Your Eligibility

Before you can opt out of OregonSaves, you need to make sure you're eligible to participate in the program. To be eligible, you must be an employee of a participating employer, be at least 18 years old, and have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Step 2: Review Your OregonSaves Account

If you've already been enrolled in OregonSaves, review your account to understand your current contributions and investment options. This will help you make an informed decision about whether to opt out of the program.

Step 3: Complete the Opt-Out Form

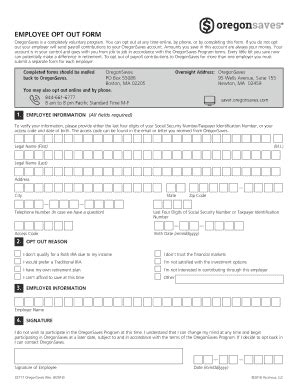

To opt out of OregonSaves, you'll need to complete an opt-out form. You can access the form on the OregonSaves website or by contacting your employer's HR department. The form will ask for your personal and employment information, as well as your reason for opting out of the program.

Step 4: Submit the Opt-Out Form

Once you've completed the opt-out form, submit it to your employer's HR department or the OregonSaves program administrator. Make sure to follow the instructions carefully and submit the form by the deadline to avoid any delays in processing your opt-out request.

Step 5: Confirm Your Opt-Out Status

After submitting the opt-out form, confirm with your employer's HR department or the OregonSaves program administrator that your opt-out request has been processed. You should receive a confirmation email or letter within a few weeks.

Key Considerations When Opting Out of OregonSaves

Before opting out of OregonSaves, there are several key considerations to keep in mind:

- Impact on Your Retirement Savings: Opting out of OregonSaves may impact your ability to save for retirement. Consider whether you have other retirement savings options available to you.

- Investment Options: If you're not comfortable with the investment options offered by OregonSaves, consider whether you can find alternative investment options that better align with your financial goals and risk tolerance.

- Fees and Expenses: OregonSaves has fees and expenses associated with the program. Consider whether these fees are reasonable and whether you can find alternative retirement savings options with lower fees.

Alternatives to OregonSaves

If you've decided to opt out of OregonSaves, you may be wondering what alternative retirement savings options are available to you. Here are a few options to consider:

- Traditional IRA: A traditional IRA is a type of individual retirement account that allows you to contribute pre-tax dollars to a retirement account.

- Roth IRA: A Roth IRA is a type of individual retirement account that allows you to contribute after-tax dollars to a retirement account.

- Employer-Sponsored Retirement Plan: If your employer offers a retirement plan, such as a 401(k) or 403(b), you may be able to participate in the plan and contribute to your retirement savings.

Conclusion

Opting out of OregonSaves is a personal decision that depends on your individual financial circumstances and goals. If you've decided that OregonSaves isn't right for you, following the 5 steps outlined above can help you opt out of the program. Remember to consider the potential impact on your retirement savings and explore alternative retirement savings options that may be available to you.

We encourage you to share your thoughts on the OregonSaves program and the opt-out process in the comments below. If you have any questions or concerns, feel free to ask, and we'll do our best to provide a helpful response.

Additional Resources

For more information on OregonSaves and the opt-out process, visit the OregonSaves website or contact your employer's HR department.

What is OregonSaves?

+OregonSaves is a state-sponsored retirement savings program designed for employees who don't have access to a retirement plan through their employer.

How do I opt out of OregonSaves?

+To opt out of OregonSaves, complete the opt-out form on the OregonSaves website or by contacting your employer's HR department.

What are the key considerations when opting out of OregonSaves?

+Key considerations include the impact on your retirement savings, investment options, and fees and expenses associated with the program.