The Schedule G tax form, also known as the Schedule G (Form 1120), is an essential document for businesses and organizations that need to report certain income and expenses to the Internal Revenue Service (IRS). Whether you're a seasoned tax professional or a small business owner, understanding the Schedule G tax form is crucial for accurate and compliant tax reporting. In this article, we'll delve into the five essential facts about the Schedule G tax form that you need to know.

The Importance of Accurate Tax Reporting

Tax reporting is a critical aspect of business operations, and the Schedule G tax form plays a significant role in this process. By providing detailed information about a company's income and expenses, the Schedule G tax form helps the IRS assess the business's tax liability accurately. Inaccurate or incomplete reporting can lead to penalties, fines, and even audits, which can be detrimental to a business's financial health. Therefore, it's essential to understand the Schedule G tax form and its requirements to ensure accurate and compliant tax reporting.

What is the Schedule G Tax Form?

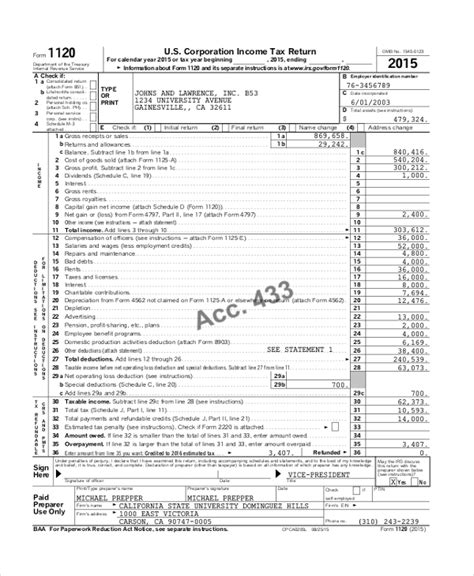

The Schedule G tax form is a supplemental form that businesses and organizations use to report certain income and expenses that are not reported on the primary tax return. The form is typically used by corporations, partnerships, and other business entities that need to report income and expenses related to specific activities, such as rental income, royalties, or gains from the sale of assets.

Types of Income Reported on the Schedule G Tax Form

The Schedule G tax form requires businesses to report various types of income, including:

- Rental income from real estate or personal property

- Royalties from intellectual property, such as patents, copyrights, or trademarks

- Gains from the sale of assets, such as stocks, bonds, or real estate

- Interest income from investments or loans

- Dividend income from stock ownership

Businesses must report these types of income on the Schedule G tax form, even if they are not subject to self-employment tax.

How to Complete the Schedule G Tax Form

Completing the Schedule G tax form requires careful attention to detail and accurate reporting of income and expenses. Here are the steps to follow:

- Identify the types of income that need to be reported on the Schedule G tax form.

- Gather all necessary documentation, including receipts, invoices, and financial statements.

- Complete the form accurately and thoroughly, making sure to report all required income and expenses.

- Attach supporting documentation, such as receipts or invoices, to the form as required.

- Review the form carefully for accuracy and completeness before submitting it to the IRS.

Common Mistakes to Avoid

When completing the Schedule G tax form, it's essential to avoid common mistakes that can lead to penalties, fines, or audits. Some common mistakes to avoid include:

- Failing to report all required income and expenses

- Inaccurate or incomplete reporting of income and expenses

- Failing to attach supporting documentation

- Filing the form late or not at all

By avoiding these common mistakes, businesses can ensure accurate and compliant tax reporting and minimize the risk of penalties or audits.

Benefits of Accurate Schedule G Tax Form Reporting

Accurate reporting on the Schedule G tax form provides several benefits to businesses, including:

- Reduced risk of penalties, fines, or audits

- Improved financial transparency and accountability

- Enhanced credibility with the IRS and other stakeholders

- Better management of cash flow and financial resources

- Increased confidence in financial reporting and decision-making

By prioritizing accurate and compliant reporting on the Schedule G tax form, businesses can reap these benefits and maintain a strong financial foundation.

Conclusion and Next Steps

In conclusion, the Schedule G tax form is an essential document for businesses and organizations that need to report certain income and expenses to the IRS. By understanding the five essential facts about the Schedule G tax form, businesses can ensure accurate and compliant tax reporting, reduce the risk of penalties or audits, and maintain a strong financial foundation. To learn more about the Schedule G tax form and its requirements, businesses can consult the IRS website or seek the advice of a qualified tax professional.

We encourage you to share your thoughts and experiences with the Schedule G tax form in the comments section below. Have you encountered any challenges or benefits while completing the form? What tips or best practices would you like to share with others? Let's start a conversation and help each other navigate the world of tax reporting.

What is the purpose of the Schedule G tax form?

+The Schedule G tax form is used to report certain income and expenses that are not reported on the primary tax return, such as rental income, royalties, and gains from the sale of assets.

Who needs to file the Schedule G tax form?

+Businesses and organizations that need to report certain income and expenses, such as corporations, partnerships, and other business entities, need to file the Schedule G tax form.

What are the consequences of inaccurate or incomplete reporting on the Schedule G tax form?

+Inaccurate or incomplete reporting on the Schedule G tax form can lead to penalties, fines, or audits, which can be detrimental to a business's financial health.