Filing taxes can be a daunting task, especially when it comes to navigating complex forms and regulations. In Colorado, the Form 104 is a crucial document for individuals and businesses to report their income and claim deductions. To help make the process smoother, we'll break down the 7 essential steps to complete Colorado Form 104.

The Colorado Form 104 is a vital document for taxpayers in the state, and understanding how to fill it out correctly is crucial to avoid errors and potential penalties. With the right guidance, you can confidently submit your tax return and take advantage of the deductions and credits available to you.

In this article, we'll walk you through the step-by-step process of completing Colorado Form 104, highlighting key sections, and providing tips to ensure accuracy and efficiency. By the end of this guide, you'll be well-equipped to tackle your tax return with confidence.

Step 1: Gather Required Documents and Information

Before starting the form, make sure you have all the necessary documents and information within reach. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, dividends, and capital gains

- Records of deductions, such as charitable donations and mortgage interest

- Any other relevant tax-related documents

Having all the required information readily available will save you time and reduce the likelihood of errors.

Understanding the Form 104 Structure

The Colorado Form 104 is divided into several sections, each with its own set of instructions and requirements. Familiarize yourself with the following sections:

- Section 1: Identification and Filing Status

- Section 2: Income

- Section 3: Adjustments to Income

- Section 4: Deductions

- Section 5: Credits

- Section 6: Tax Calculation

Understanding the form's structure will help you navigate the process more efficiently.

Section 1: Identification and Filing Status

In this section, you'll provide personal identification information, including your name, address, and Social Security number. You'll also select your filing status, which determines your tax rates and deductions.

Step 2: Report Income

In Section 2, you'll report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Freelance work and self-employment income

Be sure to include all relevant 1099 forms and W-2 statements.

Section 3: Adjustments to Income

In this section, you'll report adjustments to your income, such as:

- Alimony payments

- Student loan interest

- Educator expenses

- Moving expenses

These adjustments can help reduce your taxable income.

Step 3: Claim Deductions

In Section 4, you'll claim deductions to reduce your taxable income. Common deductions include:

- Mortgage interest

- Charitable donations

- Medical expenses

- State and local taxes

Be sure to keep receipts and records of your deductions, as you may need to provide them in case of an audit.

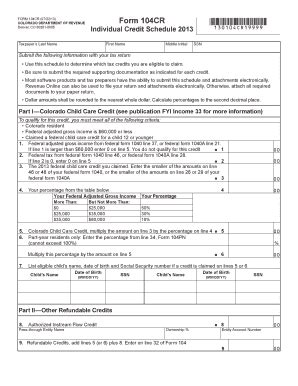

Section 5: Credits

In this section, you'll claim credits, which directly reduce your tax liability. Common credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Step 4: Calculate Tax Liability

In Section 6, you'll calculate your tax liability based on your income, deductions, and credits. This section includes:

- Tax tables

- Tax calculation worksheets

Be sure to double-check your calculations to avoid errors.

Section 7: Sign and Date the Form

Finally, sign and date the form, making sure to include your signature and the date you completed the form.

By following these 7 steps, you'll be able to complete Colorado Form 104 accurately and efficiently. Remember to keep all supporting documents and records, as you may need to provide them in case of an audit.

We hope this guide has helped you navigate the process of completing Colorado Form 104. If you have any further questions or concerns, feel free to comment below or share this article with a friend who may find it helpful.

Take Action:

- Download the Colorado Form 104 from the Colorado Department of Revenue website

- Gather all required documents and information

- Follow the 7 steps outlined in this guide to complete the form accurately

- Double-check your calculations and sign the form

FAQ Section

What is the deadline for filing Colorado Form 104?

+The deadline for filing Colorado Form 104 is typically April 15th of each year.

Can I e-file Colorado Form 104?

+Yes, you can e-file Colorado Form 104 through the Colorado Department of Revenue website or through a tax preparation software.

What if I need help completing Colorado Form 104?

+You can contact the Colorado Department of Revenue for assistance or seek the help of a tax professional.