Form IL-1120 is a crucial document for corporations operating in Illinois, as it serves as the state's corporate income tax return. Filing this form accurately and on time is essential to avoid penalties and ensure compliance with state tax regulations. In this comprehensive guide, we will walk you through the Form IL-1120 instructions, providing a step-by-step approach to help you navigate the process with ease.

Understanding the Purpose of Form IL-1120

Form IL-1120 is used by corporations to report their income, deductions, and credits to the Illinois Department of Revenue. The form is used to calculate the corporation's tax liability, which is based on its net income. The Illinois corporate income tax rate is 7%, and the tax is levied on the corporation's net income, which includes income from all sources, including business operations, investments, and other activities.

Who Needs to File Form IL-1120?

All corporations operating in Illinois are required to file Form IL-1120, regardless of whether they have any taxable income. This includes:

- C-corporations

- S-corporations

- Limited liability companies (LLCs) electing to be taxed as corporations

- Limited liability partnerships (LLPs) electing to be taxed as corporations

Step 1: Gathering Necessary Information

Before starting the Form IL-1120, gather all necessary information and documents, including:

- Federal tax return (Form 1120 or Form 1120S)

- Illinois corporate tax account number

- Business name and address

- Employer identification number (EIN)

- List of officers, directors, and shareholders

- Financial statements (balance sheet and income statement)

- Depreciation and amortization schedules

- Records of income, deductions, and credits

Step 2: Completing Form IL-1120

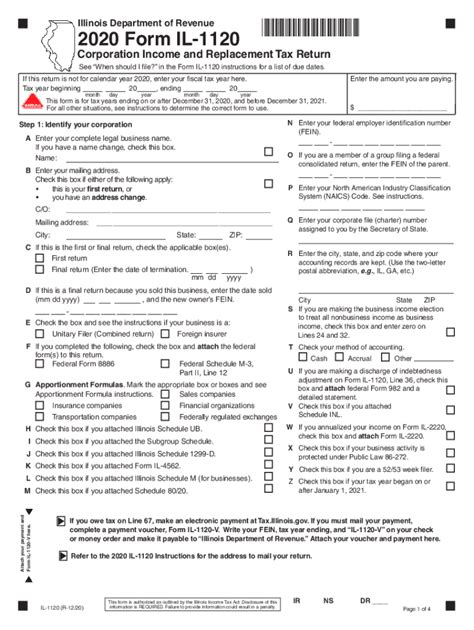

Form IL-1120 consists of several sections, which are explained below:

Section 1: Corporation Information

- Enter the corporation's name, address, and EIN.

- Provide the Illinois corporate tax account number.

- List the officers, directors, and shareholders.

Section 2: Federal Taxable Income

- Enter the corporation's federal taxable income from Form 1120 or Form 1120S.

- Adjust the federal taxable income for Illinois-specific deductions and additions.

Section 3: Illinois Taxable Income

- Calculate the corporation's Illinois taxable income by subtracting deductions and adding additions.

- Report the Illinois taxable income on Line 1 of the form.

Section 4: Tax Computation

- Calculate the corporation's tax liability using the Illinois corporate income tax rate.

- Report the tax liability on Line 2 of the form.

Section 5: Credits and Payments

- Report any credits claimed, such as the research and development credit.

- Report any payments made, such as estimated tax payments.

Section 6: Signature and Verification

- Sign and date the form.

- Verify that the information provided is accurate and complete.

Step 3: Filing Form IL-1120

Form IL-1120 must be filed electronically through the Illinois Department of Revenue's website or by mail. The due date for filing Form IL-1120 is the 15th day of the fourth month following the close of the corporation's tax year. For example, if the corporation's tax year ends on December 31, the due date for filing Form IL-1120 is April 15.

Tips and Reminders

- Make sure to file Form IL-1120 on time to avoid penalties and interest.

- Keep accurate records of income, deductions, and credits.

- Consult with a tax professional if you have any questions or concerns.

- Take advantage of available credits and deductions to minimize tax liability.

Conclusion

Filing Form IL-1120 is a critical step in meeting the tax obligations of your corporation in Illinois. By following the steps outlined in this guide, you can ensure that you complete the form accurately and on time. Remember to gather all necessary information, complete the form carefully, and file it electronically or by mail before the due date.

FAQs

Q: What is the due date for filing Form IL-1120?

A: The due date for filing Form IL-1120 is the 15th day of the fourth month following the close of the corporation's tax year.

Q: Can I file Form IL-1120 electronically?

A: Yes, you can file Form IL-1120 electronically through the Illinois Department of Revenue's website.

Q: What is the Illinois corporate income tax rate?

A: The Illinois corporate income tax rate is 7%.

Q: Do I need to file Form IL-1120 if my corporation has no taxable income?

A: Yes, all corporations operating in Illinois are required to file Form IL-1120, regardless of whether they have any taxable income.

Q: Can I claim credits on Form IL-1120?

A: Yes, you can claim credits on Form IL-1120, such as the research and development credit.

What is the purpose of Form IL-1120?

+Form IL-1120 is used by corporations to report their income, deductions, and credits to the Illinois Department of Revenue.

Who needs to file Form IL-1120?

+All corporations operating in Illinois are required to file Form IL-1120, regardless of whether they have any taxable income.

What is the Illinois corporate income tax rate?

+The Illinois corporate income tax rate is 7%.