As a business owner, understanding the intricacies of corporate tax deductions is crucial to minimize your tax liability and maximize your company's profitability. One of the most important forms you'll need to familiarize yourself with is Schedule D (Form 1120S), which is used to report capital gains and losses for S corporations. In this article, we'll delve into the world of corporate tax deductions, focusing on Schedule D and its implications for your business.

What is Schedule D (Form 1120S)?

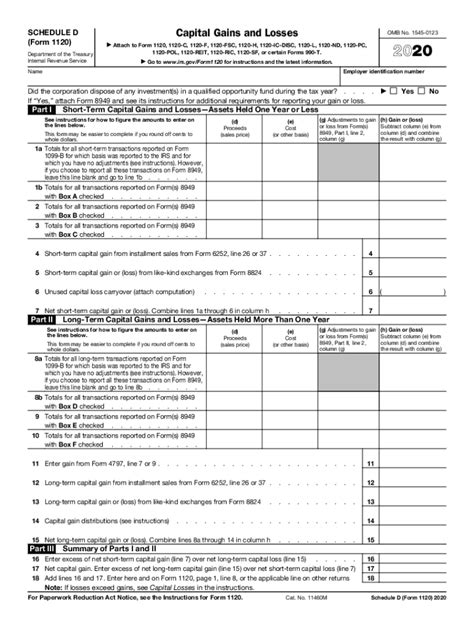

Schedule D (Form 1120S) is a supplementary schedule that accompanies the Form 1120S, which is the tax return form for S corporations. Schedule D is used to report the sale or exchange of capital assets, such as stocks, bonds, real estate, and other investment properties. The form is designed to help S corporations calculate their capital gains and losses, which are then reported on the Form 1120S.

Why is Schedule D (Form 1120S) Important?

Accurate completion of Schedule D (Form 1120S) is essential for several reasons:

- Capital Gains Taxation: Schedule D helps S corporations calculate their capital gains and losses, which are subject to taxation. By accurately reporting these gains and losses, you can minimize your tax liability and avoid penalties.

- Loss Limitations: Schedule D helps you calculate the net operating loss (NOL) limitation, which can be used to offset future taxable income.

- Investment Income: Schedule D reports investment income, such as dividends, interest, and capital gains, which are subject to taxation.

How to Complete Schedule D (Form 1120S)

To complete Schedule D (Form 1120S), follow these steps:

- Identify Capital Assets: Identify the capital assets your S corporation has sold or exchanged during the tax year.

- Calculate Gains and Losses: Calculate the gain or loss on each capital asset using the sales price, cost basis, and any adjustments.

- Report Gains and Losses: Report the gains and losses on Schedule D, using the following columns:

- Column (a): Description of property

- Column (b): Date acquired

- Column (c): Date sold

- Column (d): Sales price

- Column (e): Cost or other basis

- Column (f): Depreciation or amortization

- Column (g): Gain or loss

- Calculate Net Capital Gain or Loss: Calculate the net capital gain or loss by combining the gains and losses from all capital assets.

- Report on Form 1120S: Report the net capital gain or loss on Form 1120S, Line 10.

Corporate Tax Deductions: What You Need to Know

While Schedule D (Form 1120S) is primarily used for reporting capital gains and losses, it's essential to understand the broader context of corporate tax deductions. Here are some key deductions you should be aware of:

- Business Expenses: Ordinary and necessary business expenses, such as salaries, rent, and supplies, are deductible.

- Depreciation: Depreciation of assets, such as equipment and property, can be deducted over the asset's useful life.

- Interest Expenses: Interest expenses on business loans and credit cards can be deducted.

- Charitable Contributions: Charitable contributions made by your S corporation can be deducted.

Tips for Maximizing Corporate Tax Deductions

To maximize your corporate tax deductions, follow these tips:

- Keep Accurate Records: Maintain accurate and detailed records of business expenses, capital assets, and other deductible items.

- Consult a Tax Professional: Consult with a tax professional to ensure you're taking advantage of all eligible deductions.

- Stay Up-to-Date with Tax Law Changes: Stay informed about changes to tax laws and regulations that may affect your business.

- Plan Ahead: Plan ahead and make strategic decisions about capital asset purchases and sales to minimize tax liability.

Conclusion

In conclusion, understanding Schedule D (Form 1120S) and corporate tax deductions is crucial for minimizing your tax liability and maximizing your business's profitability. By accurately completing Schedule D and taking advantage of eligible deductions, you can ensure your S corporation remains competitive and profitable.

We encourage you to share your thoughts and questions about Schedule D (Form 1120S) and corporate tax deductions in the comments section below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the purpose of Schedule D (Form 1120S)?

+Schedule D (Form 1120S) is used to report capital gains and losses for S corporations.

How do I calculate net capital gain or loss on Schedule D?

+Calculate the net capital gain or loss by combining the gains and losses from all capital assets.

What are some common corporate tax deductions?

+Common corporate tax deductions include business expenses, depreciation, interest expenses, and charitable contributions.