The world of real estate is complex, with numerous documents and forms that play crucial roles in the buying and selling process. One such document is the NY Form RP-5217, a form that is essential for property owners and buyers in New York State. Here, we will delve into seven essential facts about the NY Form RP-5217, exploring its purpose, how it's used, and its significance in real estate transactions.

What is the NY Form RP-5217?

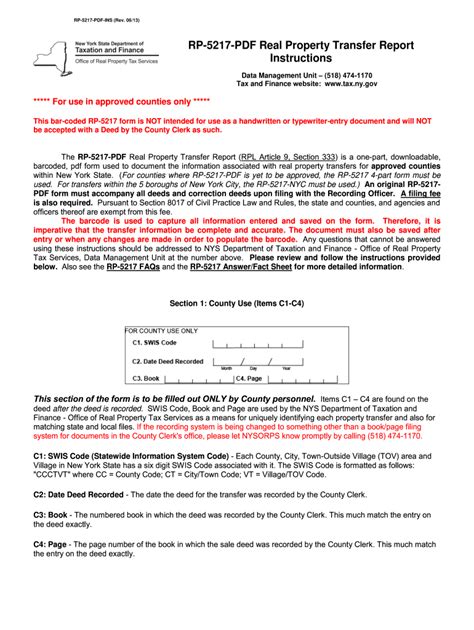

The NY Form RP-5217 is a legal document required by the State of New York for all real estate transactions involving the sale or transfer of real property. This form is specifically designed for the purpose of reporting the sale or transfer of real property to the New York State Department of Taxation and Finance and to the local government where the property is located.

Key Components of the NY Form RP-5217

The NY Form RP-5217 is a comprehensive document that includes detailed information about the property being sold or transferred. Some of the key components of this form include:

- Property description, including the location and a detailed description of the property

- The names and addresses of the seller(s) and buyer(s)

- The sale price of the property

- Information about any exemptions or credits claimed

- Signature of the seller(s) and buyer(s)

Purpose and Use of the NY Form RP-5217

The primary purpose of the NY Form RP-5217 is to report the sale or transfer of real property to the relevant state and local authorities. This form is used to calculate the amount of transfer taxes owed on the property and to update the property records.

Who Needs to File the NY Form RP-5217?

The NY Form RP-5217 must be filed by the seller(s) of the property, typically with the assistance of an attorney or real estate agent. This form is required for all real estate transactions involving the sale or transfer of real property in New York State, with a few exceptions.

Consequences of Not Filing the NY Form RP-5217

Failure to file the NY Form RP-5217 can result in penalties and fines. The New York State Department of Taxation and Finance may impose penalties for late filing or failure to file, which can include interest on any taxes owed.

Importance of Accuracy and Timeliness

It is essential to ensure the accuracy and timeliness of the NY Form RP-5217. Any errors or omissions on the form can lead to delays or complications in the real estate transaction.

How to Obtain the NY Form RP-5217

The NY Form RP-5217 can be obtained from the New York State Department of Taxation and Finance website or from a local county clerk's office. It is recommended to consult with an attorney or real estate agent to ensure the form is completed accurately and submitted on time.

Additional Resources

For more information on the NY Form RP-5217, including instructions and FAQs, visit the New York State Department of Taxation and Finance website.

Conclusion: The Significance of the NY Form RP-5217

The NY Form RP-5217 is a critical document in real estate transactions in New York State. Its purpose is to report the sale or transfer of real property to the relevant state and local authorities, and its accuracy and timeliness are essential to avoid penalties and complications. By understanding the importance and requirements of this form, property owners and buyers can ensure a smooth and successful transaction.

What is the purpose of the NY Form RP-5217?

+The purpose of the NY Form RP-5217 is to report the sale or transfer of real property to the New York State Department of Taxation and Finance and to the local government where the property is located.

Who needs to file the NY Form RP-5217?

+The seller(s) of the property need to file the NY Form RP-5217, typically with the assistance of an attorney or real estate agent.

What are the consequences of not filing the NY Form RP-5217?

+Failure to file the NY Form RP-5217 can result in penalties and fines, including interest on any taxes owed.