Navigating the complex world of tax forms can be a daunting task, especially for individuals and businesses in South Carolina. With numerous forms to keep track of, it's essential to understand which ones are crucial for your specific situation. In this article, we'll delve into the 5 essential SC tax forms you need to know, providing you with a comprehensive guide to help you stay on top of your tax obligations.

Taxes can be a significant source of stress, especially when dealing with the complexities of state-specific forms. However, by familiarizing yourself with the most critical forms, you can ensure compliance, avoid penalties, and potentially claim valuable credits and deductions. Whether you're an individual taxpayer, business owner, or tax professional, this article aims to provide you with the knowledge you need to navigate the world of SC tax forms with confidence.

From income tax to sales tax, and from credits to deductions, we'll explore the essential SC tax forms that can make a significant difference in your tax liability. So, let's dive in and explore the top 5 SC tax forms you need to know.

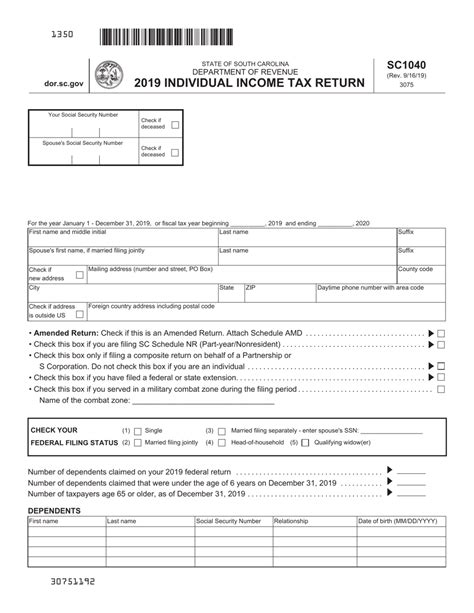

1. SC1040: South Carolina Individual Income Tax Return

The SC1040 form is the standard form used for individual income tax returns in South Carolina. This form is used to report your income, claim deductions and credits, and calculate your tax liability. As a resident of South Carolina, you're required to file this form annually, typically by April 15th.

The SC1040 form is composed of multiple sections, including:

- Income: Report your income from various sources, such as wages, salaries, and investments.

- Deductions and Credits: Claim deductions for expenses like mortgage interest, charitable donations, and medical expenses, as well as credits for things like education expenses and child care.

- Tax Liability: Calculate your total tax liability based on your income, deductions, and credits.

Who Needs to File SC1040?

You'll need to file the SC1040 form if you're a resident of South Carolina and have a taxable income. This includes:

- Residents with a taxable income exceeding $2,500

- Residents with a taxable income between $1,500 and $2,500, and who are 65 or older

- Non-residents with South Carolina-sourced income

2. SC1120: South Carolina Corporate Income Tax Return

The SC1120 form is used for corporate income tax returns in South Carolina. This form is required for C-corporations, S-corporations, and other business entities that have a taxable income.

The SC1120 form includes sections for:

- Income: Report your business income from various sources, such as sales, services, and investments.

- Deductions and Credits: Claim deductions for business expenses, such as rent, utilities, and supplies, as well as credits for things like research and development.

- Tax Liability: Calculate your total tax liability based on your income, deductions, and credits.

Who Needs to File SC1120?

You'll need to file the SC1120 form if you're a business entity with a taxable income in South Carolina. This includes:

- C-corporations with a taxable income exceeding $1,000

- S-corporations with a taxable income exceeding $1,000

- Other business entities with a taxable income exceeding $1,000

3. SC500: South Carolina Sales Tax Return

The SC500 form is used for sales tax returns in South Carolina. This form is required for businesses that collect sales tax on transactions.

The SC500 form includes sections for:

- Sales Tax Collected: Report the sales tax you've collected from customers.

- Sales Tax Due: Calculate the sales tax due based on your sales tax collected and any credits or deductions.

- Payment: Make payment for any sales tax due.

Who Needs to File SC500?

You'll need to file the SC500 form if you're a business that collects sales tax on transactions in South Carolina. This includes:

- Retailers with a sales tax permit

- Businesses that collect sales tax on services or rentals

4. SC2210: South Carolina Underpayment of Estimated Tax by Individuals

The SC2210 form is used to report underpayment of estimated tax by individuals in South Carolina. This form is required if you've underpaid your estimated taxes throughout the year.

The SC2210 form includes sections for:

- Underpayment Amount: Report the amount of underpayment.

- Interest and Penalties: Calculate any interest and penalties due on the underpayment.

- Payment: Make payment for any underpayment, interest, and penalties.

Who Needs to File SC2210?

You'll need to file the SC2210 form if you've underpaid your estimated taxes in South Carolina. This includes:

- Individuals who owe $500 or more in taxes

- Individuals who have underpaid their estimated taxes by 10% or more

5. SC1040TC: South Carolina Income Tax Credits

The SC1040TC form is used to claim income tax credits in South Carolina. This form is required if you're eligible for credits like the earned income tax credit (EITC) or the child tax credit.

The SC1040TC form includes sections for:

- Credit Amount: Report the credit amount you're eligible for.

- Credit Type: Identify the type of credit you're claiming.

- Supporting Documentation: Provide supporting documentation for the credit.

Who Needs to File SC1040TC?

You'll need to file the SC1040TC form if you're eligible for income tax credits in South Carolina. This includes:

- Individuals who qualify for the EITC or child tax credit

- Individuals who have other eligible credits, such as education expenses or charitable donations

By understanding these 5 essential SC tax forms, you can ensure compliance, avoid penalties, and potentially claim valuable credits and deductions. Remember to consult with a tax professional or the South Carolina Department of Revenue for specific guidance on your tax obligations.

We hope this article has provided you with the knowledge you need to navigate the world of SC tax forms with confidence. Share your thoughts and questions in the comments below!

What is the deadline for filing SC1040?

+The deadline for filing SC1040 is typically April 15th.

Do I need to file SC1120 if I'm an S-corporation?

+Yes, you'll need to file SC1120 if you're an S-corporation with a taxable income exceeding $1,000.

Can I claim credits on SC1040TC if I'm not eligible for the EITC?

+Yes, you can claim other credits on SC1040TC, such as education expenses or charitable donations, even if you're not eligible for the EITC.