The IRS Offer in Compromise (OIC) program is a valuable option for taxpayers who are struggling to pay their tax debts. One of the key forms required to initiate the OIC process is the SBA Offer in Compromise Form 770. In this comprehensive guide, we will delve into the world of SBA Form 770, exploring its purpose, benefits, and step-by-step instructions for completion.

What is SBA Offer in Compromise Form 770?

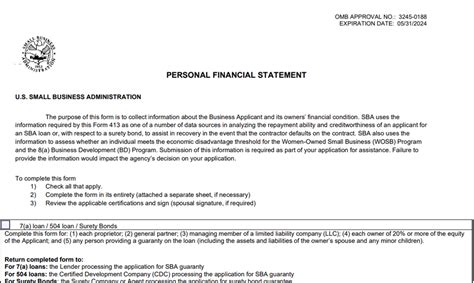

SBA Form 770 is a critical document used by the Small Business Administration (SBA) to evaluate a taxpayer's eligibility for the OIC program. The form is designed to provide the SBA with detailed financial information about the taxpayer's business, including income, expenses, assets, and liabilities. This information is used to determine the taxpayer's ability to pay their tax debt and to calculate a reasonable offer amount.

Benefits of Using SBA Form 770

The SBA Offer in Compromise Form 770 offers several benefits to taxpayers, including:

- Reduced tax debt: By providing detailed financial information, taxpayers may be able to negotiate a lower tax debt.

- Streamlined process: The form helps to streamline the OIC process, reducing the time and effort required to complete the application.

- Improved accuracy: The form ensures that taxpayers provide accurate and complete financial information, reducing the risk of errors or omissions.

Who is Eligible to Use SBA Form 770?

To be eligible to use SBA Form 770, taxpayers must meet the following requirements:

- Be a small business owner or individual with a tax debt

- Have a valid tax identification number (EIN or SSN)

- Have filed all required tax returns

- Not be in bankruptcy or have any open tax audits

Step-by-Step Instructions for Completing SBA Form 770

Completing SBA Form 770 requires careful attention to detail and a thorough understanding of the taxpayer's financial situation. Here is a step-by-step guide to help taxpayers complete the form:

- Gather required documents: Before starting the form, taxpayers should gather all required documents, including financial statements, tax returns, and bank statements.

- Complete Section 1: Taxpayer Information

- Provide taxpayer name, address, and tax identification number

- List all tax debts, including the type and amount of each debt

- Complete Section 2: Business Information

- Provide business name, address, and tax identification number

- Describe the type of business and its financial situation

- Complete Section 3: Financial Information

- Provide detailed financial information, including income, expenses, assets, and liabilities

- List all bank accounts, investments, and other assets

- Complete Section 4: Offer Amount

- Calculate the taxpayer's ability to pay based on their financial information

- Determine a reasonable offer amount

- Sign and date the form

- Sign and date the form, indicating that the information provided is accurate and complete

Common Mistakes to Avoid When Completing SBA Form 770

When completing SBA Form 770, taxpayers should avoid the following common mistakes:

- Incomplete or inaccurate financial information

- Failure to list all tax debts or assets

- Incorrect calculation of the offer amount

- Failure to sign and date the form

Tips for a Successful OIC Application

To increase the chances of a successful OIC application, taxpayers should:

- Provide complete and accurate financial information

- Calculate a reasonable offer amount based on their financial situation

- Submit all required documentation and supporting materials

- Follow up with the SBA to ensure timely processing of the application

Conclusion

SBA Form 770 is a critical component of the OIC process, providing the SBA with the financial information needed to evaluate a taxpayer's eligibility for the program. By following the step-by-step instructions and avoiding common mistakes, taxpayers can increase their chances of a successful OIC application and reduce their tax debt.

We hope this comprehensive guide has provided valuable insights into the world of SBA Form 770 and the OIC process. If you have any questions or would like to share your experiences with the OIC program, please leave a comment below.

What is the purpose of SBA Form 770?

+SBA Form 770 is used to evaluate a taxpayer's eligibility for the OIC program and to calculate a reasonable offer amount.

Who is eligible to use SBA Form 770?

+To be eligible to use SBA Form 770, taxpayers must meet the following requirements: be a small business owner or individual with a tax debt, have a valid tax identification number, have filed all required tax returns, and not be in bankruptcy or have any open tax audits.

What are the common mistakes to avoid when completing SBA Form 770?

+Common mistakes to avoid when completing SBA Form 770 include incomplete or inaccurate financial information, failure to list all tax debts or assets, incorrect calculation of the offer amount, and failure to sign and date the form.