Purdue Global is a renowned online university that offers a wide range of degree programs to students across the globe. As a student of Purdue Global, understanding and navigating the tax implications of your education expenses is crucial. In this article, we will delve into the world of tax forms and provide you with 5 essential tips to help you make the most of your Purdue Global tax form.

Paying for higher education can be expensive, and students often rely on financial aid, scholarships, and loans to cover their tuition fees. However, did you know that you may be eligible for tax benefits that can help reduce your taxable income? The IRS offers various tax deductions and credits that can help offset the costs of higher education. In this article, we will explore the 5 essential tips to help you maximize your tax benefits using your Purdue Global tax form.

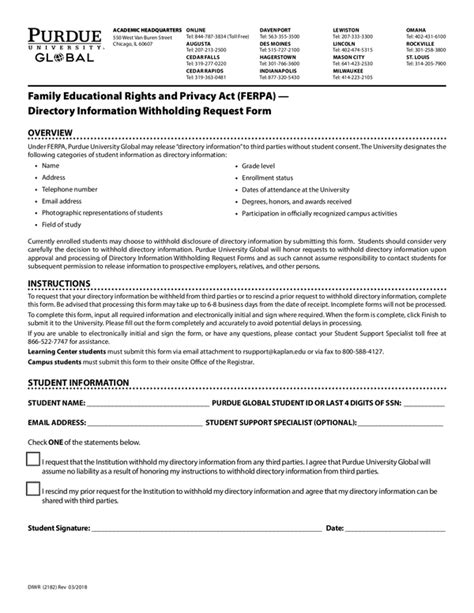

Understanding the Purdue Global Tax Form

Before we dive into the 5 essential tips, it's essential to understand what the Purdue Global tax form is and how it works. The Purdue Global tax form, also known as the 1098-T form, is a tuition statement that is required by the IRS to be completed by eligible educational institutions, such as Purdue Global. The form reports the amount of tuition and fees paid by students during the tax year.

The 1098-T form is typically sent to students by January 31st of each year, and it includes the following information:

- The student's name, address, and taxpayer identification number

- The amount of tuition and fees paid by the student during the tax year

- The amount of scholarships, grants, and other forms of financial aid received by the student

Tip 1: Claim the American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit (AOTC) is a tax credit that can help offset the costs of higher education. To be eligible for the AOTC, you must meet the following requirements:

- You must be pursuing a degree at an eligible educational institution, such as Purdue Global

- You must have paid tuition and fees during the tax year

- You must not have claimed the AOTC for more than four tax years

- You must not have claimed the Lifetime Learning Credit (LLC) for the same student in the same tax year

The AOTC can provide up to $2,500 in tax credits per eligible student. To claim the AOTC, you will need to complete Form 8863, Education Credits, and attach it to your tax return.

Tip 2: Claim the Lifetime Learning Credit (LLC)

The Lifetime Learning Credit (LLC) is another tax credit that can help offset the costs of higher education. To be eligible for the LLC, you must meet the following requirements:

- You must be taking courses at an eligible educational institution, such as Purdue Global

- You must have paid tuition and fees during the tax year

- You must not have claimed the AOTC for the same student in the same tax year

- You must not have claimed the LLC for more than 20 tax years

The LLC can provide up to $2,000 in tax credits per tax return. To claim the LLC, you will need to complete Form 8863, Education Credits, and attach it to your tax return.

Tip 3: Claim the Tuition and Fees Deduction

The Tuition and Fees Deduction is a tax deduction that can help reduce your taxable income. To be eligible for the Tuition and Fees Deduction, you must meet the following requirements:

- You must have paid tuition and fees during the tax year

- You must not have claimed the AOTC or LLC for the same student in the same tax year

- You must not have claimed the Tuition and Fees Deduction for more than four tax years

The Tuition and Fees Deduction can provide up to $4,000 in tax deductions per tax return. To claim the Tuition and Fees Deduction, you will need to complete Form 8917, Tuition and Fees Deduction, and attach it to your tax return.

Tip 4: Keep Accurate Records

Keeping accurate records is essential when it comes to claiming tax credits and deductions. You will need to keep records of the following:

- Tuition and fees paid during the tax year

- Scholarships, grants, and other forms of financial aid received during the tax year

- Forms 1098-T and 1099-Q, which report tuition and fees paid and scholarships received

You will also need to keep records of any education-related expenses, such as course materials, transportation, and room and board. These expenses may be eligible for tax credits or deductions.

Tip 5: Consult a Tax Professional

Finally, it's essential to consult a tax professional when claiming tax credits and deductions. A tax professional can help you navigate the complex tax laws and ensure that you are claiming the correct credits and deductions.

In addition, a tax professional can help you:

- Determine your eligibility for tax credits and deductions

- Complete and file tax forms, such as Form 8863 and Form 8917

- Answer any questions you may have about the tax laws and regulations

What is the 1098-T form?

+The 1098-T form is a tuition statement that is required by the IRS to be completed by eligible educational institutions, such as Purdue Global. The form reports the amount of tuition and fees paid by students during the tax year.

What is the American Opportunity Tax Credit (AOTC)?

+The American Opportunity Tax Credit (AOTC) is a tax credit that can help offset the costs of higher education. The AOTC can provide up to $2,500 in tax credits per eligible student.

How do I claim the Tuition and Fees Deduction?

+To claim the Tuition and Fees Deduction, you will need to complete Form 8917, Tuition and Fees Deduction, and attach it to your tax return.