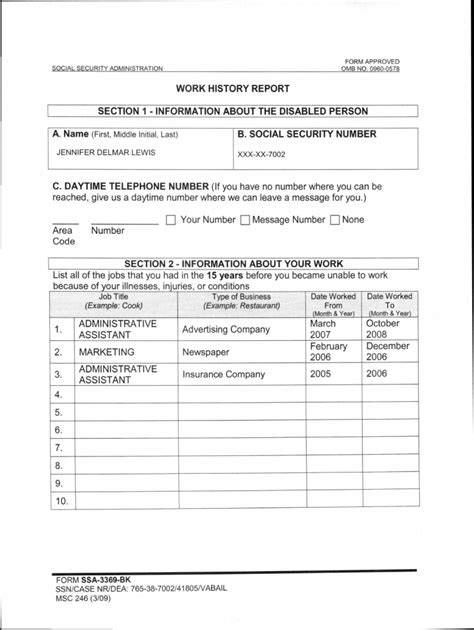

Applying for disability benefits can be a daunting task, especially when faced with the numerous forms and paperwork required by the Social Security Administration (SSA). One of the most crucial forms in the disability application process is the SSA-3369, also known as the "Work History Report." This form requires you to provide detailed information about your work history, which is essential in determining your eligibility for disability benefits.

If you're struggling to fill out the SSA-3369 form correctly, don't worry, you're not alone. Many applicants find it challenging to complete this form accurately, which can lead to delays or even denials of their disability claims. In this article, we'll provide you with 5 tips to help you fill out the SSA-3369 form correctly and increase your chances of a successful disability application.

Tip 1: Understand the Purpose of the SSA-3369 Form

Before you start filling out the SSA-3369 form, it's essential to understand its purpose. The SSA uses this form to gather information about your work history, which helps them determine whether you have a disability that prevents you from working. The form asks about your job duties, work environment, and any accommodations you may have required due to a medical condition.

To complete the form correctly, you'll need to provide detailed information about your work history, including:

- Job titles and descriptions

- Dates of employment

- Hours worked per week

- Earnings per month

- Any accommodations or modifications made to your job due to a medical condition

Why is this information important?

The information you provide on the SSA-3369 form helps the SSA determine:

- Whether you have a disability that prevents you from working

- Whether you can perform any other jobs in the national economy

- Whether you're eligible for disability benefits

Tip 2: Gather Relevant Documents and Information

Before filling out the SSA-3369 form, gather all relevant documents and information about your work history. This includes:

- Pay stubs

- W-2 forms

- Job descriptions

- Letters from employers or supervisors

- Medical records

Having this information readily available will help you complete the form accurately and efficiently.

What if I don't have all the required documents?

If you don't have all the required documents, don't worry. You can:

- Contact your employer or former employer to request the necessary documents

- Use online resources, such as the SSA's website, to find templates and examples of the required documents

- Consult with a disability attorney or advocate for guidance

Tip 3: Be Detailed and Specific When Describing Your Job Duties

When describing your job duties on the SSA-3369 form, be as detailed and specific as possible. This includes:

- Listing all your job responsibilities

- Describing any physical or mental demands of your job

- Explaining any accommodations or modifications made to your job due to a medical condition

For example, instead of saying "I worked as a receptionist," you could say:

- "I worked as a receptionist, answering phone calls, greeting clients, and performing administrative tasks. I was required to sit for long periods, use a computer, and lift files weighing up to 10 pounds. Due to my medical condition, I required accommodations, including regular breaks and a modified work schedule."

Why is this level of detail important?

The level of detail you provide about your job duties helps the SSA:

- Understand the physical and mental demands of your job

- Determine whether you can perform other jobs in the national economy

- Assess whether you're eligible for disability benefits

Tip 4: Be Honest and Accurate When Reporting Your Work History

When reporting your work history on the SSA-3369 form, it's essential to be honest and accurate. This includes:

- Reporting all your work history, including part-time or seasonal jobs

- Providing accurate dates of employment

- Disclosing any gaps in employment

What happens if I'm not honest or accurate?

If you're not honest or accurate when reporting your work history, you risk:

- Delaying or denying your disability claim

- Being penalized or fined for providing false information

- Losing your eligibility for disability benefits

Tip 5: Seek Help if You Need It

If you're struggling to fill out the SSA-3369 form or need help with your disability application, don't hesitate to seek help. You can:

- Contact the SSA directly for guidance and support

- Consult with a disability attorney or advocate

- Use online resources and tools to help you complete the form

Why is it essential to seek help if you need it?

Seeking help when you need it can:

- Ensure you complete the form accurately and efficiently

- Increase your chances of a successful disability application

- Reduce stress and anxiety associated with the application process

By following these 5 tips, you can ensure you fill out the SSA-3369 form correctly and increase your chances of a successful disability application. Remember to be detailed and specific when describing your job duties, honest and accurate when reporting your work history, and seek help if you need it.

We hope this article has been informative and helpful. If you have any questions or concerns about the SSA-3369 form or the disability application process, please don't hesitate to comment below.

What is the SSA-3369 form used for?

+The SSA-3369 form, also known as the "Work History Report," is used by the Social Security Administration (SSA) to gather information about your work history, which helps them determine whether you have a disability that prevents you from working.

Why is it essential to be detailed and specific when describing my job duties?

+Being detailed and specific when describing your job duties helps the SSA understand the physical and mental demands of your job, determine whether you can perform other jobs in the national economy, and assess whether you're eligible for disability benefits.

What happens if I'm not honest or accurate when reporting my work history?

+If you're not honest or accurate when reporting your work history, you risk delaying or denying your disability claim, being penalized or fined for providing false information, and losing your eligibility for disability benefits.