As a business owner, you're likely no stranger to the various forms and paperwork required to keep your company running smoothly. One form that's particularly important for small businesses is the SBA Form 1244, also known as the "Stock Losses on Small Business Corporations" form. While it may seem like just another piece of paperwork, the SBA Form 1244 offers several benefits that can make a big difference for small business owners. In this article, we'll explore five benefits of SBA Form 1244 and why it's an essential tool for any small business.

What is SBA Form 1244?

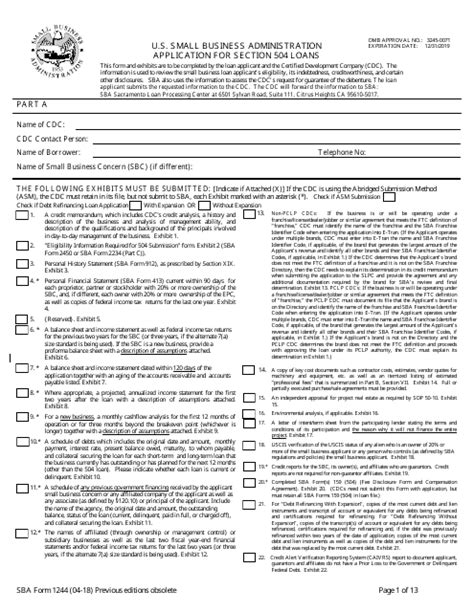

Before we dive into the benefits, let's take a quick look at what SBA Form 1244 is. This form is used by the Small Business Administration (SBA) to allow shareholders of small businesses to claim a loss on their personal tax returns if the business is struggling or goes under. The form is typically used in conjunction with Form 1040, the standard form for personal income tax returns.

1. Reduced Tax Liability

One of the most significant benefits of SBA Form 1244 is that it can help reduce your tax liability. By claiming a loss on your personal tax return, you can offset other income and reduce the amount of taxes you owe. This can be especially beneficial for small business owners who are struggling to make ends meet.

For example, let's say you have a small business that's struggling and you've incurred a loss of $10,000. By claiming this loss on your personal tax return using SBA Form 1244, you can reduce your taxable income by $10,000. This can result in a lower tax bill and more money in your pocket.

2. Increased Cash Flow

Another benefit of SBA Form 1244 is that it can help increase your cash flow. By reducing your tax liability, you'll have more money available to invest in your business or use for other expenses. This can be especially beneficial for small businesses that are struggling to stay afloat.

For example, let's say you have a small business that's struggling to make ends meet. By claiming a loss on your personal tax return using SBA Form 1244, you can reduce your tax liability and free up more money to invest in your business. This can help increase your cash flow and give you the funds you need to keep your business running.

How to Increase Cash Flow Using SBA Form 1244

To increase cash flow using SBA Form 1244, follow these steps:

- Claim a loss on your personal tax return using SBA Form 1244

- Reduce your tax liability by offsetting other income

- Use the resulting tax savings to invest in your business or pay other expenses

3. Simplified Tax Filing

SBA Form 1244 can also simplify your tax filing process. By claiming a loss on your personal tax return, you can avoid having to file a separate business tax return. This can save you time and money, as you won't need to hire a tax professional to prepare a separate return.

For example, let's say you have a small business that's struggling and you've incurred a loss of $10,000. By claiming this loss on your personal tax return using SBA Form 1244, you can avoid having to file a separate business tax return. This can save you time and money, as you won't need to hire a tax professional to prepare a separate return.

4. Reduced Risk

Another benefit of SBA Form 1244 is that it can help reduce your risk. By claiming a loss on your personal tax return, you can limit your personal liability for business debts. This can be especially beneficial for small business owners who are personally liable for business debts.

For example, let's say you have a small business that's struggling and you've incurred a debt of $10,000. By claiming a loss on your personal tax return using SBA Form 1244, you can limit your personal liability for the debt. This can reduce your risk and give you more peace of mind.

5. Increased Flexibility

Finally, SBA Form 1244 can give you more flexibility when it comes to managing your business. By claiming a loss on your personal tax return, you can use the resulting tax savings to invest in your business or pay other expenses. This can give you more flexibility and allow you to make better decisions for your business.

For example, let's say you have a small business that's struggling and you've incurred a loss of $10,000. By claiming this loss on your personal tax return using SBA Form 1244, you can use the resulting tax savings to invest in your business or pay other expenses. This can give you more flexibility and allow you to make better decisions for your business.

Conclusion

In conclusion, SBA Form 1244 offers several benefits for small business owners. By claiming a loss on your personal tax return, you can reduce your tax liability, increase your cash flow, simplify your tax filing process, reduce your risk, and increase your flexibility. Whether you're struggling to make ends meet or just looking for ways to optimize your business, SBA Form 1244 is an essential tool to have in your arsenal.

What is SBA Form 1244 used for?

+SBA Form 1244 is used to allow shareholders of small businesses to claim a loss on their personal tax returns if the business is struggling or goes under.

How does SBA Form 1244 reduce tax liability?

+SBA Form 1244 reduces tax liability by allowing shareholders to claim a loss on their personal tax returns, which can offset other income and reduce the amount of taxes owed.

Can SBA Form 1244 increase cash flow?

+Yes, SBA Form 1244 can increase cash flow by reducing tax liability and freeing up more money to invest in the business or pay other expenses.